Early Investor , Smart Investor – magic of compounding

You are 25, and want to retire at 60, after 35 yrs. You earn anything more than 10k+, and can save more than 2k per month for investing if you wish. You might be earning 30k or 60k or whatever, but I am considering an average urban Indian who is earning 10k or 12k or anything like that and can save more than 2k per month.

Now, What would you like to do?

Choice 1 : Start now and invest total of 8.4 Lacs (8,40,000) distributed in a span of 35 yrs (till your retirement).

Choice 2 : Or after 15 yrs, when your salary is increased and you have good money, then Invest 72 lacs (72,00,000), in a span of 20 yrs (start when you are age 40).

In Choice 1 you will have to invest 2,000 per month for 35 yrs, so you invest total of 2000 * 12 * 35 = 8,40,000 (8.4 lacs)

In Choice 2 : You invest 30,000 per month for 20 yrs, so you invest total of 30000 * 12 * 20 = 72,00,000 (72 Lacs).

In choice 1 you pay less than 12% of what you pay in choice 2. I am sure that you must have got a hint by now that which choice will lead you to generate more money, But it has to have some assumptions.

Choice 1 : You are investing for 35 yrs. What is the return we should expect in this case, In last 29 yrs of history, Indian Equities have returned 17.5%, So we will expect same return of 17.5%, but I am expecting it to be much more.

Choice 2 : In this case you are investing for 20 yrs, we can easily expect close to 15% returns in this case.

Lets reveal the secret and see the numbers now.

Choice 1 : You pay 2000 per month for 35 yrs @17.5% CAGR, total amount at the end : 5.9 Crores

Choice 2 : You pay 30000 per month for 20 yrs @15% CAGR, total amount at the end 4.5 Crores

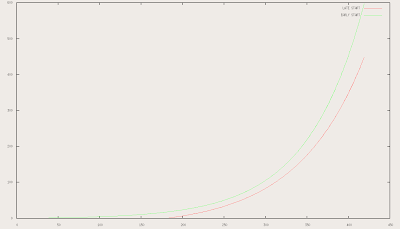

The graph below shows how the money increases with each choice (Early start and Late Start, I spent 2 hrs figuring out how to plot this graph using gnuplot (linux command for plotting graphs … man, it took me so much time to just do this)

CLICK ON THE GRAPH TO ENLARGE …

Now, What is the Learning?

Now, What is the Learning?

This article is for people who think they don’t earn much money to invest, There are many who earn 7k, 10k or 15k per month and there are many who earn 30k, 40k, 50k per month. People who earn less often think what can 1k per month do, they fail to see what will happen in long term, they do not appreciate power of compounding.

Wealth is generated by people who invest smartly and with discipline, not who just earn lots of money.

Where to invest?

If you are a regular reader of this blog, then you know the answer, if you don’t, then let me tell you, Its Diversified Equity Mutual funds, take a SIP and invest small sum of money every month, The more you can contribute in the start, the lesser you need to invest in later years of your life.

For example : If you can invest RS.4000 per month (Instead of Rs.2,000) in the starting years of your career like 10 yrs, then you can stop investing for rest of 25 yrs and still generate more wealth (around 7 crore), considering same interest of return.

Is it practical to put 4k for starting 10 years and then leave it for 25 yrs, May be NOT !! .. People tend to take the money out when they require it and never give compounding any chance to show its strength. But if people leave it, they will see how amazing and powerful it is.

Why do you believe me and whatever I write here?

Ans : You never believe me or for that matter any one when it comes to investing and your money, you just choose to learn from me and check the authenticity of what I say, you can read what I tell you and what I write, Ask your self if there is any logic behind anything or not.

When I say expect 17.5% CAGR return in 35 yrs time duration, Its because equity outperforms every other asset class in long, and it has happened over centuries.

When I say that if you invest X amount every month @r% return for t years, you will get A amount at the end, you should go and check using your own calculations to see if the figures are right or not.

For people who are new to Mutual funds and don’t how to choose it can read my earlier post : https://www.jagoinvestor.com/2009/01/what-to-look-for-while-choosing-mutual.html

Be a early Investor, be a smart Investor.

I expect your comments related to this article whether you like it or not. If you have any query you can leave it in our comment section.

February 2, 2009

February 2, 2009

Thanks for the link Manish!

It looks really helpful.

I have another question, I see that you mentioned Rate of Interest as 17.5%, I made some fixed deposits and I got nothing more than 8-9% pa.

Can you please explain me where do you invest which assures you of atleast 17.5% returns?

Aishwin

I have taken that because the stock market returns over last 30 yrs have been like that . But in reality you should expect not more than 12-15% from equity funds . From FD and all , you cant expect that much over long term

Hi Manish,

I have a quick question.

I am 24, If I invest Rs.2,50,000 now, and I decide to forget this amount as a part of final investment for the retirement. How would that work?

Since, I am in a business and not in a job, I don’t have a fix monthly cash flow.

And, if I decide to retire at the age between 45 -53, what should I be getting?

Thanks in advance

aishwin

Aishwin

You can try out this calculator http://jagoinvestor.dev.diginnovators.site/calculators/html/Future-Value-Calculator.html

nice pics on flickr bro 🙂

best part is all queriies are well & personally attended.

gr8 job.

Bhupat

thanks 🙂 . Keep reading and ask questions 🙂

Manish

[…] 30-40% of their salary, but they are not doing . Dont underestimate the power of early investing , Early investing is so powerful that it can compensate for big mistakes in investing later in life. If you are a 25 yr old person […]

@zzboy

No , Its just free for 30 days and then needs to be purchased , I would recommend a simple Excel sheet to maintain the records . No need to complicate thing .

There are many online tools available , which can be used too .

Manish

I will recommend using Desktop Budget to manage personal finances and my investment portfolio. Its the best, free, offline personal finance software I have seen so far.

@Sanjay

In respect of every share there are two important terms called Support and Resistance

Suppot is the price area where there are a lot of buyers ready to buy the share (so they support the share from falling more) and resistance is a point where there are lot of sellers wanting to exit the share (because they think its a good time to exit and its over priced) .

So these are the points where an investor needs to be little cautious .

read : http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:support_and_resistance

http://www.investopedia.com/articles/technical/061801.asp

A simple google search of “support and resistance” would have given you the links .

Manish

Manish,

I am constantly hearing/reading these two words “Support level” and “Resistance” . What exactly these means?

Thanks,

Sanjay

Jace

You are correct . Active monitoring is required . Anyways , when i say invest in Equity for 30 yrs , It means you will also require to see it periodically atleast once in a year . Monitoring at this level is very much possible .

Good funds come and go , New fund take over old funds , and a person investing for long term would be required to shift his funds from one to other . This is not a big pain because it has to be done once in some years .

Good selection of funds at the start will anyways eliminate the headache of churning the portfolio ,

Do you agree ?

Manish

Aren’t you failing to account for selection bias? How many of the funds that are considered safe choices today will continue to exist in twenty or thirty five years?

Ronak ,see this

http://manishanalysis.blogspot.com/2009/02/investing-in-rpl-in-feb-2009.html

Hi Ronak

By seeing the charts i can see that its in a trading range of 70-93 , 70 is the support level . and 95 is a resistance level . see its 1 year chart at http://in.finance.yahoo.com/q/bc?s=RPL.NS&t=1y&l=on&z=l&q=l&c=

Long term low of this share is around 65 , so looks like its very difficult to fall below this .

With markets still unpredictable in short-medium term , the share is expected to dance in this same range of 70-95 .

So the best idea would be to buy it either at suport level prices of 70-75 , or after it breaks up from 100 levels .

the best thing i woulld suggest it to invest your 25% money near 70-75 levels .

I hope you got what your wanted . Better we discuss things like this on a mail or i would run a seperate blog for this kind of analysis .

Understand that the small analysis i gave you is purely technical and not fundamental . it is only indicative and probable .

Yes ! You are very right… The Power of Compounding is pure magic in the long term. Like how Junjhunwala made his Rs.5,000 grow to Rs.5,000 crores !

Btw, good pictures you got there too…(on Flickr). Should join clubs like that someday …

Hi Manish,

I am not sure whether this is the right article to ask this question or not. My apologies if it is not. Here goes my question:

I am planning to invest around 1-2 Lakh Rs to buy RPL shares. At the current rate @83, do you think I should go ahead and buy somm shares? like 500-700? or should I wait for sometime to lower the rate? i.e. at around 70-75? I am looking to invest with the time span of 3-5 Years. Your advice would be greatly appreciated.