Top 10 tricks used by Agents for misselling financial products

Buyers Beware. This is the mantra one has to follow in Indian financial markets. From last many years agents and so-called “Financial Advisors” are using fancy words and tactics to lure investors and sell them inappropriate products like wrong Mutual funds, ULIPS, ULPP’s and Endowment Policies.

In this article we will see what are the common tactics used by agents and how we should handle them and demand logical explanation.

Note that this is not an exhaustive list and there are many more miss-selling techniques which is not covered here. Lets see them one by one.

1# High Dividends declared by Mutual funds.

This is very common tactic used by agents. Even the mutual fund companies advertise about big dividend payout to lure investors.

Investors who do not how mutual funds with dividend options work fall in the trap thinking that dividend is something extra which they get apart from growth, where as the reality is that dividend is your own money which comes back to you and then NAV goes down by that much quantity.

Have a look at Difference between Growth and Dividend option in Mutual funds

2# Premium can be stopped after the first 3 years

This is a very effective statement because every investor wants “no trap” investment option, hearing that we just have to premiums for 3 yrs and still our insurance cover and policy will keep running makes us interested in these products.

There are two wrong things here:

Firstly, ULIP premiums can be stopped even before 3 yrs, there is just lock in period of 3 yrs, even some agents don’t know that you can stop the premiums of ULIP’s anytime after 1 yr and you won’t loose 100% money.

The other thing is that advising paying premiums just for 3 yrs is wrong thing as ULIPs are long-term products and should not be used for short term. This is against the basic principle of any equity related product.

3# This fund has returned 36.6% annual return in last 4 years

Last 4-6 yrs have been extremely good for Indian markets and performance of every mutual funds, ETF or Equity linked product has been great. This single most fact has been used by agents and they have been advertising about the “great performance” of their respective ULIP’s and mutual funds.

What one has to really look at are the returns a product has provided over and above its benchmark or other peers. If Nifty has given 40% return and a mutual funds with bench mark as Nifty has given 41%, there is nothing great in this1p..

In fact its better to use Nifty ETF’s then and get 40% return without the fund manager risk and other costs associated with Mutual fund . We should also ask the agent about the performance of product in bad times and not just good times .

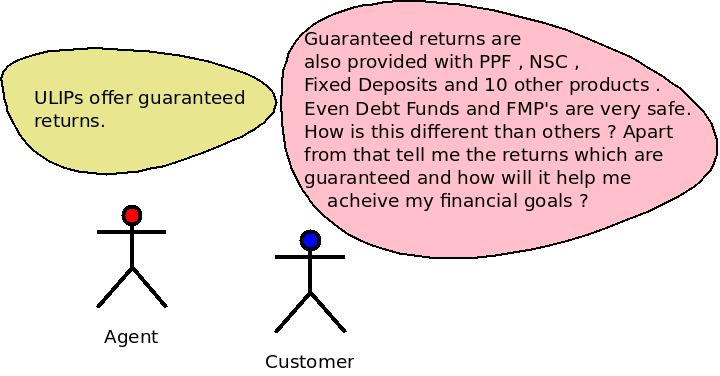

4# ULIPs offers guaranteed returns

This is not true! Any Unit Linked product does not come with Guaranteed returns. Agents some times just say this to attract customers and moreover their Greed! There might be the case that there is some guarantee for initial years premium or over all but then it will be so low that its not even worth considering.

This is not true! Any Unit Linked product does not come with Guaranteed returns. Agents some times just say this to attract customers and moreover their Greed! There might be the case that there is some guarantee for initial years premium or over all but then it will be so low that its not even worth considering.

A simple thumb rule is that anything beyond Bank FD returns will always carry some level of risk otherwise why will someone buy FD at all if they can get some guaranteed returns. Nothing comes free in this world, there is always some risk involved.

Watch this video and don’t get fooled by the agents selling ULIPS plan:

5# This is regarding 180% – 250% guaranteed return plan Sir.

Now a days I can see this strange thing with most of the products, that they have started giving “guaranteed returns” with first year premiums.

This has two reasons, people in India like words like “guaranteed” and “secure” especially at times when markets are doing bad, second reason is that they can use these words at the time of promoting their products, I get a lot of calls which start with “Hello sir, this call is regarding 250% guaranteed return plan sir, Can i explain it to you?”

I can sense that sense of pride in the caller’s voice clearly when they say this even though they dont know whom they are talking too.

My first question to them is “Just tell me the IRR of this policy” and then starts the process of “wait sir, let me transfer the call to my senior” and then “wait sir, Let me transfer the call to the regional manager and CEO” who have no idea what is IRR!!! Finally

6# I will give you 10% of Cash back on premiums paid.

ULIPs and an endowment plans have very high commissions in the first year [See a case of miss-selling in ULIP]. So agents lure customers by giving back some part of their commissions back, in this way they get more clients and more money overall.

Don’t fall in trap of this. Many agents also offer to pay your premiums for 1 yr so that you fall into the trap and take the policy.

7# Money doubling in three years

This is again based on past performance, ask for the average rate of return over long term and anything above 15-16% should look unrealistic. Many agents tell the illustration by taking 20% or as high as 30% as return, they will show your last 5 yrs data when this has actually happened, but its not a right thing for 2 reasons.

First reason is that as per IRDA they are supposed to show you illustration with 6% and 10%, nothing other than this. Ask the agent to explain why they are showing you anything other than 6% or 10%. The other reason is that 20% and 30% are not realistic returns from equity in very long run, you should not expect more than 12-15%.

see this article which explains what are the realistic long term returns from Equity

8# You also get Free Insurance and Tax Benefit.

“Free”, we love this word. You can see that even I have used this word at the top of the page right hand side of this page to lure visitors to subscribe to this blog. It works in most of the cases.

There is nothing called as “Free Insurance”, most of the investors do not understand how insurance works and what are the terminologies, they don’t know that there is something called as “mortality charges” which we have to pay as cost of Insurance.

Apart from this agents also stress on tax saving part which is not something which is unique to those products. We have tax savings on different products anyways.

Dont forget to grab your Free Ebook by Subscribing to this blog by Email or RSS.

9# These are most bought product in the market and have good returns.

Now this is vicious circle, ULIPs are around 70-80% of the products sold by Life insurance companies these days, the reasons are simple. They are explained by agents in such a way that things looks so rosy that customers feel its a worth buying product.

So agents pitch these products to other investors and then they feel “if everyone is doing it then it should be right thing“, far from the actual and real truth. Common sense is not common, so don’t do what others are doing just blindly, think about it yourself, evaluate it.

You should rather be doing what very less people do. Buy Term Insurance which is not even 1-2% of policies sold 🙂 .

10# Low NAV of a NFO from mutual funds

Most of the NFO’s pay very heavy commissions to agents. This is the reason agents tell investors that they should invest in this mutual funds because they will get more units. Even Investors confuse NAV of mutual funds as share price of a company.

At the end its fund performance which should matter and not NAV number, truly speaking we should request IRDA to ban publishing NAV numbers. Some agents also lure investors saying that they should buy low NAV mutual funds because they will get more units and then more dividend as dividend is paid per unit basis.

This is true but again at the end investor will not benefit as dividend is nothing but their own money.

11# Readers Contribution

Add a comment telling how agent tried miss-selling a product to you and I will add it here :). You can also share any incident small or big.

Readers Tip, How to reduce Misselling: One of the readers “Jagbir” has suggested an excellent idea for IRDA to curb miss-selling: As per Jagbir, “Agents must get commission only after customer feedback, If customer is not satisfied with the agent suggestion or his way of selling, they can give the feedback and then agent commission will not be paid “.

What do you guys think about this ? Please comment ..

Conclusion

India financial markets have two main issues

High commissions for agents:

Because of high commissions, agents tend to go beyond limits and start unethical selling. Apart from this lot of sales pressure, pressure of meeting targets force agents to achieve the target by hook or crook. IRDA should finally come up with some rule where they remove the commissions on the products.

Low awareness and understanding from investors:

Finance Industry has very smart people at higher level, CEO, Relationship managers, advisers and everyone. they are smart people. they understand human psychology. They know Indian public more than Indian public knows themselves. They know what words to use when and how to divert our minds, our thinking.

Why do they come up with “Guaranteed return products” when markets are low?

That the the perfect and the most right time for everyone to enter Equity, but companies know we are afraid of losing, we don’t like losses, we have lesser risk appetite and then all the Jeevan Astha and Jeevan Nishchay and other Secured products like RGF will pop up.

Most of the NFO’s will come in the bull markets and when markets are already up because that is the time we are charged up and ready to bet our home on anything, that is the time when we have to avoid those things.

So finally avoid the trap, ask questions, doubt everything!!

I would like to hear if anything like this has happened with you did some agent every tried some tactic to missell a product to you. Please share your experience and let others know what happened with you.

January 17, 2010

January 17, 2010

this website spreading false news about life insurance ..he always talkng abt term insurance but in rural area u dont find all the private sector life insurance comp which will give term insurance in cheaply …only few of the agents will mis sell the insurance products ……this website is endorsed by stock market brokers it seems ….term plus ppf and other investment is gud …but our rural ppl r not that much educated in invest in stocks and mutual fund ….

Manish stop spreading false news about life insurance …..only few of the educated fools were cheated by smart agents …but most of the ppl are aware about life insurance ..sbi life insurance educating policy holders…..every where agents will get commission even stock brokers also …..

Hi Venky

Which statement is false or misleading , can you give me that line ?

in 2008 my lic agent explain me about market linked policy and i give her money for 2 policies but they handover my jeevan aastha which i just recently got to know is not market linked…i dont have any writen prove about our conversation of that time…what should i do..please help..

If you dont have it written or any kind of proof , then its as good as you are lying ! . I know you are not lying , but how do you prove it ?

OH.. i am already in the trap. Either there is very less awareness or it was my fault of not enquiring. i bought the metsmart plus back in 2006. The agent might have used almost all of the above 10 tricks to get me into it.

policy details:

insurance of 1200000

expirs in 73 yrs

its a multiplier

monthly premium : 4000

I paid the premium regularly for 3 yrs and then stopped.

I have always noticed that the fund value has never gone above my principle amount that i have paid. and if i plan to discontinue i will get the sum after deducting 10% of the total value. (Which is ridiculos)). i had paid total of 148000 and the current value is 141ooo. And its dropping by the day.

i have not been paying the premium since 2010.

They say its only after 10 yrs i will be able to get the amout out without any charges. I guess they are right as by that time they anywys might have eaten up the entire sum.

Just one question.. i am going ahead and discontinuing it.. Taking out whatever is left..Paying them what ever charges..i guess the total i will get in hand frm them is around 110000. its better than losing the entire sum…

There is no other way out right? Switching the fund wont help right?

By the way manish i have listed your site on my blog aswell..as i feel everyone should visit your blog before making any finanacil decisions.

Thankyou

I think you are over panicking .. i know your fund has not done good and most of the returns have been eaten up , but once markets take a U turn from here you can see some good jump in your ULIP . However if you just want to get rid of it . just surrender it !

Dear Manish,

This is 2nd year of the HDFC Young Star Supreme Suvidh plan i took for my daughter. I can recall all the statements from agent as mentioned by you. Now the policy fund value is even than the premium i already paid. I am little worried. The term is 15 Years.

Umesh

What does policy document say about stopping the premiums before the lock in period of 3 yrs ? Better stop this policy and start your investments in some MF

Manish

Dear Manish,

Looks you have very deep knowledge of Insurance Industry.

I need a suggestion:

I’m seeking to purchase a health insurance & I’ve even done R&D to my level.

As per my findings Apollo munich is best one but I have a doubt ,how Apollo providing the lifetime renewal,is there something hidden cause maximum of the companies have renewal limit till 70years,but how come Apollo is providing lifetime & that with flat premium for life time.

We all lucky to have a person like you in our network who tells the facts very bluntly to the level that many of Insurance guys don’t like to read.

Kindly suggest me ….!

Expecting your reply soon..!!!!

Rahul

First thing you need to know is that premiums not FLAT for lifetime . It can change every year because its a yearly contract only . Also the premiums today might consider the LIFE TIME RENEWAL THING . Each company has their own thinking, experience in health insurance and based on that thye feel that they can provide life time renewal . Other company might not think like that .

Also when a person would be of high age , his premiums at that time will also be big

Manish

Hi all

WHile browsing some of the comments, what I find interesting is that it is not the SELLERS, but BUYERS, who are more greedy on two counts, i.e. rather than trying to get into the nitty-gritty of the products, what MAXIMUM RETURNS ( GREEDINESS ), they would achieve; and secondly what the under-the-table ( commission ) the SELLERS ( CFA ) are going to get and they would part with how much portion.

I apprehend, if honestly all BUYERS OF financial products, stick to their requirements, and make some home-work, brain-storming session with couple of CFAs, then certainly, whole is blame-gaming would get over

Comments from viewers welcome, as also from the moderator

Pankaj

I would agree with you .. You are right in saying that buyers are in mess today because of the wrong expectations they have created over the years .

Manish

Manish,

Thanks. Thats a great article. I am in the trap. 3 years I have invested in ICICI Lifestage Pension Plan 100000 rupees premium a year. I already have paid 3 years. As of today, the fund values are about 3.95 lacs. I would like cancel and withdraw my money and invest in good mutual funds.

My questions,

1. How can i cancel my policy and get back my money?

2. Can you name few good mutual fund names?

Moorthy

You can take money out but there will be surrender charges in it ,.look at policy document on how much is it . Regarding mutual funds , there is already an article which has those names

Manish

i like to know whose fault is this –

Policy holders, agent, company who is creating such product to cheat others .

I believe lack of awarness among the agents is the root cause.

If you go and asked any agent atleast 70% dont know about the products.

and sell to there family mambers

Swarup

I agree with you , agents in India are also mis-informed at the same level as investors

Manish

HI all

Here while browsing the details, I, on first hand, got the idea, that it all at the end AGENTS are held liable for selling ( mis-selling) of any financial products. But I think, that apart, the onus of responsibilities also lie with the COMPANY, they are also under full stress for achieving the TARGETS, as set by their top-notch, and all they in the company, get is their benefits ( commission – charges ) on turn-over of AUM, which might be daily, weekly, fortnightly, monthly etc.etc. that is finer point, everybody giving a blind eye to it.

Pankaj

Yes , I agree with you . Its not just agents but also companies for designing those kind of products and have aggressive marketing and competition . However this is not yet highlihted on the articles.

Manish

Hi Manish Excellent work Once Again.

I would also like to share one more trick they are using now a days.

I suppose many of them even never thinked of it ever before.

I meet one Insurance agent who was having as usual a great hunger(or rather never ending) hunger to sell the policies.

when we meet for first time he did not uttered a single word about any policy.Same was the case for subsequent 4 to 5 visits. I was wondered!!! then on one fine day he asked me what does your sister in law do? Does she go to job or does she do any work ? I replied NO, she is a housewife. He said she has opportunity to earn extra amount & doesn’t has to go to any office. He offered us to make her Insurance agent by simply passing IRDA exams. we thought that it was good & she can earn by her own & that to without going office. He took some 800Rs. fees,filled up some forms & given us the date for exam. She prepared a lot for exam & got Passed out by Good numbers.

This is where we actually entered the trap.after some days he started calling her to sell at least one Insurance policy. Friends, Relatives every one was tried out but all in vain. At last we decided to take one Insurance policy by ourselves. Same thing next month, again some attraction of some good commission & attractive prizes. Again the same trial for friends & relatives & again we took one more policy. This was again repeated for the third time but this was the time when we got alerted. His main motto was not make a good agent but to sell his policyto us, the only thing is that he was having a different way.

Hats off to this Guy & to his idea!!!

Amit

thats interesting 🙂 , many agents might read this and try this trick now 🙂 . But never mind , In the example you mentioned, why was your sister in law not able to sell any policies, lets take this as a positive event and really she got some opportunity to earn some money provided she does it right way .Can you tell why didnt she sell any policy and how does pressure from that agent matter ? He was not the boss in this case ? right ?

Manish

yes,every word is true.

the agent has not lost his 800 rs any more, instead he got some incentives for refering one agent plus pass in the exam successfully plus active by giving some polices.

this is a old trick.

But the readers can learn from this is life insurance co. are more interested in natural market with OBLIGATION instead of teaching agents about financial planning.

thanks for this service

Thanks for updating 🙂

financial products are not just MF’s & ULIP’s right?? instead of criticising each act of a financial product marketing executive, thinking of the need of insurance, will also be desirable. It’s high time that india should implement compulsary isurance to every citizen jus like american and british nations…

most of the posts above shows the pre conditioned nature of typical indian mind.. sorry to put it this way though i too agree that not all financial products are worth it..

Sarin

ULIP’s and mutual funds are the most missold products to most of the people , so thats the reason those are covered .

Manish

Hi Manish,

I am 24 years old software employee.I have taken HDFC ULIP endowmnet plus 2(equity plan) on Sept 2009 for Rs3000 SIP .I have paid 11 installments (Rs 33000) .Current fund value is Rs11000.After reading lot of blogs i came to know that ULIP is not a better option for long term.

Now i want to come out of this plan.what is the appropriate time(after 3 or 5 years) to stop paying the premiums.Can you give me your suggestions on the same.

Durga

looks like your charges are too high , you paid 33k and the total value right now is just 11k , you can get out of this after 5 yr without any charges , after 3 yrs you can take money out but you will have to give some surrender charges as per policy docs .

Manish

Thanks for suggestion Manish,

i have some more question regarding my ulip plan.

1)My fund was equity managed fund(60% – 90% in equity & 10% – 40% in debt)from beginning.Till now i have not used the switching option.Is it good time to switch the fund to growth fund(90% in equity and 10% debt).As from 2nd year onwards deductions are very less(7%) compared to 1st year,so most of my money will be invested in market.My plan was to stay invested for at least 5 years and come out of it.

Can you tell me what are the precautions taken into consideration before using switch option

2)I was not clear about the NAV growth concept for HDFC ULIP endowment plus 2(presnt NAV is 10.60) when i was taken the policy last year endowment plus 2 NAV is approximately 9.

Is this mean endowment plus 2 is not performing well or because of steady stock market?

3) Right now Sum Assured was 3lakhs and i want to reduced to less amount as much as possible and planning to take a term insurance.Does this make any sense?

Eagerly waiting for your response

Manish can you give your inputs on the above

1) How to do switching ? : This is equal to saying how to sense market movements , Its not a short game which can be learned in fews hours , thats the reason ULIP’s are not suitable product for everyone , its for people who can understand market well so that they can also time their switching in ULIP’s .

If you ask for my personal opinion which can be dangerous to apply on some one else financial life , My opinion is that its not the right time to switch to equity , the reason is that now market is in over bought region , markets can fall down , but we dont know when , 1 month or 6 month , we really dont know , but its not the best time to buy , thats sure .

2) Fund NAV comes after deducting the charges , and als0 where is this investing ? from the name seems like they are more into debt instruments , if that is so then its not a high growth investment option , its more of a secured option .

3) ULIP’s insurance is also same as Term insurance , they cut the mortality charges only for insurance, which is same as term insurance . However i would suggest go for term insurance anyways .. I am not sure if you have an option to reduce your cover in ULIP , anyways its just 3 lacs 🙂

Manish

Manish,

Because of initial high charges I am already in loss of 22k, which is better option do i need to invest for 2 more years (36k + 36k) and surrender after 2 years(total 3 years premium of Rs1,06,000 ) to recover some loss or stop paying the premium no itself.

I don’t know how much money i will get after 3 years if i stop paying the premium right now.

I am in confusion I need your suggestion on the same.

I had a look at this plan just 2 days back because one of my team mate was holding this one and I saw this policy . I must say .. “One of the worst ULIP policies” .

here is the policy document .

First the allocation charges itself are so high , 60% in first year (the document shows 40% allocation rate) . And 7% in the second year and 2% after that every year .

On the top of that the surrender charges are also so high , if you complete 3 yrs and surrender , it would be 15% of the fund value .

So over all I do see much value in this plan , but if you have paid 2 premiums , then just stop paying anything further and then take money out after 5 yrs .

Manish

If you look at the Surrender charges section

Manish

Thanks for the quick inputs , i am paying the policy using SIP.Till now i have paid 12 premium(1 year completed).If i stop paying now and if i take the money after 5 years what will be the NAV value taking into consideration while redeeming the units.

Do i need to explicitly tell them i don’t want to pay the further premiums??

Manish,

Can you pls give ur input on the above

Durga

NAV cant be predicted , Not sure on what happens if you surrender before 3 yrs , generally there are two things which happens , either they sell everything and keep your money in cash , and then pay you back after 3 yrs , or the value of NAV goes up and down as per market , but in that case the yearly charges will still apply .

Manish

Its really wonderful to see such elaborated blog for personal finance.

Also please make me clear is their any logic so that we rank which is the best insurance company from which we can take cover.

I don’t want to compare by Cost of the policy, cost is almost 10-20% around.

If we can have information about companies financial health, claim ratio, turnaround time, ratings by CRA’s etc.

Adi

This is a question asked by almost everyone , and truly speaking i dont think one should think much about it . the problem happens most of the times from customer side while giving details to insurance companies which lead to claim rejection .

How ever , what a customer should concentrate on is giving 100% proper info while filling info , you can select any company after that .

Manish

[…] Read the rest of the article here. […]

[…] Look at Different tricks used by Agents to missell products […]

Hi Manish,

Excellent presentation. Its spot on. In my family, we have invested in at least 4 UILPs without knowing each other. Generally the agents impress you and dont give much time to think about it (saying that the last date is round the corner). Mostly these agents are your friends/acquaintance and try to play at emotional level.

My suggestion is each fund should have a feedback post in their website where the unit holders can give feed back. I have seen there are lots of good funds which are not getting attention in common public, only the unit holders know their benefits. Vice versa for negative aspects of the funds as well.

Looking forward for more enlightening articles from you.

Thanks, Giridhar

Giridhar

Good suggestions 🙂 .

Manish

My father has taken a ulip and the return is still in a negative after 4 years of premium being paid would it be right to quit specially when the higher percentage of commission has already been paid off

Should I wait till I achieve a break-even or some positive return (maybe next 2-3 years) or should immediately quit because now also even if I quit it will charge me something

Keshav

YOu can get out if you are not ok , waiting does not mean sense ,you will be loosing the time anywyas ,which you can use to grow the amount anywhere anyways .

Surrendering the ULIP before 5 yrs , will attract tax on the amount which you recieve , as it will be treated the income .

Manish

hi

there is so many policy offered by insurance company,high allocation charge =80%

zero allocation charge with high amount of hidden charhe. addministration charge etc

my question is how thease product approved by IRDA,

I THINK HEAVY ILLEGAL TRANSACTION TO APPROVED THEASE POLICY(my personal view)

rahul

Yea . ULIPs by design have heavy upfront costs . Anyways … now ULIPS are finally banned for the moment from SEBI .

Manish

gr8 job dude.keep it up.

[…] tax savings second and then somewhere in the last we talk of insurance as well. Now again such practice of mis-selling has emerged and agents are targeting LIC’s new product Wealth […]