New Mutual Funds Charges from ICICI

ICICIDirect has revised its brokerage charges for Mutual funds Investments . Some time back SEBI abolished mutual funds entry load , In this post we will see the new charges by ICICIDirect and analyse if its good or bad . The new revised charges look good to me . In case you don’t know what is SIP , Read here

So ICICI Direct came up with this Rule . If your Mutual Funds portfolio with them is

Your Mutual Funds Portfolio Above 8 Lacs with ICICI

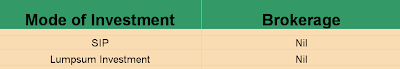

So , it means you can just invest through ICICI Direct website and your brokerage would be Nil and you wont pay any thing in charges .

Your Mutual Funds Portfolio is Below 8 Lacs with ICICI

You will have to pay lower of Rs 30 or 1.5% of the amount each time if you go for SIP . On a lump sum investment , you will pay Rs 100 .

Is it Good or Bad ?

If your SIP payment is High

This revised charge structure will be very good for you if you are making Higher SIP payments like 10,000 . In that case your charges would be Rs 30 each time , which is 0.3% , which is 87% cheaper than earlier cost (2.25% entry load) . Even with 5,000 SIP , your charges would be .6% , which is much better than what you were paying earliar and this all with the convenience of doing everything online yourself .

Read why SIP is best for salaried class people

If your SIP payment is Small

If your SIP payments are less than 1,500 , then your charges would be 1.5% , which is near 2.25% , what you earlier paid, you are still benefiting , but not to great extent . Now its you who have to decide

- if you would like to go with direct Mutual funds investing yourself (without any charge at all)

- You can find some other agent who charges less than 1.5%

- You are ok with 1.5% charges and comfort is more important to you .

Suggestion to people who have lot of Mutual funds in your portfolio

In case you have too much mutual funds in your portfolio and your SIP payment in each of them is small , the better thing would be to prune out most of them and consolidate your mutual fund portfolio to maximum 5 funds and better to more payment in each , for example if you have 15 mutual funds of Rs 1,000 each , change it to 4 mutual funds with 4k payment to each or Something like that . It will help in management of funds also and also help you reduce the charges .

There may be some other agent or web portal who are not charging at all for mutual fund investments through them . For people who are yet to open a Demat account and also looking for Mutual fund investments , Opening a ICICI Direct Demat account may be worth looking into .

What is most Important

Don’t try to put too much thinking in this , less charges are good , but its not the main thing , you must concentrate on your Asset Allocation and Portfolio Rebalancing and choosing a good mutual fund for you . So if you getting a good advice , its worth to pay good fees for that , don’t try to save that small amount just for saving it .

Please comment what do you think about this ? Do you know of some other alternative route through which the commission will be better than this .

Liked the post , Subscribe to Get Posts in Email or RSS Reader

August 18, 2009

August 18, 2009

Can I invest in direct funds of other AMC’s through ICICI direct?

No you cant !

Thanks Manish

Hi Manish,

I was looking for option to reduce the Mutual Fund charges in ICICIDirect.

Please let me know this option worksout.

ICICIDirect doesn’t charge anything for Liquid funds.

Let say, i buy some liquid funds in HDFC and then enable STP from liquid to “HDFC top 200” monthly.

With this option i believe i’ll get dual benefits 1. Better than savings account interest 4% till SIP date 2. No mutual fund charges on SIP.

Do you see anything wrong in it? or I missed any charges in STP?

Thanks,

Prabakaran

Dont they charge any thing for each SIP ?

You may look into this for detailed charges. http://content.icicidirect.com/mailimages/Fee%20Structure.html

ICICIDirect charges for Non-Liquid fund in both SIP & Lump sum.

There are No Charges for SIP & Lump-sum in Liquid funds.

I thought of follow this approach,

1. Have a monthly SIP on “HDFC CASH MANAGEMENT FUND – SAVINGS PLAN” [To beat 4% Savings account interest]

2. Create STP on “HDFC CASH MANAGEMENT FUND – SAVINGS PLAN” to “HDFC PRUDENCE FUND” & “HDFC Top 200” on a specific date.

Through this route, i would be saving ICICIDirect charges and getting more than 4% on the funds waiting for SIP date.

Did you find anything wrong with this approach? or I missed any charges or hidden conditions in STP?

Note: I couldn’t find the charges from ICICIDirect/HDFC for STP. So I assume they don’t charge anything on STP.

Thanks,

Prabakaran

STP is nothing but the SIP only , just that instead of your bank account, the money is going from your funds.

Since ICICIDirect didn’t show any upfront charges while creating STP Request.. I assume, through this route i can skip MF transaction charges.

Let me create a STP request and let you know if there any charges after execution.

Why dont you call the customer care and enquire !

Hi Manish,

I spoke to Customer Care, they confirmed there are no charges for STP.

I have created an STP on 15th Feb, I can confirm this after the STP order execution.

Thanks,

Prabakaran

Good .. thanks for sharing

I cross-checked after order execution, i wasn’t charged anything.. 🙂 Now planning to modify all my SIPs through this route…

Great !

Rs 30 for each sip …is this we have to pay evry month (for each sip) or this is annual charges???

akash

Hi

Can you guys let me know that icicidirect or hdfc fund or even sharekhan charge any annual holding charges for mutual funds??

HDFC has 100 per quarter . You can know about others at our forum : http://jagoinvestor.dev.diginnovators.site/forum/

Manish

One clarification here, above KYC comment applies to ICICIdirect customers only.

ok

Hi,

Recently I heard that kyc is now applicable to all i.e. investors has to fill kyc even if investment amount is less than 50,000/-

following info i got from one of the mf amc…

>>>>>

As per Association of Mutual Funds in India (AMFI) circular dated August 16, 2010 sent to Asset Management Companies (AMCs), KYC (Know Your Client) is mandatory for investors wanting to transact in Mutual Funds, regardless of the transaction amount.

What this means is that we will not be able to process any fresh MF purchases post October 1, 2010, unless you are MF KYC compliant as per CDSL Ventures Limited (CVL) norms.

<<<<<

I thought worth sharing.

-Hiral

Hiral

Wonderful 🙂 . Thanks for sharing 🙂

Manish

Pls let me know which charges and what per cent charges applicable on mutual fund as well as sip

Sachin

I am not sure what information you are not getting in this article ?

Manish

Hi Manish,

I read few articles and those are really informative.

I have question on this article. Your views would be appreciated

I have sharekhan demat account and using it for a year. I asked them about buying MF through them and they said they its free when using sharekhan. Isn’t it best choice than ICICI direct since MF is free? They have annual fees of Rs. 400. Do you have idea if there are really no charges with MF buying with sharekhan. I am little doubtful since ICICI is charging something.

Also, recently they have something called “Know Your Client” form to be filled if investment is more than 50000 Rs. in case of MF. I read about it but could’t get much really.

thnx

Milind

Milind

Yea . I think its makes sense to buy it from Sharekhan is you already have an account . If you dont , then it does not make sense as you can buy mutual funds for free these days . whats the doubt with KYC form ?

Manish

Thanks manish,

KYC is know your client mandate for investment above Rs. 50000. See at this link http://www.sbimf.com/sbi_kyc/images/Form%20for%20Individual.pdf . But since I am planning for SIP below 10,000. It doesnt need KYC as such.

Between, can you tell me sources from where I can buy MF for free?

Thanks!

Milind

Yes using Sharekhan buying mutual funds is free…. i mean they dont charge you for buying/selling mutual funds. The annual maintenance charges covers all of the charges…

In a way it promotes buying into mutual funds….

Thanks Manish for the information

Hi Manish,

What is the Tax liability on Mutual Fund Investments.

Thanks,

Krishnendu

Equity Funds after 1 yr : no tax

Equity funds before 1 yrs: 15% tax on profit .

Manish

I am an old user of ICICI Direct, since my SIPs are more than 5k/m i have no issues with ICICI . But one of my friend had a very bad experience with ICICI housing finance.

http://icicidupedme.blogspot.com/

-sid

Sid

I would like to publish your story http://icicidupedme.blogspot.com/2009/12/what-i-want-from-icici-pune-home-loan.html on my blog . Please let me know if thats fine with you . My blog is read by thousands of people and i am sure this is something worth reading . Give me more details .

manish

@Jagoinvestor

Thanks , though not sure i am nice of fool 🙂

@Debashish

In that case you can/should continue with your agent .. Make sure he understands the scenario , so that he doesnt compromise on service .

You are an nice investor 🙂

Manish

@Jagoinvestor ,

Thanks for a quick reply .

In fact I have already registered with the All my required Funds and can invest on there website directly . How ever I think it will be a pain to track investment in multiple websites .

But my dilemma is more of leaving my existing advisor in favor of ICICI . I do not cut his income even further after the entry load ban . So its convenience V/s Emotions(ethics) .

whats ur take?

@deb

Yeah .. Cost will be same , but only if you continue doing investment of 15000 per month .

What if you reduce it in coming years ..?

Also paying paying 1200 per year upfront means paying commision for whole year .. Is it 100 per month or 1200 in one go ..

Will it increase if you increase your investment from 15k to 30k per month ..

However .. if you are going to do 15k per year , in that case I would recommend not to go with either your agent or ICICI ..

you can directly invest in Mutual funds .. you already have folio numbers.. just go to AMC site or office and do paper work yourself (one time only) .. that way you will save all 1200 🙂

Manish

@Jagoinvestor

I have a different dilemma . For last 3 years I am using service of a local Mutual Fund Advisor (More of an Agent ). Mostly I choose which funds to Invest in and he does the paperwork for me .

He is a sub-Broker of NJ india invest, so I can track my portfolio on-line .

Currently I have 3 SIPs running with investment of 15K per month .

Now After the new charges came out , he has came up with a charge of Rs.1200 flat per year . I also have an ICICI direct Account .

Now with the new cost structure using either my Advisor or ICICI will Cost me similar amount . ICICI direct gives me the convinence of online purchase how ever I am feeling little gulty of Dumping my advisor

Whats should i do ?

– Deb

@Abhishek

Great

I think its a great model for people who are regular investors and do investment of more than 50,000 a year .. for them it would come around 1% , which is acceptable ..

nice one .

manish

hdfc has chosen a completely different approach for charging its customers, in the form of quarterly maintenance charges of Rs 100 + service tax + edu cess. People like me having no holdings have no option other than closing the account and invest through agents instead.

~abhishek

@anonymous

ETF is totally seperate thing , The details for ETF you can get from there website.

Manish

What will they charge for ETFs?