Review of LIC’s Wealth Plus

If you were to hear about an investment plan with 17% p.a. returns i.e. if you invest Rs. 1lac today, it would become Rs. 3.5 lacs in next 8 years time, wouldn’t you get greedy?And what if it is told to you that such Highest NAV Guaranteed ULIPs are guaranteed by one of the biggest financial institution LIC of India, it would be Icing on the Cake and a “Never Miss Opportunity”. But everything sounds so good, if looked deeply may reveal something else. Someone rightly said “the big print give it and the fine print take it away”. Such is the case with LIC’s new insurance plan- Wealth Plus.

Game Started in 2007

Every year during the last quarter of Financial Year, insurance agents find new ways to misguide people and make them invest in policies based on false assumptions and promises. Let us take example of year 2007 when LIC launched one of its most famous policy “Money Plus”.

During the launch, pamphlets were distributed in all the nook and corner of the country showing high returns. Eg. Invest Rs. 1 lac for next three years and get Rs.3.38 crores after 20 years at a return of 25% p.a. Based on such exuberant returns printed on a pamphlet and false promises made by agents, thousands and lakhs of investors across India invested their money. Not only did people invested their savings but there were many instances where smaller households sold their jewelry and other personal belongings believing what they were told by the agents that LIC is guaranteeing such high returns.

What LIC have to say

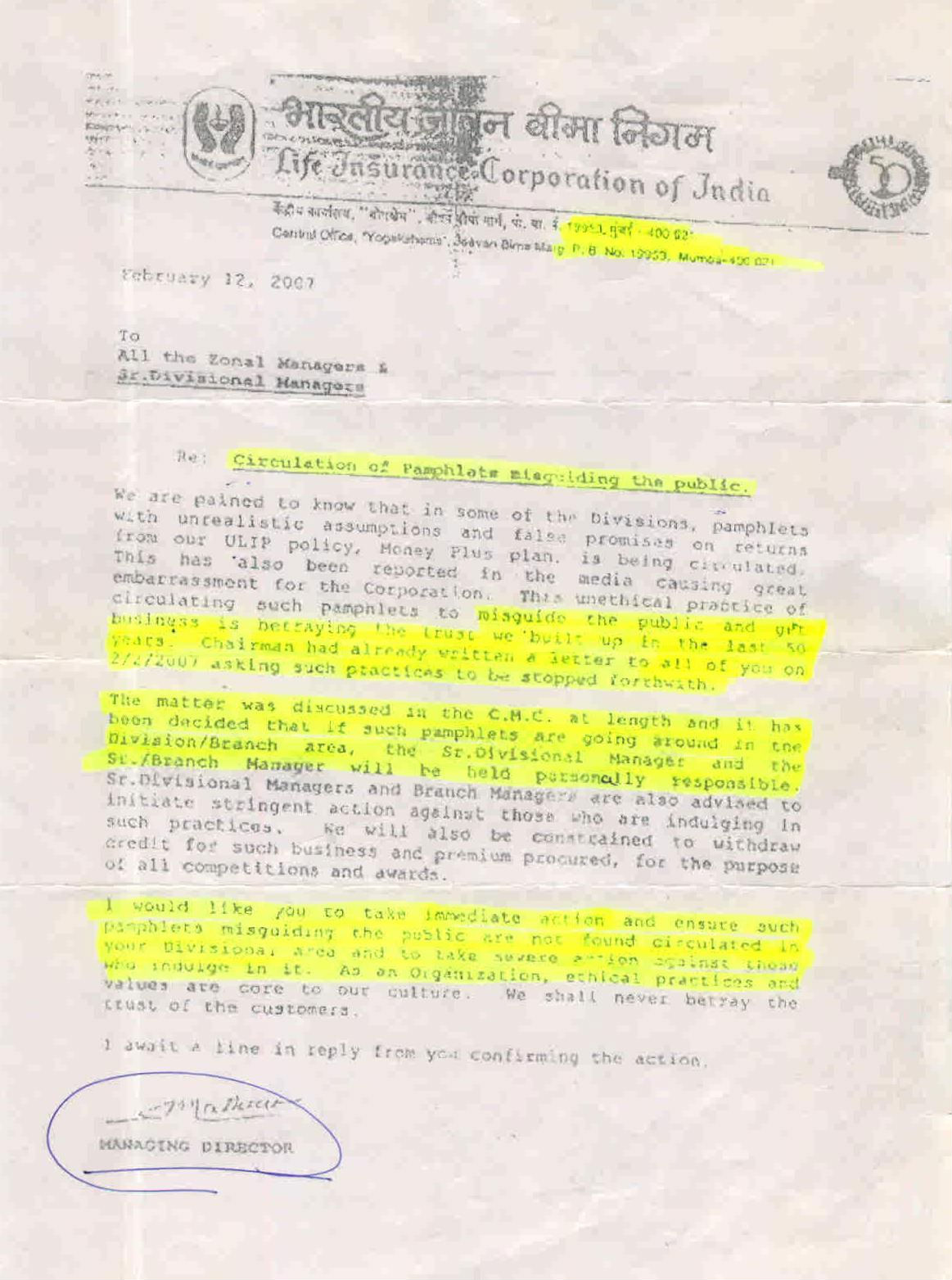

Later when the news of misguided selling of this policy was brought to the notice of LIC management. LIC states that such assumptions are unrealistic and totally false. Investors should not be misguided in the name of LIC. On a letter dated February 12, 2007 to all the Zonal Manager and Sr. Divisional Managers, Managing Director of the LIC Mr. Mathur himself writes that “The unethical practice of circulating such pamphlets to misguide the public and get business is betraying the trust we built-in the last 50 years.” See the Letter Below (Click to read in bigger Size , recommended)

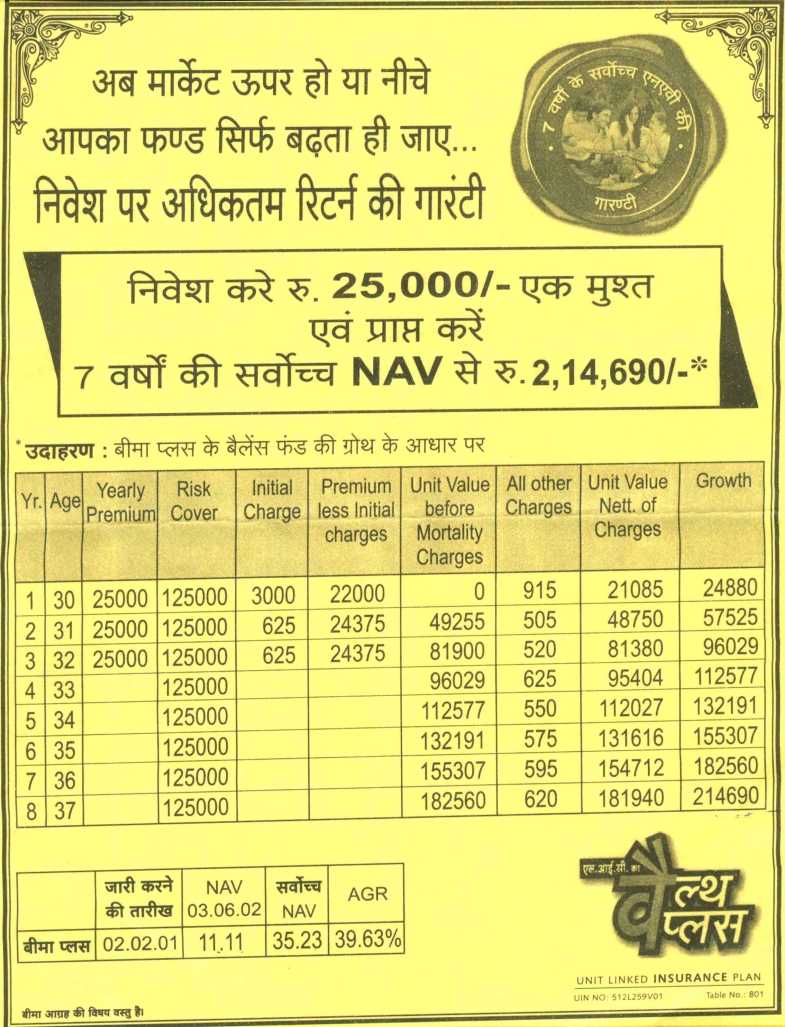

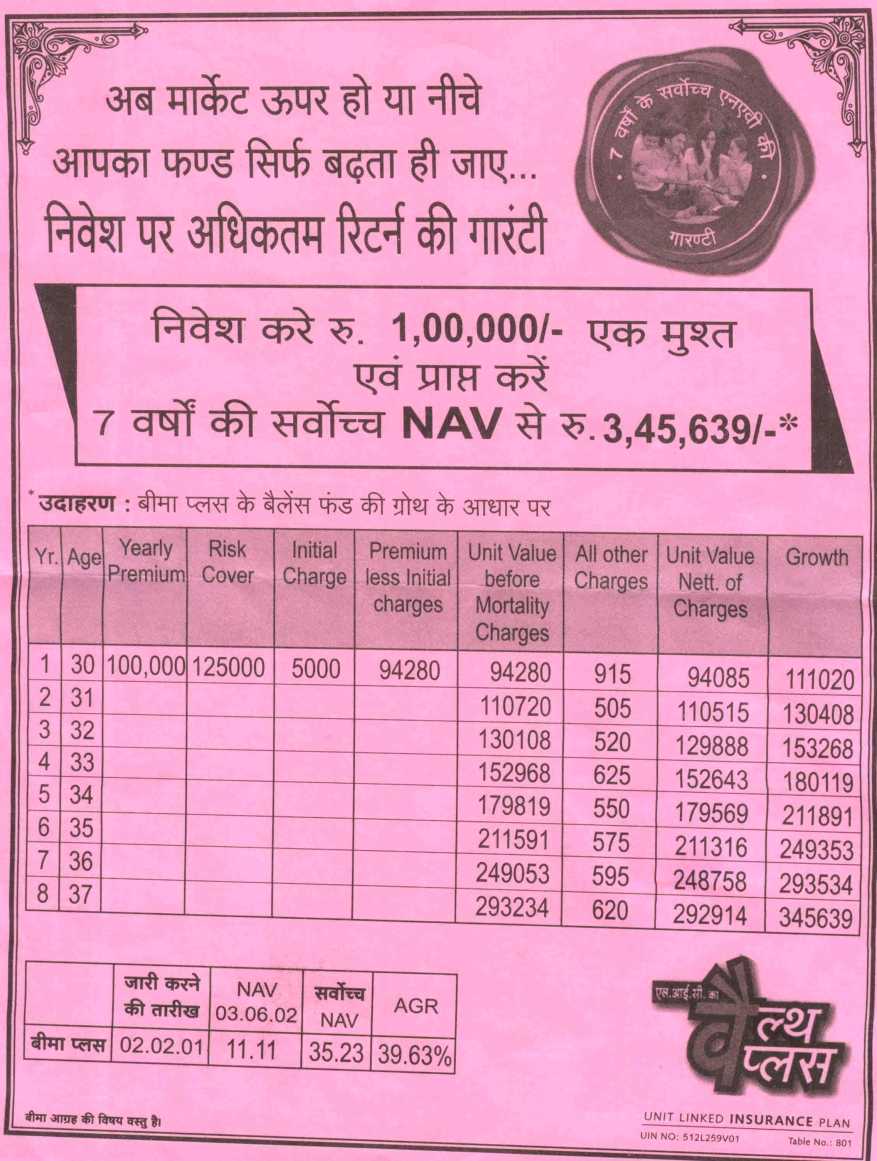

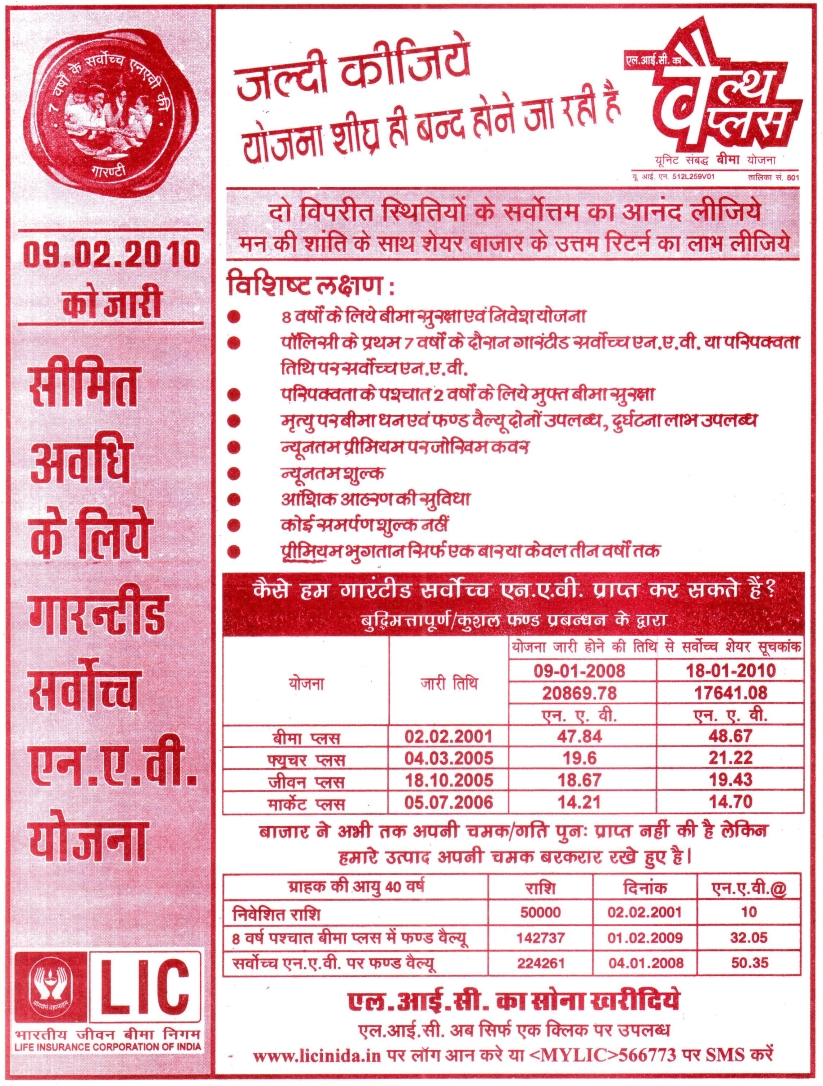

Though efforts were made to stop agents to use such pamphlets to increase their business but since the agent community is so big and scattered not much could be done. It was quite amazing that all over India similar pamphlets were distributed and hence it is clear that without the help of Development Officer of LIC such work was not possible. D.O. of LIC also gets commissions or incentives when his agents gives more business to LIC. See the pamphlets Below:

Pamphlets showing returns with Term 3 yrs and investment 25,000

Pamphlets showing returns with Term 1 yr and investment 1,00,000

Another template with LIC Logo

What other Govt bodies have to say

Ministry of Consumer Affairs, Food and Public Distribution through “Jago Grahak Jago” also acknowledged that such misleading things are taking place and hence warned investors to refrain themselves from such high return promises.

D Swaroop (PFRDA Chairman) committee on investor awareness & protection states that “The chief cause of mis-selling is the incentive structure that induces agents to look after their own interest rather than that of the customer. If that were not true, the average sum assured of the insured Indian would be higher than the current Rs 90,000.”

Now when a income earner of an average Indian family dies untimely, do you think his family will survive for the rest of their life with less than Rs. 90,000? Insurance is meant to cover risk of untimely death first and investment and tax savings are secondary criteria. But we Indians, have been taught Insurance as an investment first, tax savings second and then somewhere in the last we talk of insurance as well. Now again such practice of miss-selling has emerged and agents are targeting with LIC’s new product Wealth Plus.

What is LIC Wealth Plus Product

This product of LIC which was launched on February 9, 2010 (Table 801) states that LIC will guarantee the highest NAV to the investor in the first 7 years and product will mature after 8 years. It nowhere guarantees the return. In it’s official web-site, LIC states that the minimum guarantee will be of Rs. 10 NAV as Rs. 10 will be the starting point. Actually that means that they are not even guaranteeing that you will get your entire money back as there will be certain charges in the policy itself. They have nowhere written that they will guarantee any amount of return to the investor. Nor they have mentioned that your money will be invested 100% into equity.

Now what Agents are telling

- LIC is giving guarantee on HIGHEST RETURN. (LIC is saying Highest NAV)

- Now what is highest return? Based on past performance of LIC’s ULIP policy (Bima Plus), you will get 17%-18% return on investment.

- Lumpsum Rs. 1 lac invested today will become Rs.3,45,693/- or give Rs 25000 for 3 years & get Rs.2,14,690/- after 8 years.

- You should switch all your earlier product (on which agents have already made huge commission) into this product as this is something which is as good as KOHINOOR DIAMOND.

To generate such high returns, the money has to remain in equity but LIC nowhere states that. In almost all ULIPs it is clear how much money will go in equities and how much money will go in debt but this policy is silent on the allocation percentage and hence you may land up getting return that of endowment or money back (nearly 6%-7%).

Bima Plus of LIC was a ULIP where it was mandatory for the fund manager to remain invested in Equities in a pre-decided proportion. It was launched in 2001 when the markets were trading at 3000 sensex levels and later sensex touched even 21000. Is it a right approach to compare such high returns which were made during Bull Market and making investor believe that such returns will be now guaranteed by LIC. Now if you go to a small shopkeeper, a carpenter or a young executive and show them that you will get such high return, why he/she will not invest and that too if they are told that guarantee is done by the India’s biggest financial institution, LIC.

We feel sorry to say but such agents who are misleading people do not even think twice before selling such policies in a wrong approach. The fact of the matter is that the money is just not invested in policies but gets invested in someone’s kids higher education, someone’s retirement, some dreams which common man look to achieve. We believe that

Insurance agents have sold to Indian everything other than Insurance.

Comment from a Reader who is an LIC Agent

Thanks Manish for bringing up this burning issues today. As a agent I can confirm you that these pamphlet actually circulated by LIC office. If you have any doubts go to any LIC branch ask any sales manager or BM they will tell you same. Actually agents sell the product because they are misguided by Senior LIC officials but unfortunately when debate arise agents are vindicated and punished. The projection shown in the phamphlet, circulated to us at the time product launch meeting. For a wealth plus policy LIC given extra incentive to us. But yes you are absolutely true we should think about our client not LIC/BM/DO. It is not true that agents always think about their pocket,they bound to sell product sometime otherwise they face a painful situation. Ask any Insurance company/agent how many term insurance they sell, they wont tell you the truth. IRDA also not interested about selling pure term insurance product otherwise they also issue circular to increase the term insurance sales growth. If this is the situation what will a agent do? Either he has to terminate his agency or keep continuing same practice as Big agents/Insurance Company/IRDA like to do. ( Original Comment )

What is IRDA guidelines says

As per IRDA, agents and Insurance companies are mandated to show return either at 6% or 10%. But the pamphlet distributed have no regards for Regulatory guidelines. Let’s Compare return according to pamphlet & IRDA Guidelines:

| Regular Premium | Single premium | |

| Premium | 25000 | 100000 |

| Paying Term | 3 years | 1 Year |

| Pamphlet | 214690 | 345639 |

| As per IRDA guidelines | ||

| 6% | 87549 | 118442 |

| 10% | 114306 | 161697 |

- Figures are approx

Innocent Investors ?

We believe even investor is at fault and not all the blame should be transferred to the Agents alone. It is always “Buyers Beware”. We take well thought decision before we buy even a fridge in our house. We do research which fridge is best for us and look at least 4-5 shops before we finalize. But when it comes to financial products, we don’t really do our home work and at times decision is taken not even going through the pros and cons of the policy.

Now what investors should do?

If you have already taken the policy

- Cancel the policy if bought under false promises and high projection. The policy can be returned within 15 days of the receipt of the document without any charges under ‘free-look’ option.

- If 15 days are over, nothing much can be done.

If Not Taken

- Take your well thought decision before jumping on to this product.

- Tell your friends about the same.

[ad#big-banner]

Comments ? would love to here your views on Wealth Plus from LIC . Please share what do you feel about it ?

This is a guest article by Hemant Beniwal & Ashish Modani. They both are CERTIFIED FINANCIAL PLANNERCM & writes at The Financial Literates

|

Regular Premium |

Single premium |

|

|

Premium |

25000 |

100000 |

|

Paying Term |

3 years |

1 Year |

|

Pamphlet |

214690 |

345639 |

|

As per IRDA guidelines |

||

|

6% |

87549 |

118442 |

|

10% |

114306 |

161697 |

March 7, 2010

March 7, 2010

i have 50000 invested . can i withdraw now .now it is 60000

You can get it at maturity

I have invested Rs.40,000/- in LIC Wealth Plus in March 2010, please suggest.

Suggest what ?

Sir,i am holding shares of 160000 for the last 6years and those are going to be paid after 2years in 2018 ……whether I had to hold or sell them …. please suggest…..If I sell them now I will get 46200….

Can understand what to do sir

If you have shares, you can sell it anytime .. Why wait for 2 yrs incase you need money right now ?

sir i m purchased LIC wealth plus policy in march 2010 rs 50000 up to 3 years invested

now i get 180000 so what is your opinion i should quit or wait upto maturity time march 2018

Better surrender and take the money. YOu should then invest that money in mutual funds if you want long term growth of your money. If you are interested in investing in mutual funds, please leave your details at http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

I have invested Rs.40,000/- in LIC Wealth Plus in March 2010. Please advise shall i wait until maturity i.e. March 2018 or exit.

Better wait till maturity

dear sir,

HAVE INVESTED RS 50000/- IN WEALTH PLUS POLICY IN MARCH 2010 , now am having 55050……shall i quit

yes

sir

I HAVE INVESTED RS 40000/- IN WEALTH PLUS POLICY IN MARCH 2007 ,BUT IS CURRENT VALUE IN RS OF MY PAYMENT,TELL ME

What do you want to know exactly ?

Hi,

I went through this link

http://www.ninemilliondollars.com/2012/07/how-highest-nav-guarantee-fund-works-lic-wealth-plus/

and as mentioned it, we can expect at least debt returns of avg 8-9% over 7 years terms ??

So anyways instead of redemption in loss, we can have 8% returns in 7 years ?

Am I correct ?

Its assumption .. On an average they might give debt fund returns ,but nothing is guaranteed . You might still get 5% !

Wht to do in lic wealth plus policy? Stay or exit? My s.v is became less than my invested amount.. 10% less than i invested in qtly premium for 3 yrs. Suggest..

Out 🙂

Hi

I have invested Rs. 1,00,000 in LIC wealth plus in March 2010. Now three years gets over. But when i check the current value it shows Rs. 92,000 only. My problem is whether i continue it or quit and invest in any other bank fixed deposits.

If i continue this until 7 years., can i get atleast the bank percentage of interest or not?

There is another choice of partial withdraw.

I HAVE INVESTED RS.2000=00 PER MONTH IN LIC WEALTH PLUS PLAN SINCE MARCH-2010 .WHAT I WILL DO , SHALL I GET MY MONEY AFTER 3 YEARS OR CONTINU UP TO 7 YEARS . BECAUSE AS PER TODAYS INDEX I WAS IN LOSS BUT AGENTS SAYS THAT YOU CONTINE UPTO 7 YEARS YOU WILL SURE GET MINIMUM 15 % RETURN

PL. GIVE ME PROPER SUGGETION

What agent is saying has no guarantee . Its a ULIP product and totally depends on market value !

Sir,

I am a customer of Aviva Life Insurance Co.Ltd. My Policy No is ALA3095466.

I am not receive my original policy document till now, I am also inform Aviva customer care and request to hisar Aviva life insurance co ltd branch but they not give me my policy till date 15/09.1012 and ignore my complain.

Right now I have not any faith at Aviva Life Insurance Co ltd. I am a heart petitions. If I fell any problem and happen some thing wrongs with me Aviva lifeinsurance company Ltd will be responsible.

When I am go to Aviva Hisar branch Mr. Parveen Khatri see me a fake signature of my on receiving format of Indusind Bank Hisar. That signature is fake signature. I am request to you please help me and provide me original policy document.

Pls take some immediate action.

Thank You

Regards Date: – 15/09/2012

Sunil Kumar

H.No. 657 ward No 28,

Patel Nagar, Hissar

125001 Haryan

Dear Manish,

I went through ur article. it seems to be very informative. I had invested 1 lac in money market plus. How about investing in either endowment plus/bimabachat/ jivan virdhi or jeevan vaibhav. which is better. Could u pls guide me. I am not interested in continuing with money market plus

Better surrender money market plus and start with mutual funds !

Hey Manish,

Good job here.I went through this blog.Despite of my little knowledge about all this I found it quite useful. It can be a base to refer before makig any investment.

Actually I was also planning for some investment. The range can be 1 lak. Need ur guidance, naturally my requirements will be the highest return but totally safe. I have already taken SBI Flexi smart Insurance for 25000 per year. Please provide ur insight about this plan. Kindly suggest me other combinations for investment with the above plan for 75000.

Thanks and regards

Vijay

For investment related questions ,you can ask it on our forum – http://jagoinvestor.dev.diginnovators.site/forum

manish

you are wrong

i invest rs.50000/- in mutul funds in 2007 and i got rs 35000/- after 5 years

while i invested rs. 100000/- in lic market plus at the same time i got rs. 122000/- after 5 years so in my view lic is best rather than mutul funds

i think that mutul funds give you some money for marketin while lic dindn’t

if you came to my office i give you all proof for above details with red. vouchers

don’t misguide the invester

Mahesh

You are biased for that particular 5 yrs only . Wait for 15-20 yrs . Also can you share the performance of the same mutual fund in 2003-2007 ?

dear manish…….

please give me a suggestion i go for LIC endowment policy jeevan aanand + term insurance of 1 crore+ a medical family floater plan

or

term plan+family floater plan + ppf (insted of jeevan aanand)

my age is 28. annual income 6 lacs

Second option

Hai Manish ,

I have invested in Wealth plus plan and paid 3 premiums of 30000 (yearly). Now I have 8381 units

1. If I want to withdraw money now, can I get full amount I have paid?

Are there really any benefits of this policy? is it advisable to surrender this policy now?

Thanks for your support and guidance

What is the current NAV of the policy ? You can multiply that number (NAV) with your units and see what is the FUND value, you will get that

Hi Manish,

I have been paying Rs.5000 per quarter in Wealthplus and it is almost over excepting two more payments for 3 years. So, I have totally paid so far 50000 till now. After the completion of 3 years payment period, if I withdraw the amount, will I get the highest NAV or at the current NAV rate only. As per the current accumulation of units and the current NAV rate, the amount will be much lesser than what I have invested so far. Will it be beneficial if I keep the amount till 8 years?

The highest NAV is applicable only if you continue the policy for minimum 7 yrs . If you sell now , you will get current NAV value!

Thanks for the wonderful article, I was researching for details like this, going to check out the other articles.

Thanks !

LIC bima account policy with down payment and useful policy for investors according to your budget.mostly people are don’t know this policy so you have loss of money and capital.

Dear Manish,

first of all very congratulation for your ironic connotation over the underneath of fradulancy occured in insurance company.The comment made by you are proven facts and perhaps only the persons who have been in indulged in such a drained way will discard you. You have prooved that government sector copanies are also promoted reaping out maximum profits at any cost. You are once again very congratulated and hopfully will meet us with new article.

Satish Ch. Tiwari

Researcher

Banaras hindu University

Thanks Satish 🙂 ..

Hello Manish ,

I have invested in Wealth plus plan and paid 2 premiums of 20000 (yearly).

I know it has 3 years of locking period.

1. If i want to withdraw money after 3 years , can i withdraw full amount i have paid? what will benefit get?

2. Also provide details if i wait till 7 years , what are the benefits?

Are there really any benefits of this policy? shall i discontinue it after 3 yrs?

Saurabh

Saurabh

BEtter stop paying premiums and get the FUND VALUE after lock in period , look at your policy document and what are rules if you stop premium before 3 yrs

Manish