We will discuss about LIC’s Jeevan Tarang Policy today, One of the readers asked me my review about Jeevan Tarang in “Ask a Question” Section.

I thought it would be a good idea to discuss it with every one here. So lets see Whats the policy and lets evaluate and answer the question “Is Jeevan Tarang worth consideration or Not”? Also see How can we beat this Policy by huge margin.

Jeevan Tarang Policy Highlights

- Jeevan Tarang is a Whole Life Plan from LIC, Whole life plan means that you are insured for whole life (max age 100) The plan offers three Accumulation periods – 10, 15 and 20 years. A proposer may choose any of them. This is the Tenure by when your Policy Matures.

- Whenever you die, you will ge the Sum assured and then the Policy Expires. This policy will expire if you are at age 100.

- If you Die before the Maturity, you will get the Sum Assured + All the Bonus Accumulated till date.

- The yearly Premimum will depends on two things, your Tenure and your Age. It can range from 11% (Policy for 10 yrs), 7-8% (Policy for 15 yrs) or 5-5.5% (policy for 20 yrs).

For exact numbers see here. The percentages are with respect to your Sum Assured, 5.5% premium means 5.5% of your Sum assured. so Rs 10,00,000 of Sum assured means 55,000 of Premium each Year . - Incase you surviuve till your Policy Tenure, then at the end of your Tenure, you will get Bonus accumulated (not the Sum assured) and an annuity of exact 5.5% each year after the Policy Matures. One will get 5.5% of the Sum Assured each year till his death or upto age 100 whichever is earliar.

- If you can not pay the Premiums and want to stop the policy (only after 3 yrs), you have two choices, either make it a Paidup policy or take back the Surrender Value. This is explained in detail later, so move on.

- These are the main basic and approximate points of the Policy, for exact detials see the policy page at LIC website.

Let us now see an example with different Scenario. This will help you understand it better. Read Important of Life Insurance

Now let take Scenario’s

Ajay’s age is 30 and he takes Jeevan Tarang Policy for a tenure for 15 yrs with Sum Assured of Rs.10,00,000 (10 Lacs). His Yearly Premiums will be 71.40 for every 1000 sum assured, which is 7.14%. Which comes to 71,400 per year.

If Ajay dies before 15 yrs

In this case he will get Sum Assured + Bonus Accumulated till date. The Bonus amount is not fixed and we can not tell how much it will be now , But on LIC webpage its mentioned in range of Rs 20-88 .

Lets take a good figure of Rs 30 . In that case Per year it would be 30,000 more . So If he dies in 8th year , it would be 10 lacs (Sum Assured) + 2.4 lacs (bonus for 8 yrs) = 12.4 Lacs and the policy Expires .

If Ajay survives the Policy and does not die at all

In this case, Ajay will pay his premium upto 15 yrs and then in 15th yr, he will get back the Bonus accumulated (not sum assured), so may be it would be 4.5-5 lacs assuming Rs 30 as Bonus for every 1000 SA. Also he will get 55,000 per year(remeber 5.5% of Sum Assured) as annuity till he dies or upto age 100 .

He will also get Loyality additions , this will again be a very small amount just like Bonus , but this is not assured at all. Read this for same concept : Term Insurance with Return of Premium

If Ajay survives the Policy and Dies Later.

Its almost the same case as above, in this, Ajay will get Bonus at the end of 15 yrs and then He will start recieving 55,000 ever year. And suppose he dies before age 100, he will receive the Sum Assured of Rs.10 lacs and thats it .. The game is over and then LIC doesnt recognise him there after.

Ajay is not able to pay premiums because of some problem and wants to stop.

This is possible only after 3 yrs of taking the Policy, If he wants to stop it before 3 yrs, then sorry buddy, just forget your Money and go home cry. If its after 3 yrs, then He has two choices

- Make the Policy Paid up : In this case, you stop the Premium payments and you will get your Premiums and Bonus Accumulated will date at the end of the Maturity. You Sum assured will also reduce in Proportion to Premiums Paid, so if you stop the policy in 6th year, your Sum assured will reduce from 10 lacs to 4 lacs (40%), as you have paid the premium only for 40% of the tenure (15 yrs), thats 6 yrs.

- Take your Money Back : After 3 yrs of completion, the Policy acquires a Surrender value, generally its the Net Present Value of money in todays term what you are going to get at the end. See this post on Net Asset Value. So if you are going to get 5 lacs at the end of 15 yrs and todays worth of that money is 2 lacs, you will get 2 lacs today.

Watch this video to know about other features of this policy:

What is the Return of Jeevan Tarang Policy overall ?

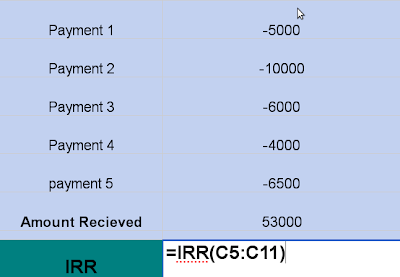

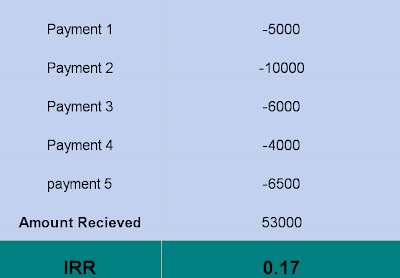

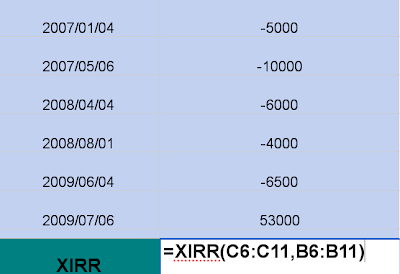

Even if you receive all the annuity upto your age of 100 , the CAGR return for this policy using IRR Analysis comes to mere 4.72% .

I have taken the above example and assumed 5 lacs of Bonus and no loyality additions , even if we consider 7-8 lacs of Bonus and Some loyality additions, the CAGR return Does not cross 6% CAGR .

Why this Policy excites people and general people get fooled?

These kind of Endowment policies make sure that you concentrate too much on numbers and it traps your mindset in the present moment , One who is able to forsee beyond “now” can understand the real value of these Policies .

We concentrate on numbers, If we get something for a long time and we pay for less time, it appeals to us, and hence this policy takes care of that very beautifully, You pay for 10, 15 or 20 yrs and you get back till you are Age 100, Sounds great !!0

Psychologically our mind is programmed by nature to think about the best case for ourself, but how many of us will survive upto 100 yrs to get annuity back, The average person thinks emotionally , Insurance Companies work on Data, Statistics, probability Theory and complex calculations, which tell them that average person will die at 60-70, and only 1-2 will survive till 100 years of their age.

Most of the people see Numbers and Present, The policy will demonstrate how much You will get at the end of the Maturity but it never tells you how much will it be worth then and how much will it help you in your Financial goals. We never think that Rs.100 today can buy much more than Rs.100 after 15 or 30 yrs.

We know this somewhere inside us, but out mind just doesn’t feel everytime the same way, that’s the reason you need to calculate things by hand, on paper or computer and do some small analysis like I did on this article. Then you get the clarity

Trust and Blind Faith, We trust companies because they have been in existence from long time and our parents were made to believe that these are the best friends in our life, they will protect our Future. Love and “Taking Endowment Policies” in India has similarity.

I grew up hearing Love is Blind and experienced it too, and I feel that its same with Taking Endowment Polices. People just take it blindly, some new Policy comes up and bang !! It has to be great, no matter what, because it comes from the GOD company !!

No one will concentrate on 4 important features of his portfolio and how that policy fits in, Look at GFactor of a product to find if it suits you.

What are the Limitations of the Policy

- Why age 100? How many people are going to live upto age 100 , why putting that number at 100, why not increase it to 500, even though life expectancy is just 60-70. Not more than 1-2 in 100 live upto 100.

- In case of Ajay, if his monthly expeses is 30,000 (considering married, even though I doubt he will ever get any one), after the accumulation period of 15 yrs, he will start receiving yearly pension of 55,000 per year, read it again, 55,000 per year, but now after 15 yrs, even with 6% of inflation his monthly expenses has gone upto 72,000 . And his policy pays him 55,000 which cannot even take care of his 1 month of expenses . Now i can see him pulling all his hairs .

- If he is dead at age 70 , His family would get back the Sum assured of 10 lacs and at that time , it can only pay for his family’s 3-4 months of expenses and his Funeral cost , thats it .. Aha .. atleast something , so one this is confirmed , There will be no financial burden , pun intended .

Have a question in Mind , Ask a Question from Jagoinvestor Here .

Can we do better?

This is the question which we should always ask in every situation of our life, not just Financial planning. Lets take care of Ajay’s situation in Jagoinvestor’s way and plan him something better than Jeevan Tarang.

With Rs.71,600 per year to pay for 15 yrs, lets see what can we do.

First thing First, Lets cover his Family first from the Mis-happenings of life an secure his dependents, Lets take a Term Insurance of 50 lacs for maximum tenure of 30 yrs, Premium would be close to 13k or 14k approx, lets assume 14k. So out of 71,600, 14k is gone and we are left with 57,600.

Now lets put 21,600 each year in PPF for 15 yrs. We are now left with 36,000 to invest, we will start Rs.3,000 SIP per month (Rs 1000 each in 3 different Equity funds) for 15 yrs . See list of some good Equity Mutual funds for 2009 .

PPF will accumulate to 6.3 lacs in 15 yrs and Mutual funds will accumulate to 15 lacs in 15 yrs assuming a pessimistic return of just 12% (Historical return has been more than 17% and last 5 yrs return are more than 25%). Lets assume just 12% and not 18-20% even though its possible because our aim is to do better than Jeevan Tarang and achieve our goals and not compete with some one.

So total amount will be around 21.3 lacs at the end of 15 yrs. Now lets visit and see our Scenario’s again and hows does it compare now.

If Ajay dies before 15 yrs :

Gets 50 lacs from Term Insurance and also the money from PPF and mutual funds, which will be more than 50 lacs 🙂 . We beat Jeevan Tarang by huge margin in this case.

If Ajay survives and Does not Die at all :

In this case he already has 21.3 lacs accumulated and now he can use this amount to buy an Annuity which will pay him more than 1.6 lacs Per year, much more than what he was getting in LIC policy.

As a toppings, he also has a 50 lac cover for another 15 years. We can generate 3 times more annuity than Jeevan Astha here, again beat by huge margin.

If Ajay survives the Policy and Dies Later :

In this case if he dies in next 15 yrs , his family would get 50 lacs from Insurance (10 lacs in LIC), apart from this he will have his 21.3 lacs growing every year.

If he dies after 15 more year, There will be no Insurance money, but his money would have grown a lot by now .. If he dies after 15 yrs (total 30 yrs from starting), his money would have grown to 1.17 crores assuming 12% return per year (no annuity every year). and if he dies after 25 years (total 40 yrs from starting , means at age 70), his money would have grown to 6 crores.

Now incase you don’t want to faint, don’t ask me how much would have he had if he lived till age 100 and left his money to grow, Its 13 crores 🙂 . I have not assumed any annual annuity here, we can do that but the result would remain almost same. We beat Jeevan Tarang by hugest margin in this case. See how we can create Wealth using Equity in Long term.

Ajay is not able to pay premiums because of some problem and wants to stop.

His money will still be in PPF and Mutual funds and keep growing, there is no liquiditity issue with Mutual funds, he can withdraw from mutual funds anytime, even from PPF he can withdraw partially.

If he has limited money, he can at least pay his Insurance premiums and still get covered for 50 lacs, no big deal there. In every aspect it beats Jeevan Tarang

Note : For doing better than Jeevan tarang we have invested in Mutual funds which are risky instruments , but anyways we are not in great position with Jeevan Tarang .. so taking risk is worth it . If one is too concerned about risk , then even plain PPF will be better .

Conclusion :

Think Logical , Think mathematical , Think smartly and at last THINK !! .

Note : The figures have not considered the rebate provided by LIC, and hence the actual figures can deviate a bit from the actual numbers used here, but it wont be significant and the review still holds . ahh .. tired now !!