How to use losses to reduce income tax?

Are losses good? Do they have any benefit?

When you make a loss, do you feel it has nothing to provide or not at all beneficial. The answer is NO! Losses are bad, but our tax laws gives us a way to utilize them in such a way that we can reduce our income tax liabilities.

Let’s see how 🙂 , don’t worry, we will start from scratch and will explain in detail so that everyone can understand .

Let us talk about capital gains in detail today and let us understand how should we utilize it to minimize our tax liability. Things we will discuss would be stocks, mutual funds, Gold , Debt funds, Real Estate etc.

Understanding Terms and Rules

Capital Gains and Loss : Any profit or loss arises from the sale of capital assets is capital gain or loss. Capital Assets Include Shares, Mutual funds, Real Estate, GOLD etc.

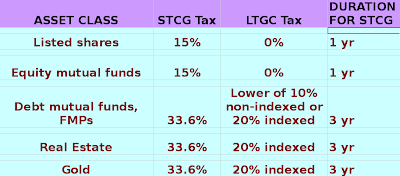

Short Term Capital Loss and Profit : STCL for Equity (shares and mutual funds) is when you sell them at loss before 1 yr, for Real estate, GOLD its 3 yrs.

Long Term Capital Loss and Profit : LTCG for Equity is when you sell it after 1 year, for Real estate, GOLD its 3 years.

Following is the chart showing the tax treatment and time frame for short term for each asset class. Click on the chart to enlarge it.

General and Carry forward Rules :

- Short-term capital loss can be set off against any capital gain (Long-term or Short-term)

- Long-term capital loss can be set off only against long-term capital gain.

- A long-term capital loss will have no value in a case where the long-term capital gain is exempt from tax. For example, In case of shares or mutual funds after 1 year, LTCG is exempt from tax, so If you hold a share for more than 1 year and then take a loss, That LTCL will have no benefit. This loss cannot be set off against any other income.

- A capital loss can be carried forward for next 8 years.

How can you utilize the losses ?

As we know that capital losses can be offset with capital gains, we can utilize this advantage to reduce the tax liability.

The main idea is to create losses to offset any profits. There may be the cases where there is an investment on which you are losing, but still you have not booked the loss, but you can book it and use this loss to offset a profit on which you may have to pay the tax.

Let us see some examples

Example 1 :

Ajay had invested Rs.5 lac in GOLD in 2005 and currently in 2009 he sold it for Rs 10 Lacs, Now he made a profit of 5 lacs and it will be considered as a LTCG, as its after 3 yrs. and it will be taxed at 20% indexed (If you don’t know what is indexed, just forget it, don’t worry ). The tax would be around Rs 1 lacs.

Now Ajay also had invested Rs.10 Lacs in Unitech Shares in Apr 2008. His investment has come down to Rs.4 lacs now. But he thinks that it will go up and he wants to keep it and not sell.

Good !! I appreciate his belief that it will go up again. But what is stopping him from selling it today and then again buying it next day.

Watch this video to know 7 ways to save your tax:

What will happen if he does that ?

If he sells his shares and takes a loss of Rs.6 lacs, He now has made a STCL of Rs.6 lacs and law says that he is allowed to offset it with any STCG or STCL. So now he can offset his 5 lacs profit with this 6 lacs loss and hence, he can save his tax of that 1 lac which he had to pay, also he can carry forward a loss of remaining 1 lac which was not offset.

He can again buy his favorite Unitech share the next day. The only loss he will make is the brokerage charges and any fluctuations which may occur in prices, which will not be much, may be it has gone down and he can buy them later at better prices.

So the point is to generate the loss by selling a losing investment and again buying it back in some days. This will help you cook up the loses which then you can offset with existing profits and hence reduce your tax liabilities.

Example 2

Robert had invested 5 lacs in mutual funds in early 2008 or end of 2007 and currently has a good loss of 2.5 lacs (1 yr is still not complete). This is currently every one state, most of the people have burnt their fingers and made huge losses.

Now he is sad that he made losses, He also had bought some shares before some months and made a profit of 50k. Let us also assume that next year his mutual fund will rise to 4 lacs from current 2.5 lacs, which he sells next year.

Now he has 2 choices to make, let us see 2 cases.

Case 1 : He does not book the loss and holds it .

In this case, he will have to pay profit of 15% STCG on his profit of 50k, and next year he will have his current investment at 4 lacs. When he sells it, it will be a loss of lac which will be LTGL (because he had held it for more than 1 yr).

Case 2 : He books the loss of 2.5 lacs and then again buys it back the same day or next day .

In this case, he has made a STCL of 2.5 lacs (bought at 5 and sold at 2.5), Now he can offset his 50k profit with this loss. Then he would not have to pay the tax and he can then carry his loss of 2 lacs carry forward.

Next year, he sells his mutual funds for 4 lacs and makes a STCG of 1.5 lacs (because he has re-bought this mutual fund and 1 yr is still not complete) .. But he can offset this profit of 1.5 lacs with the carried forward loss of 2 lacs, and still carry another 50k worth of loss forward.

So what’s the advantage of case 2 ?

The advantage is that you can save tax on the existing profit and also generate STCL which you can take forward and save tax on future profits.

There are many people who make losses and don’t bother to show it in their returns, if they don’t show it in returns then they will not be able to use it for offsetting purpose in future. Note, The way I have shown the examples have their own benefit and problems, Its you who have to decide what you want and how to utilize the tax rules to your advantage.

Its smart use of knowledge, not cheating 🙂

I wish you have got some knowledge out of this article, please put your comments/corrections/suggestions so that we can do more discussion.

Also, don’t forget to put your vote on the poll at the top of this page.

March 23, 2009

March 23, 2009

Hi,

In FY 2015-16, I have a LTCG (after indexation) from selling Debt Funds of a little over 6 lakhs. All funds were held for over 3 years and hence qualify for indexation benefit with corresponding tax rate of 20% on this LTCG. I also have carryforward Long Term Capital Gains of over 6 lakhs from previous years (less than 8). My question: Can I offset the 6 lakh LTCG in fy 2015-16 against the carryforward losses? If so, does that mean I have no tax liability on the 6 lakh LTCG. I understand the carrforward LTCG losses will be reduced by 6 lakhs for FY 2016-17. Await your reply to this

Yes thats correct, if you have the LTCL carried forward, you can set off with the profit and pay nil taxes

Manish

Hi,

Being NRI If I am making loss due to housing loan currently (no other taxable income) & have intention to sell property within next three (3) years. Do I have to file IT return to get LTCG tax benefit later? Pl advise.

Yes, unless you record that loss, how will you prove that it actually happened?

Hi Manish,

I am an NRI , who is doing a little bit of trading through my PIS account with Axis Bank and broker IIFL. My question is that when I sell some shares for profit, STCG is immediately deducted by Axis Bank (as shown in my bank statement). Let’s say, the total deduction of STCG in this year is about 10k.

However, I also made “realized” losses on other positions in the portfolio, say 20k, then theoretically , I think the tax should be offset 100% ( or is it only 15% of the loss amount, in this case 3k? ) . However, I don’t know how to claim this tax refund . Is it to be done at the time of filing returns or can it be done by bank – or broker – who deducted the STCG in first place ? How do I prove that I have incurred capital loss of 20k ? Is there any form which I can ask my broker?

Tax is never offset directly. YOu need to file the returns and mention it there and if there any access tax , then you can claim it back !

can we adjust short term gain fro residential property against short term losses from shares?

No you cant

Hi Manish,

I have some stocks that are listed outside India. Now, i am making LTCG on those.

Also, i do have some stocks listed in India listed in BSE. For the stocks listed in BSE, i am making LTCL.

Can i offset LTCG on stocks listed outside India against LTCL for stocks listed in India ?

thanks, anurag

No you cant do that as far as I know . Still I suggest take help of a professional CA on this

Hi Manish awesome article it really helps a lot.

Just a couple of queries regarding my issue if u dont mind…,

*In the current year i hv booked a loss of abt 1lac in equity stocks (stcl i guess) while im having a profit of approx. 1lac in equity Mutual funds (stcg).

Now if i book profit in mutual funds does my loss in stocks acc get setoff by itself ,since it usually doesnt’ show in icicidirect ac in such cases, so do i need to do something when i file my annual return. im an nri in uae by the way.

*also do the losses in derivatives get set of too with stock/mf stcl/stcg ?

*iv had losses in previous years, can i bring them forward nw or are they lost?

thanx bro &God bless u for your help.

Anand

Hi Anand

You can do it that way .

Hi manish,

Very nice article and many of thoughts are got clear and what i was looking for. Few question like

1. Do only equity shares profit/loss will be counted or this is also applicable for profit/loss in derivative segment like Options

2. What amount of purchasing/selling is considered. Will it with brokerage, STT and other or just a principle amount

Just principle amount will be considered. Also option loss/profit is considered business loss or profit .

I have brought flat on jan 2013 with home loan , I want to sell it in jan 15 . my understanding is sale of flat will be STCG .

If its STCG then my taxable amount will be (sell price – purchase price)i.e. 5 lakh, my question is I have brought home loan on this flat can I offset interest part of my home loan i.e 2 lakh from 5 lakh STCG , so that my STCG will be 3 lakh ?

please clarify.

5 lacs has to be added to your income and tax has to be paid ! , no rescue !

Hi Manish,

Thanks for sharing wealth of information. Much appreciated for your time and effort. Here is my query. I purchased a property (a 30×50 plot) in Bangalore a year back. I have taken 20 years loan.

Now I plan to invest in a second plot with the intent to sell it in 4-5 years. This sale profit I plan to use to pre-closure my loan on the first plot. Do I need to pay long term capital gain in this scenario

No , you dont

Hi, I have a question : can you offset STCG out of Debt against STCL on equity MF?

For NRI case, can short term capital gains form slae of equity shares be adjusted against long term capital loss from sale of equity shares in the same FY?

Can long term capital loss(equity shares) be carried forward and adjusted in subsequent year against short capital gain (equity shares) in subsequent year?

Yes, it can be done !

Can losses be adujusted against salary income

No

THANKS MANISH , TAX DENA HI PADEGA

dear manish ,

1. is there any change in your article pertaining 2013 -2014 taxation .

2. gifted money to my spouse,she invested in shares and booked some profit ,then What sort of taxation Will come in picture,as she is using as loan and getting earning from it.

3.if to any advisory body she is paying to get technical analysis ,Whether that expense Will be covered or not as expense made vis a vis her income

i knoW it sounds someWhat silly but just help me out .

Sandeep

If the money is spent somewhere, its fine . But if its invested and the profits come, they will be treated as your income

Hi Manish

Thanks for this very informative article. My query is on carry forward of losses from profession. In derivatives trade, I made a loss of 4 lacs in Fy12. I had filed returns by due date and so got it carried forward. Next year (FY13)I made a gain of 1.5 lacs in income from profession. How much is to be carried forward to next year? Is it 2.5 lacs (4-1.5) or is it the entire 4 as 1.5 lacs in income does not come under the tax slab. (that’s my total income for the year, I have no other source). Could you please clarify. Thanking you in advance

Then 4 lacs will be carried forward again !

I exited ELSS fund (dividend option) 4 years back since fund value had dropped far below initial investment, and i saw no chances of bounce back.

Similarly I am looking to surrender ULIP which is invested in Balanced and growth funds. Fund value is far below the total premium paid.

Are there any hopes of saving some tax?

Not in case of tax saving products !

I have madea capital gains from plots sell LTCG of 8 lacs and loss in shares -equities and commodities market of 20 lacs , so How can it be treated against LTCG;

keep me informedat [email protected], as i have ti file ITR

yes, it can be

Dear Manish,

Can you help in calculating my tax liability in following case:

I am having following for current FY.

STCG=2,50,000

LTCL=10,000

STCL=80,000

I am carrying LTCG of 5,00,000, LTCL of 30,000 and STCL of 40,000 from previous FYs.

Thanks in advance.

Ask on forum http://www.jagoinvestor.com/forum/

dear manish

purchased mutual fund of 1 lakh ,sold at the loss of 25 thousand ,within a year

what is the short term capital loss in this case ,still i have to pay 15% on remaning amount

No , in your case its short term capital gains, no tax for you on any amount remaining, you can carry this loss in your returns so that you can adjust this later

Hi,

I have a short term capital loss as i sold the property less that what i bought last year. I dont have any other capital gain’s to offset them. Can i use this short term capital loss to reduce my taxable income this financial year?

Thanks,

Rajesh.

Hi Mahish,

My mother has foreclosed few of her LIC policies, which were not very beneficiary. She got refunded the premium [ after deduction] which is around 50-70% of the total premium she paid. I know she should have made the policies as paid up.

Now can she get a tax saving on the amount she lost [30-50%] on these policies?

Thanks

Raghav

No