Introduction to Health Insurance in India

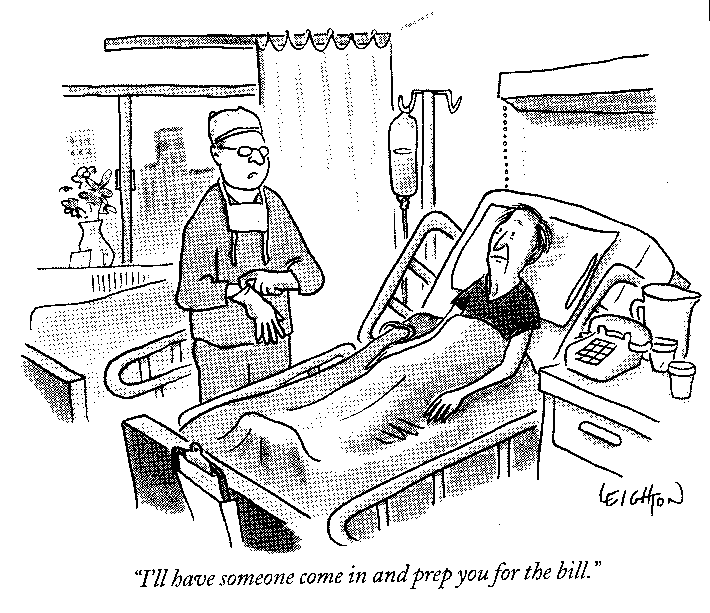

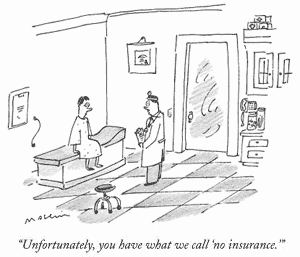

How many accident you need to realise that you need Health Cover? It takes just one visit to a hospital to make us realize how vulnerable we are, every passing second. For the rich as well as poor, male as well as female and young as well as old, being diagnosed with an illness and having the need to be hospitalized can be a tough ordeal. Heart problems, diabetes, stroke, renal failure, cancer – the list of lifestyle diseases just seem to get longer and more common these days. Thankfully there are more speciality hospitals and specialist doctors – but all that comes at a cost. The super rich can afford such costs, but what about an average middle class person. For an illness that requires hospitalization/ surgery, costs can easily run into five digit bills. A Health insurance policy can cover such expenses to a large extent. Read why Health Insurance is more Important these days compared to Old days

Types of Health Insurance

There are mainly three types of Health Insurance covers:

- Individual Mediclaim : The simplest form of health insurance is the Individual Mediclaim policy. It covers the hospitalization expenses for an individual for up to the sum assured limit. The insurance premium is dependent on the sum assured value. Example : If you have 3 family members you can get an individual cover of Rs 2 lacs each . In this case each of you are covered for 2 lacs , if 3 members face a need for hospitalization , all 3 of them can get expenses recovered upto Rs 2 lacs . All the 3 policies are independent .

- Family Floater policy : Family Floater Policies are enhanced version of the mediclaim policy. The sum assured value floats among the family members. i.e each opted family member comes under the policy, and it covers expenses for the entire family up to the sum assured limit. The premium for family floater plans is typically less than that for separate insurance cover for each family member. Example : In this case if suppose there are 3 family members , you can take a Family floater policy for Rs 6 lacs in total . Now anyone can claim upto 6 lacs in expenses , but then the cover will go down by that much amount for that year . So if one of the family member is hospitalised and the expenses are 4.5 lacs . It will be paid and then the cover will be reduced to 1.5 lacs for that particular year . Next year again it will start from fresh 6 lacs. Family floater makes sense for a family because that way each one in family gets a big cover and probability of more than 1 getting hospitalized in same year is too low untill and unless whole family is travelling together most of the times in a year .

- Unit Linked Health Plans : Taking the ULIP route, health insurance companies too have introduced Unit Linked Health Plans. Such plans combine health insurance with investment and pay back an amount at the end of the insurance term. The returns of course are dependent on market performance. These plans are very new and still in development phase . This is only recomended for people who can handle market linked products like ULIP and ULPP . Read who should buy ULIPs .

For a number of reasons, it is advisable to steer clear of unit linked health plans. The best way is to treat insurance purely as an expense. So if you are single, opt for an Individual Mediclaim policy and if you have family, opt for a Family Floater policy. The amount paid (by cheque or debit/ credit card) for health insurance premium provide tax exemption under section 80D for a maximum of Rs.15,000.

What is the Ideal Cover for Health Insurance

As mentioned earlier, the cost of Health Insurance depends on the sum assured , age, current health condition and your previous medical history. Higher the sum assured, higher the premium. So what is the ideal health insurance cover requirement? There is no standard answer or thumb rule for this. If we agree that health insurance is important, one has to look at his/ her own lifestyle, health condition, age/ life stage, family history of illnesses and affordability. Keep in mind that most insurance companies limit the sum assured to a maximum of 5 lakhs. Also note that many health insurance policies “provide additional benefits” such as daily allowance, ambulance charges, etc. for hospitalization. Not only are such “benefits” superfluous, they tend to drive the premiums higher. So it is best to avoid such plans and stick to something basic and simple.

Image courtesy

Health Insurance provided by Employer

Many employers provide health cover for their employees. Isn’t that sufficient? Three aspects need to be considered in such a case – Is that cover sufficient? Is the insurer good enough? What happens if you change your job? Health insurance is provided as a perk to the employees. So it is important to understand the policy a bit more in detail and to check for coverage. The best way is to ask the HR Department for policy details. Get into details , what is covered , what is not covered ? Many times Employees just think that they have health Insurance and are just relaxed only to find later that it does not cover X and covers Y only upto a limit . That can be a painful situation .

Health Insurance for the aged

Till a few years back, health insurance companies were reluctant to provide cover for the aged. But nowadays there are a lot of insurance companies providing policies for the senior citizens. Insurance cover paid for a person of age 65 years and above, can provide additional tax exemption of up to Rs.20,000. But keep in mind that the premium rates are higher for senior citizens. For the employed, another option is to approach the employer to negotiate with the official insurer to provide an option for additional cover to parents. Since the volumes are high, the insurer can provide such added cover at attractive premium rates.

One of our readers Pattu has shared a great calculator which he discussed in his comment is uploaded here , If you want to download it , Click here

Tax Exemption from Health Insurance Premiums

Sec 80D covers Health Insurance . You can get exemptions of

- Upto Rs. 15,000 paid for self + spouse + cildren.

- Upto Rs 15,000 paid for Parents (Rs 20,000 if parents are senior citizens)

So in total if you pay your health insuance and your parents health Insurance premium , you can save upto maximum of 35,000 .

Note : If you take Health Insurance riders with Term Insurance like Critical Illness cover , the extra premium paid for that will be actually be covered under Sec 80D , not sec 80C . See Tax Rules

What is TPA (Third Party Administrators) ?

TPA stands for Third Party Administrator. TPA is a middlemen between Insurer and the Customer . Customer can directly deal with TPA at the time of claim and TPA will help with with all the process of claim settlement . A TPA is a specialized health service provider rendering variety of services like networking with hospitals, arranging for hospitalization and claim processing and settlement. The concept of TPA has been introduced by the IRDA (Insurance Regulatory and Development Authority of India) for the benefit of both the insured and the insurer. While the insured is benefited by quicker & better health service, insurers are benefited by reduction in their administrative costs, fraudulent claims and ultimately bringing down the claim ratios. An insurance company can have more than one TPA and a TPA can serve more than one insurance company. Some of the services TPA provides are

- Maintain database of policyholders

- Issue of identity card to all policyholders

- Provide ambulance service

- Provide information to policyholders about hospitals.

- Check various investigations

- Provide Cashless service

- Process claims

Health Insurance Claims settlement process

A bit on how health insurance claims processing works. In most cases, the Insurance companies appoint a third part administrator (TPA) for claims processing. That means once the health insurance policy is sold, the insurer passes on the baton to the TPA. In case of a claim, the insured has to get in touch with the TPA for all versification and formalities.

There are 2 ways by which health insurance claims are settled:

- Cashless : For availing cashless treatment (only at authorized network hospitals), the TPA has to be notified in advance (for planned hospitalization) or within the stipulated time limits (for emergencies). The insurance desk at hospitals usually helps with all paper work. The claim amount need to be approved by the TPA, and the hospital settles the amount with the TPA/ Insurer. Typically there will be exclusions and such amount will have to be settled directly at the hospital.

- Reimbursement : Reimbursement facility can be availed at both the network and non-network hospitals. Here the insured avails the treatment and settles the hospital bills directly at the hospital. The insured can claim reimbursement for hospitalization by submitting relevant bills/ documents for the claimed amount to the TPA.

The TPA mode of claims settling has its own problems. The TPA is incentivized to limit insurance claims and they are not the one’s who sells the policy. There are many cases where the insured had a tough time to claim for his hospital expenses. So before taking health insurance it would be useful to check who the TPA is and how good are they when it comes to claims processing. Internet search and a friendly chat with the hospital staff can give you good insight on the insurer/ TPA. There are also some health insurance providers who do not employ TPAs and does claims settlement directly (this is called Inhouse TPA) .

Comments , What are the best health Insurance policies you are aware of ? Do you feel it makes sense to buy health insurance at early stage or after getting married only ? Please share your views on this .

This is a Guest Article from Ganesh who is an avid follower of this blog and his blog is My Graffiti Page. Please note that this post is NOT intended to promote or suggest any Health Insurance plan. If anyone is planning to take Health Insurance this New Year, the post can possibly provide some useful tips and pointers for selecting a suitable plan. Your comments and thoughts are most welcome.

January 7, 2010

January 7, 2010