How to look beyond short term returns in Mutual Funds

Want to buy a mutual funds which has given 105% return in 2009? Go ahead… How do most of the people choose a mutual fund? Let us try it once! Go to Valueresearchonline.com and find Top 10 funds across all the equity funds with 1 yrs performance. Below is the example of the page I got. So all these funds have given more than 100% return over the last 1 yr. Now it’s pretty simple to choose them, right? Just pick any of them and you have done your “Investment Planning”!!…… Far from the truth! Most of the mutual funds starts advertising their mutual funds “great” performance just after a strong market. They will claim that their fund has 1st rank in some blah blah category and they have the unique way of investing and what not. Let us see in this article, how we should look at short-term performing mutual funds and evaluate them on different parameters.

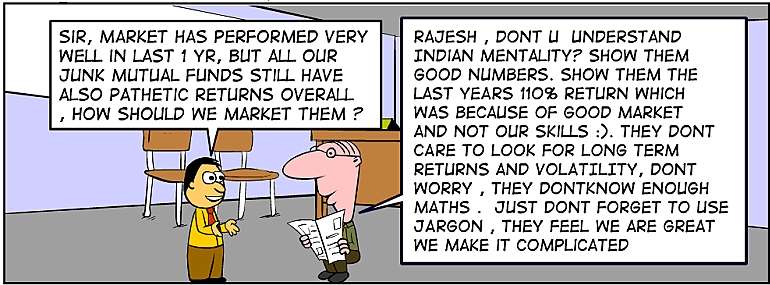

How Mutual Funds are marketed

Let’s take a case of “JM Emerging Leaders” Mutual Fund. Try to look at the points which a Mutual funds company can use to attract customers and What is the reason for each of them.

Its one of the 10 funds on the return parameter out of thousands of Mutual funds in this planet. Its 1 yr return is 144%.

[ad#big-banner]

True! But what are the reason for this? The fund is extremely risky, risky to the extent you can’t imagine! The fund portfolio looks like this:

Mid Cap: 56.18%

Small Cap: 43.82%

(as of Feb 7, 2010)

Now what else do you expect from a fund which has all 100% of its money in Either Mid cap or Small Cap companies which moves like crazy after a big bear market? If the fund is so great in 1 yr parameter, what is the reason its overall return since it came in existence is -5% (negative return in last 5 yrs)? The answer is simple, the fund is exposes to too much Risk. In order to get extremely high returns, it’s exposing itself largely to risk that the returns over long-term will be unstable and probably low.

The fund beats it’s benchmark and category average returns by huge margin

This happens for the same reasons we talked above. Benchmark is an Index and it’s returns are not based on some one’s judgement or decisions, but mutual fund returns are!! Fund manager decides how aggressively they want to invest, so if today the fund has beaten it’s benchmark or Category in positive side, tomorrow when there will be disaster, it will beat it’s benchmark by huge margin on the negative side and the performance will be much lower than the benchmark, it’s called Beta

NAV more than doubled in 1 year

Again an idiotic comment, it’s all about return, the fund has made 105% return in 2009, but what is NAV value? Ans: 7. something % . It’s 5 yrs in existence now, started from NAV of 10 and still its at 7.something. At one time in 2009 the NAV went down to Rs 2.9, this 144% year in last 1 yr has helped it come back to 7.something levels now and still the returns are the marketing factors. I am wondering how it manages to get so much of investment (Fund has 262 crores of Net Asset Value as of 31/01/2010). Who is putting all the money in this?

What are the Two important factors you can look at and make a quick opinion

Lets talk about two main things

- Mean

- Standard Deviation or Volatility

Mean: Mean is nothing but the average of returns over a particular time. It tells us how much can we expect over a period from the mutual fund. It’s important to look at Mean (average) of Mutual funds return so that we have an average expectation. For some period we can get 20% return, for some period we can get 10% and for some we can get -15% also. But we have to concentrate on the average. Look at average return from Equity in Long run from Indian Markets

Standard Deviation : Now this is some thing we never see, what is this? Looks like a scary term from our school maths, but dont worry, it’s very easy thing to understand. Its nothing, but how much deviation you can expect from the average. To clear the point, understand that (10,12) and (1,21), both have average of 11 but standard deviation of (1,21) is high because both the values are at much distance from their average of 11. In that same way if we have two mutual funds say Mutual fund A, which has given returns of 20% and 30% in 2 yrs and we have mutual fund B, which has given return of -10% and 60% in 2 yrs, both of them have average of 25% (simple average), but the second mutual funds B has higher standard deviation compared to A. What it means is that its more risky, the return range of B is higher. This is directly related to risk/reward. It’s very risky and very rewarding compared to mutual fund A. So it does not suit general investors who need high and consistent returns.

Look at List of Best Equity mutual funds and Debt mutual Funds

What to look at in mutual funds

So over a long term, we have to choose funds which are higher in Return and Lesser in Risk . That mean is there are two Funds X and Y, we have to look which has higher Mean and lower Standard deviation in returns. This is not true for investors who have extremely high risk appetite and want to take extra risk, in that case this will not be very much recommended.

Make sure you dont calculate these things on just 2-3 data points, make sure you have enough (at least 10-12 numbers) so that its more accurate. In the Table Below I have taken two funds which I consider BAD and 2 Funds which are GOOD and their quarterly returns from Q1 2006 – Q4 2009 (16 quarters) and finally calculated the Standard Deviation and Mean.

| Fund Names | BAD FUNDS | Average of BAD FUNDS | Average of GOOD FUNDS | GOOD FUNDS | ||

| JM Emerging Leaders-G | Magnum IT | HDFC Top 200-G | DSPBR Top 100 Eqt Reg-G | |||

| Quarters | Return in % for 1 quarter | |||||

Return in % for 1 quarterQ1 200616.196.9911.5921.6720.3522.98Q2 2006-13.69-7.53-10.61-10.09-10.83-9.34Q3 2006-0.6618.438.8916.9317.516.35Q4 20061.1529.0215.0911.01913.01Q1 2007-8.981.63-3.68-4.27-4.93-3.61Q2 200722.266.4114.3416.5915.1518.03Q3 200723.4-10.046.6815.8716.7514.99Q4 200741.659.325.4823.4620.8626.06Q1 2008-40.36-26.34-33.35-23.78-22.53-25.03Q2 2008-13.84-2.24-8.04-11.04-12.25-9.83Q3 2008-25.45-20.02-22.740.892.89-1.12Q4 2008-48.73-37.83-43.28-20.2-21.86-18.53Q1 2009-16.26-10.24-13.250.52-0.271.31Q2 200981.5858.2769.9347.4155.3339.49Q3 200924.837.6131.2119.3819.4819.27Q4 20098.3915.7712.085.085.065.09Standard Deviation

32.2424.3827.0718.3919.5717.47Mean3.224.323.776.846.866.82

Interpretation of the numbers

So you can see the Standard deviation and mean of returns for 2 Bad Funds and 2 Good funds and their mean return and mean standard deviation in a single quarter. So you can see that Bad funds have given return of around 3.77% per quarter on average (simple average , not compounded one) and the standard deviation is 27.07%, which means that it can deviate up to 27.07% on the upside or downside with 68% chances. (forget the maths, you have to go into probability and normal distribution and all those things, interested people can look for this link to get more insight on this. Similarly the good funds would return on an average 6.84% every quarter with deviation of 18.39% on upside or downside with 68% probability.

Conclusion

So, the conclusion of this whole mind boggling exercise is that we should understand that short-term performance of mutual funds is not where we should aim! We should properly evaluate the fund performance with different parameters. We should also concentrate on volatility and risk exposed by the mutual fund.

February 8, 2010

February 8, 2010

Great.It is not only the return numbers but also some other numbers that has to be taken into consideration before investing.

How about the star ratings by different agencies.They do take all this things into consideration before giving a ranking.Am I right ?

Pro

All companies have their own critiera .. Better look at ratings for filering , not choosing !

Does all the calculation done on the numbers include the inflation (6.5 %) after 5 or 10 years? What is the actual value of money invested in MFs?

What I means is when you say return from Diversified 23.86% (or whatever) & ELSS 19.33% (or whatever) in 10 years or 5 years…

Does it means Actual return with Diversified = 23.86% (after – 6.5%) or Actual is 23.86% (after + 6.5%)??

Please advice!!

Amit

No it does not contain Inflation ,. no website ever gives the return after inflation , you have to adjust it later

Manish

My mutual fund portfolio’s current market value is about ten lakhs .

I will invest 4 to 5 lakhs by sip in next two years.

How is the idea of becoming AMFI CERTIFIED agent by clearing NCFM exams ?

Can I claim trailing returns of my own portfolio by declaring myself as own agent ?

Regards,

Naveen

Kumar

first its not allowed . second thing is How much will you be able to save ? 5 lacs means 2-3k as commission , Do you think its worth the effort ?

see http://www.amfiindia.com/showhtml.aspx?page=cirarn-0303-03

Manish

Well, it seems that this article has been inactive since a long time. I came across this article while searching an answer to the question mark raised in my mind by the single digit 3-yr returns of most of the mutual funds. http://www.moneycontrol.com/mutualfundindia/

I find mutual fund investment quite a wasteful exercise if this is the rate of return expected. Also, the inflation rate is somewhere around 8%. Ultimately, we seem to be loosing value on money and trying to minimize loosing value by investing. Better to spend, uh :D, unless you are looking to save.

Hello Manish :

I have a question regarding SIP investment and monitoring . In my case , I have been investing in SIP for the past 3 years and the fund is an average performer .

In order to switch into a better performing fund , the very first thing I believe I should do is to redeem all units from the current fund and transfer the amount into the new fund … right ? But this defeats the very purpose of SIP as I’m forced to put the entire money into a new fund . I’m not a big fan of lump sum MF investment.

STP helps , but will take time to transfer the entire amount into the new fund … What’re your thoughts ..? In nushell ,what should an investor do if they realize that their fund is not performing ..?

Thanks, Krishna

Akrishnar

If your fund is not performing , there can be two things which you want to do .

Case 1 : if you want to get out of it as you are pissed off by the performance , you can redeem everything and put money in Debt funds and STP .

Case 2 : You know that it is not performing , but still you can get out of it gradually , in that case start a SWP to your bank account and also start SIP to the new funds, just look at the exit load if any .

Manish

Hey Manish,

As NRI’s can we have a health insurance in India…Do you think it better to get one done for future…we do not plan to settle beck in India atleast for the nxt 5 yrs…we have medical insurance covered in the country we currently reside in..Can I go for a family floater for myself and my husbnd with star health insurance,? How does this health insurance thing work?

Oops,posted the above in the wrong section,pls ignore will repost in Health Insurance blog.

Hey,

Thanks a ton for sharing ur knowledge…good to see young financial advisors bloom….Keep continuing your good work!!!

Need your advise on the below… I had the following SIPs for 2 years, but later had to discontinue.. Birla Sun Life Tax Relief 96 Fund – DSP BlackRock T.I.G.E.R. Fund – Gr & SBI Magnum Tax Gain Fund – Gr

now i intend to stat my SIP”s again with Rs 10000 pm,have been researching for a while but confused on which ones will b good for me

Reliance Growth Fund ,

Birla Sunlife Mid Cap Fund ,

BNP Paribas Growth Fund,

HDFC Top 200,

SBI Magnum Multiplier,

DSP BR Top 100,

Prudential ICICI Discovery Fund

Birla Sunlife Frontline Equity

Kindly do advise me, guess i can onli invest in two funds from the above with 5000 pm..Appreciate your help..tc 🙂

[…] Mutual Funds […]

hi manish,

i have invested in some MF & all r SIP. i want to know in how many funds should one invest at the most.

and i m tracking the returns of the some of the short term debt funds. From last one month these funds r giving very good returns,

as Birla Sun Life G-S. F – L T (G) has given 2.6% return in last 15 days.

so plz tell me

1) is it the right time to invest in these debt funds.

2) risk associate in investing in these funds.

Vedanshu

Read : http://jagoinvestor.dev.diginnovators.site/2010/02/how-many-mutual-funds-you-should-have.html

The debt funds carry interest rates risk , default risk etc . Debt should be choosen only if you have short term goals , otherwise be in equity .

Manish

Hello Manish,

I have curremtly 5 MF all are SIP and are in pipeline since last 3 years

Fidelity Tax Advantage – Growth

Fidelity International

ICICI Service

ICICI Infra

Reliance Equity Growth-Growth Option

As the locking period of all the 5 are ending innext few months….are there few other in which i can start investing……?

Sachin

which Locking period ? I can see that only Fidelity Tax Advantage – Growth is a tax saver fund , rest all are non-tax saving funds , so there is no locking period , are you in impression from so many years that they are locked in ?

Make sure these are right products for you , else churn it and move to better ones 🙂 , see my articles on funds names

Manish

Thanks Manish,

Can u name a few better ones in which i can start investing

http://jagoinvestor.dev.diginnovators.site/2009/08/list-of-best-equity-diversified-mutual.html

Hi Manish,

How to buy mutual funds/SIP with less transaction charge? For e.g. icicidirect charges flat 100 for purchasing mfs and 30 for SIP. But it is very simple, no paperwork, you can buy almost all AMC mfs via this. But, Is there any other way where I can buy with less transaction cost?

I know one way is to directly buy from corresponding AMC. But is it possible practically to visit 4-5 AMCs and buy from them? Is there any other easy way? How you guys are doing?

BTB, I’m staying in Bangalore.

Ravikumar

http://www.fundsindia.com/ can be an option , other than that , visiting different AMC is the only way

Manish

[…] not possible at all, just ask how? How do they achieve it? Stop seeing dreams of getting high returns without looking at the risk involved, and try to find out – what is the strategy they’re using […]

[…] moving forward, let understand why do we buy Mutual funds at the first place ? We sometimes neglect the basic reason to invest in mutual funds, the reason is very simple. We invest in Mutual Fund because we have money to invest but we dont […]

Interestingly interesting discussion!!!

Astha

Thanks 🙂

Manish

Guys, what do you feel about this article by ET?

Top 10 Fund Houses for the quarter

http://economictimes.indiatimes.com/articleshowpics/5575407.cms

Praveen

I am not sure if I like this article , they have not talked about how a reader can use this information , what will I do by knowing top 10 fund house , I cant take decision of picking a mutual funds from that .

Manish

Praveen,

The basis on which awards are given to Fund houses is not clearly mentioned. So, we cannot be sure of ratings.

Manish,

The awards seem to be given to specific mutual funds for “Platinum” category, which seems to be above Gold category. So, I guess it should help readers in atleast evaluating these mutual funds against others in same category (using valueresearch or moneycontrol).

NKanani

I would again say that please dont use RATINGS for choosing , always use Ratings for filtering out !! .

Ratings have biasness somewhere , and you cant take them as the source of truth , dont forget the basics , we never rely on anyone .. not even on jagoinvestor , do all the checkings and thinking yourself, choose things applying the principles of choosing .

manish

Hi Vivek,

I agree with ur views. Once u got sufficient profit can decide to quit & re-invest.

But as u mentioned once we got 100% profit & in case market is faling can’t

we shift to debt to secure our profit & again shift to equity in case market again coming up.

This option is available in ULIP .Not sure in case of MF.

Hi Manish,Pattu,Hemant..

Shd we also take in account sector in which particular fund is investing ?

Is this also imp thing while deciding for MF?

Does the fund manager changes sectors/companies if any particular sector is going down ?

In MF is there any switching options ..like we switch to debt if market is going down in order to save our already earned amt..I am telling in regeards to vivek response..aS he mentioned

there is 3 yr locking period in ELSS program & if we invest in such tax saving

scheme can’t do anything & just can see our money getting reduced(when market is coming down)

can we switch to debt in MF?

Regards

Yogesh

Yogesh

Its you who have to decide which sector you want to bet on if you are buying sectoral fund ? So obviously its your job to look at which sector a fund is investing in !! .

There is nothing like switching in MF, its only ULIP

Manish

Manish, is the expert but when it comes to MFs. I take the lazy route. I decide how much equity I need to invest in and then choose a well diversified fund. Maybe two, one with large cap tilt and one small cap tilt. Choosing the fund requires the simple steps Manish outlines in his video. After that it needs yearly review to shift if necessary. I would think of shifting only if there is consistent poor performance.

Taking the SIP route solves many things and investor doesn’t have to worry about timing the market, since the loss will be smaller with time. Watched kettles don’t boil. If you keep watching a fund you would feel its not giving enough retunns. The mantra I follow is choose well, and forget about it for the first 1-2 year to give it a chance after which you could shift.

Reg. asset allocation two things are important; how much equity can you stomach and how you want to decrease it in the coming years. Decreasing involves two steps. Increase debt component as your salary grows and do systematic withdrawal to liquid debt instruments as your goal approaches.

The new pension scheme has a good asset allocation strategy. 50% equity upto 35 years. Equity decreases linearly to 10 % by the time you reach 60. Debt increases correspondingly.

Pattu

Your strategy is the best .. I cant think more better way to invest in mutual funds by a normal investor with less time in hand 🙂

Manish

Hi Manish,Pattu,Hemant..

Before deciding for MF shd we also take in account asset allocation ?

Does the fund manager changes asset allocation of the fund if any sector is going down ?

Or asset allocation always remains same & can’t be changed ?

What things we shd need to look into asset allocation ?Shd it be equally

disturbed in all sectors &shdn’t be specific to any sector ?

How shd be ratio?

Plz throw some information in this direction.

Yogesh

Fund manager decides on sector allocation depending on the market expectations and his research .

Manish, As most of your other articles, this one is also a good one.

The thing is the thing that looks so simple to you is damn complicated for other. So you may say that it is a 5 min job comparing 2 mutual funds using excel but if you look from some one else’s perspective, it may be extremely complicated :). CAT is always straightforward for a guy who has already cracked it :). Most of the layman investors are not that IT savvy + they may not have that much of domain expertise to give them the confidence that their calculations make sense.

One question I have is: Is it better to keep taking money out of MFs and investing in other MFs ? What if I stay put in MF x for say 10 yrs and if that MF x has given a return of 15% then would that mean my corpus has grown at a 15% compounded rate ? or should we keep on switching between MFs every 1-2 yrs, take the profits and then reinvest in some other MFs. I know the question may sound stupid but it never hurts to ask ;-).

I would like to see more on Gold as investment vehicle. There are so many options like Gold ETF, Gold mining MFs, physical gold and now I see a schme by Birla (in collaboration with some one else) where you can lock the gold price today, pay in yearly installments and either get gold in physical form or get certificates. What is your take on that scheme ?

Thanks for your articles,

DG

DG

Its really a 5 min job once i tell you how to do it .. its some copy paste only 🙂 . If you dont know how to do it , then yes , it can take even hours .

regarding your question , You should not switch very soon , give time to mutual funds to perform , you have to monitor the returns over long term and if you see the performance going down ,then you can switch to other fund 🙂

Regarding the gold scheme , I dont know much , but i would recommend using plain gold ETF’;s only

Manish