Don’t Judge a mutual fund by its Short Term Performance

“Don’t judge a person by their Sunday appearance” applies to Mutual funds also. Best Mutual funds are the best over most the time frame and Worst mutual funds are the worst performers in most of the time frame.

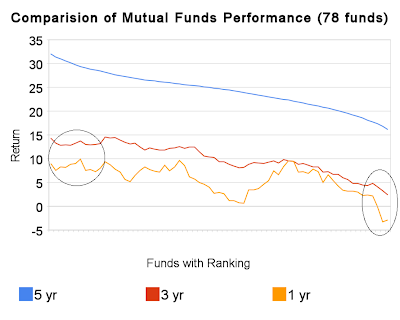

What I mean by this is that the best performers return wise in 5 yrs, 3 yr and 1 yr are almost at the top and worst performers are always in the bottom for 5 yr, 3 yr and 1 yr time frame. Let us look at the Chart of mutual funds performance

I compiled a list of 78 top mutual funds on the basis of 5 yrs Return and plotted a graph of returns for 5 yrs, 3 yrs and 1 yrs for them accordingly. To smooth out the data, I took a 10 period moving average (i.e. I took an average of Top 10, then an average of 1-11, then 2-12…) Just want to see what is the pattern of Mutual funds list. Have a look below:

Source: Valuereserchonline.com

Source: Valuereserchonline.com

If you look at the chart above, you will see that the Best performers (Top 10) were in the best performers list for 3 yrs and 1 yr time frame also. And at the same time, the worst performers in 5 yrs time frame were the worst performers in 3 yrs and 1 yr time frame, whereas the opposite was not true… See this video post on how to choose a good mutual fund for yourself?

Here are the Learning’s and conclusions:

Do not judge a mutual fund by it’s short-term Performance like 1 yr

There were many mutual funds who gave top returns in 1 yr time frame (See the orange line, see all the top positions) but not all of them were the best in 5 yrs time frame. The same thing happened with 3 yrs time frame: there were 2-3 mutual funds at the top in 3 yrs time frame but they were not best in 5 yrs time frame. See why SIP works well in long-term

Short-term performance does not give enough indication of Long-term

This is common sense, just like meeting a person for few hrs or days cannot tell us about his/her nature or behaviour, the same way a mutual fund cannot give a good indication of its long-term perspective from short-term performance.

In the above chart you can see that if I gave you just one year performance chart and it was sorted by returns, you could never tell which amongst the top would also be at top in 5 yrs time frame.

Bad performance in short-term should not be taken too seriously.

This is kind of same thing which I said above, but let’s see it with a different perspective. Short-term performance should not be the only reason for selling your mutual fund or Shares. We generally take our decisions based on short term performance, that is true for Life also.

We need patience and give time to our investments to show its true colors. Good investments happen by giving time to your investments and Early Investing, not just by choosing one.

Comments please, your 4-5 kind words will help me know if you liked it 🙂

September 22, 2009

September 22, 2009

Hey Manish, planning to foray into the following GROWTH schemes on SIP: HDFC Top 200, HDFC Bananced Fund, HDFC Prudence Fund, IDFC Premier Equity Fund PLAN A, DSPBR Top 100 Equity Fund. Do I stand well-advised?

Sandy

Why so many ? just put in HDFC top 200 & DSPBR Top 100 Equity Fund . thats all

Manish

I had invested in two top funds SBI Magnum and HDFC Taxsaver earlier. I saw that while the former performed at 8-10% p.a the latter did about 14-16% p.a last 2-3 years, averaging out the performance levels. I was hoping to average better across 3-4 well managed funds. Is it a wrong way of thinking? Since a single bad performing fund wipes out the gains from the good one.

Let me know what you think ……

Sandy

yea 2-3 funds are good for diversification

Manish

Hi, have about a Lac from bonuses this year and want to be able to channel this into investments using MF as my chosen money market instruments. Kindly let me know if I should do a SIP or go lumpsum. Also need you to help suggest about 3-4 good MFs that I can invest in. Also is there any website that provides year-on-year returns of Mutual Funds. The ones I know rate them, worship them etc etc and give 3 yr, 5 yr and since inception performance figures but never the Y-on-Y data. Last but not the least, have been invested the last 3 plus years in HDFC Taxsaver and SBI Magnum tax gain and now thanks to the impending DTC norms, am breaking free and planning to divert this money (4K+4K) into SIPs some good funds. Can you pls help recommend a few?

Sandy

You can do a SIP for next 6 months out of the money you have . Valueresearch shows the Y–O-Y data (go to PERFORMANCE section of amutual funds page) .get out of SBI magnum now

Manish

Dear Sir

I want to know are mutual funds are tax exempted,or i have to pay the tax when i sold the bond say after 20 year

Binod

It would depend on the tax rules at that time when you sell. As of now Equity mutual funds are exempt from income tax provided you sell them after 1 yr. However you have to pay tax on debt funds

Manish

[…] Last 4-6 yrs have been extremely good for Indian markets and performance of every mutual funds , ETF or Equity linked product has been great. This single most fact has been used by agents and they have been advertsing about the “great performance” of their respective ULIP’s and mutual funds . What one has to really look at are the returns a product has provided over and above its benchmark or other peers . If Nifty has given 40% return and a mutual funds with bench mark as Nifty has given 41% , there is nothing great in this . In fact its better to use Nifty ETF’s then and get 40% return without the fund manager risk and other costs associated with Mutual fund . We should also ask the agent about the performance of product in bad times and not just good times . […]

[…] from equity (2009) and he will be happy with even 25% next time! LOL! This happens when you look at short-term returns. Investors who started in 2004 started thinking that they are all “Warren Buffet” and can […]

[…] have the unique way of investing and what not. Let us see in this article, how we should look at short-term performing mutual funds and evaluate them on different […]

[…] Debt Oriented Mutual Funds are those Mutual funds which Invest primarily in Debt products like Debentures , Certificates of deposits from Corporates , Govt Bonds etc , They put a small portion in Equity also (10-40% max) . These funds generally return in range of 10-20% in long term and the downside is limited in these Mutual funds as Debt Component is High . Please note that even these Funds can give Negative Returns but that happens in Extreme fall downs or very bad times . You should not assume these will always give positive returns . Also You should also concentrate on Long term returns , Dont judge a Mutual fund by Its Short term Returns […]

@Business Pandit

Thanks for the link 🙂

@Samson Smith

Welcome to Jagoinvestor .. I checked your blog , its pretty cool .. with some very good articles 🙂 .. liked it .

Manish

Great post, as i am searching for such good information about short term and long term, it will surely help me a lot.

For comparing one-time and SIP returns, go to valueresearchonline.com and check the "Returns Calculator".

For historical returns, check http://www.mutualfundsindia.com/historical_nav.asp

good one manish

@Manshu

Bar chart is not a suitable one for this , I will explain you the chart . So on x axis its performance of 78 funds .. you can see it as 78 different small points and on Y axis is the CAGR return for them . So if you see first circle its showing some 6-7 funds which were top performers in 3 and 1 yrs time frame .. then as yu move left you can see the performance of others funds and their returns dropping and finally you have funds with least performance . I hope you got it . If not revert back .

@Rajan.T

Its a great Idea, I would have loved to implement it , However it would be too much of work and collecting data is an issue , How do i get per month NAV of all the mutual funds , any idea ?

Also you can look at http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html for time being ..

@Zindagi

Thanks, I would love to know what else could have made it much better .. what part was not good .

Manish

Another great article with lots of info, good work Manish

Thanks for posting!

As usual great job manish..I have one idea for further refinement.you can come up with a comparison(5yr/3yr/1 yr) between the Onetime and SIP investment.that way we can highlight the benefit of SIP or the Rupee cost averaging process for the readers

thanks,

Rajan.T

That's a great point you make,but I am unable to decipher the chart myself, this may probably be better as a bar graph?