What is long term in Share market? – Understand short term, mid-term and long term investment

Long term investments are the investments that are suppose to be held for an extended time period which will be considered to be more than 1 year.

There is no exact definition for long term investments. Let’s see how it is different from short term and medium term investments.

How long is long term ?

There are mainly 3 time frame in markets

- Short term (6 months – 2 yrs)

- Medium term (2 yrs – 8 yrs)

- Long Term (8+ yrs)

We are taking about long term investing from point of view of Investor , which invests in a company on the basis of fundamentals and valuations .

Time Frame is a relative term , Short term for some one can be medium term for some one and long term for other . similarly if some time duration is long term for you , it can be short term for someone else .

I have also written a small post on IDBI FORTIS WealthAssurance ULIP , Read it

But here we are talking about an average investor . So lets look at predefined tenures .

from my understanding, any time frame less than 6 months shall be considered as trading Time frame . Traders are people who like to take advantage of short term price movements based on news , Charts patterns etc .

One thing you must understand before hand is that Risk and returns are proportional , If you take high risk , there are chances of high Returns.

Now , lets see different time frames .

Short Term (6 months – 1 yrs) :

Any investment made from 1-3 yrs should be considered as short term .

Risk/Return Potential :

VERY HIGH .

Investing for short term :

Invest for short term only if you can afford take the risk. Its always good, not to invest for short term for any goals which are very important. Like for example, if you are going to have an operation or a marriage after 1 years, don’t put your money in stock markets for less than a year to gain extraordinary gains .

Its for professionals , not for an average investor. do it if you can afford to risk loosing it.

Low risk Short term investment option :

Corrections in a BULL RUN : If there is a BULL Run, wait for a correction, It happens many times that there is some correction in stock markets , At that time you can do some investments for short term like 6 months – 1 yrs. Invest only when markets start rising again .

Have a level in mind where you will take loss if it goes against you. There is no guarantee of profits ever. If you are in profit after 6 months, take your profits and get out, don’t convert your short term investment in long term one, One who can not be loyal to his plan in markets will eventually loose it all some day.

Same thing can be applied to short selling in corrections in Bear markets.

Example : In April 2005 , Oct 2005 , June 2006 , there was very good correction, after which it gave 30-40% returns within 6 months – 1 yrs.

If you want to understand the short term and long term in share market, watch the video given below:

Medium Term (1 yrs – 3 yrs) :

Any investment made from 2-8 yrs should be considered as Medium term .

Risk/Return Potential : HIGH/Medium :

Higher the tenure , lesser the risk .

Also it depends on the situation , there is again no guarantee , There can be some time , when there can be high risk in 3 yrs and some time it can less , but over all it should be less than the short term investment .

Investing for Medium Term :

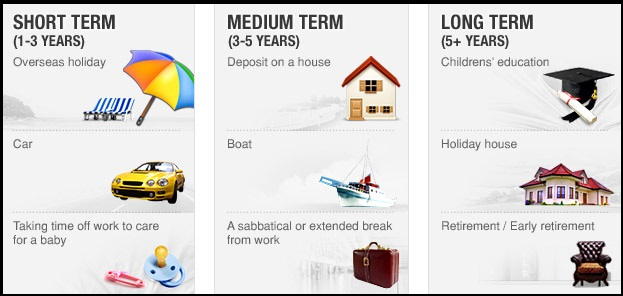

You should invest for medium term for goals like Car , Vacations , etc and some part of portfolio for House , etc (close to 5+ yrs , not 2 yrs) . Choosing well diversified portfolio and investing in strong fundamentals is extremely important . Good timing is always important in any time frame .

But its difficult to time the market .

Low risk Medium Term Investment Time :

After a Bear Market is there for some time around, and markets have fallen considerably, you can start accumulating good stocks with good valuations every month in installment. Don’t jump and put all your money at once ,just because you feel, “now markets have fallen much”, Markets are supreme and you are no one to “feel” or “tell” markets movements.

Just expect it to come back soon and now start accumulating good shares , or start a SIP. There is no guarantee of any profits, we are just discussing the low risk opportunities here.

Read why SIP helps in falling and Volatile markets , Part 1 and Part 2

Example : Current time . This is an excellent time to start accumulating fundamentally good stocks in installments over next couple of months , especially a big chuck should be invested when there October lows are breached within some days ,which is expected with high chances .

Long Term (8+ yrs) :

Any investment made from 2-8 yrs should be considered as Long term .

Risk/Return Potential :

LOW , By Low do not think that we are saying you will get lower return , we are talking about CAGR, obviously the CAGR you can expect over long term is lower than the CAGR which you can expect in short term or medium term, but more important is the risk, the loss potential, and that is extremely low here, almost Nil i would say, This I am saying on the basis of past historical data.

Loss is possible but chances are very bleak .

Investing for Medium Term :

You should invest for Long Term for goals like Retirement , Child Education , Children Marriage or any financial goal which is to be taken care of after 8+ years , Do it using SIP .

Low risk Long Term Investment Time :

Ideally speaking, you can start doing this any time without seeing the current situation of market, because over long term it would matter less that when you entered markets. This does not mean that timing is not important in growth of money, obviously, If you enter neat the end of bear market or at some other important time, it would help .

But the point here is that , it would not harm if you start investing for long term at any time frame assuming that you are diversifying it well across sectors and stocks and also apply some extremely beneficial techniques like Portfolio rebalancing over this long tenure .

Don’t get scared by these words ,they are extremely easy to understand things and can be applied by anyone , and it does not take much time also , The only thing required from investor is the his share of determination to do all this .

Read what is Portfolio Diversification and Portfolio Rebalancing.

Final Note :

What ever i have talked about here are my personal views and my own idea of short term, medium term and long term. It can differ from people to people with different risk – appetite. Also understand that deciding your time frame is important to deal with the situation in markets after investments.

For example: if you decide that you are investing your money for your retirement which is going to come after 25 yrs, then it would be really easy for you to digest the volatility of markets and to see it going down while you invest. So know your time frame and invest it smartly at correct time.

Don’t try to get smart and get greedy. Markets are the place where Albert Einstein and Issac Newton also failed and returned to try what there were good at. That does not mean we will also fail. try to made fast money, in fact try to make smart money.

For new comers in this area, its advisable not to enter through Direct equity, better go though mutual funds, and please listen to people when they tell you all this, don’t get smart, else you will be ruined like millions others.

I have also written a small post on IDBI FORTIS WealthAssurance ULIP, Read it

My trip to Savandurga on Saturaday was Great, check the pics at flickr here

March 9, 2009

March 9, 2009

A very nice and informative article. Thanks 🙂

Pavan

Thanks .. what was your take away from the article ?

I read all your article I agree 100%. I have read all the warren buffet letters to shareholder.I believe in long term investing and the power of compunding. Even though I started investing late in my age 38,I have target of 22 years (60 years) to make wealth. my strategy to my buy 10-15 bluest of blue chip companies (buy atleast one share a month for the next 20 years ) I have been doing for the past two years I have good returns( 45% absolute in two years).

Nambi

yea .. I think 22 yrs is also a good time to accumulate the wealth , good you learnt from your mistakes 🙂

Manish

[…] should have some good quality friends who are there with us for long term . They are not 1 month or 2 month friends , they are friends who are there us for long term , like […]

[…] is true , but people do not understand that Its not a short term wealth building asset class , Its some thing for long term . When you invest in Equity for Long term , You are bound to get excellent returns given that you […]

[…] annual report shows good performance over a long period of time. The ‘ten year review’ in the annual reports shows an increasing profits and dividend over the […]

[…] funds are suitable for people who are looking for long term investments and are ready to take the risk of mutual funds […]

[…] earliar , now its 3 lacs loss , now what let it run .. I know it will come back and anyways “I am a long term investor” (ahh .. It felt so nice somewhere in my heart when I said […]

@Mithun

Definately , if mutual funds are Equity Funds (funds which put most of the money in Equity) , then its totally true for them , Because at the deep level , they are buying shares from stock markets .

Manish

Does this time frame applies to MF investment also ?

Thanks Anu

Keep visiting …

Manish

Thank you very much… it is a very useful article.