All about TAX in 2008

There is just one word which can describe the year 2008-2009 tax structure … GREAT. This article will tell you everything about tax in 2008. Following things will be discussed :

1. Tax Slab in 2008 for salaried employees

2. How much will you save?

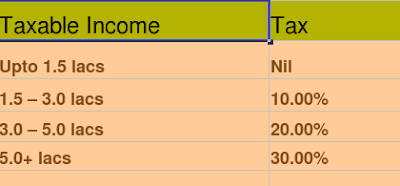

The exemption limit for the year 2008 is 1.5 lacs, which means that if your taxable income is upto 1.5 lacs, you don’t pay any tax.

What is Taxable Income?

The pay which you get has many components, like HRA, conveyance allowance and others.

Out of this income, some things are deductible on your hand and after deducting you arrive at an amount called Taxable income, on which you have to pay income tax.

Taxable Income = Your Gross Salary – (HRA) – (Investments under Sec 80 C) – (Conveyance allowance) – (Health insurance Premium, Sec 80D) and some more things which you may claim.

The slab for the year 2008-09 is as follows:

Exemption Limit for Men = 1.5 lacs

The Exemption Limit for Women = 1.8 lacs

Exemption limit for Senior Citizens = 2.25 lacs

3% Education cess also on the tax amount after tax and surcharge (if any)

What is surcharge?

* If salary is above 10 lacs, a 10% surcharge will also be applicable.

Example : Ajay earns Rs 14 lacs

Total Income (14 lac ) – amount under sec 80c (1 lac) – HRA (Rs 70k , for example) – Conveyence allowance (9,600 , 800*12) – health Insurance (10k , max 15k) under sec 80D (its seperate from sec 80C) = 14 lacs – 1,94,800 = 12,05,200

Now lets do tax calculation :

0 – 1.5 : 0

1.5 – 3 : 15,000 (@ 10%)

3 – 5 : 40,000 (@ 20%)

5+ : 2,11,560 (@ 30%)

= 2,66,560 + surcharge (10% of this amount)

= 2,66,560 + 26,656

= 2,93,216

Now education cess will also be applied : @ 3% , so 2,93,216 + 3%

= 2,93,216 + 8796.48

= Rs. 302012.48

This is the total tax payable.

Note: education cess is charged after surcharge is applied and not before.

I would be happy to read your comments or disagreement on any topic. Please leave a comment.

April 13, 2008

April 13, 2008

I am Mr.Avinash & i am govt employee .I have paid my tax but return file have not done.But from last two years i am doing my return file .can u plz, suggest how to file my ITR before 2014.

Hi AVINASH

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Hi Manish… Gud explanation… Just 1 doubt… Dont we deduct EPF n Gratuity for salaried class? N for my case I do’ve a Group Mediclaim provided by my company, for which I pay monthly premium of Rs 5k pa.. So can I include it for exemption?

You can include only EPF for 80C ,rest all is seperate . Gratuity comes into the picture in the year of reciept

Manish

[…] if your Total income for the year exceeds your exemption limit, you have to file tax . Do you know how to calculate your tax ?Should I file tax return even if I don’t have to pay any tax […]

[…] Note : If you take Health Insurance riders with Term Insurance like Critical Illness cover , the extra premium paid for that will be actually be covered under Sec 80D , not sec 80C . See Tax Rules […]

[…] to file your return of income for the assessment year 2009-10 till March 31-2011. See the basics of how tax is calculated […]

We can also claim upto 1.5 lacs on house loan interest paid. That saves good money for us.

Hi Modeller

I like short term trading ..

Manish

Im confused about Assessment Year & Financial Yr as this is the first time i would be paying Income tax.Would you be able to explain for which year`s income should the income tax be paid before this March 31st 2010 ?

for the period from April 2009 – Mar 2010 OR April 2008 – March 2009?

April 2009 – Mar 2010

This is good blog about investing.

did you like the short trading or long term stock (value investing) ?

this is my blog about foreigner investment in asia.

ASI report : The report is all over image of Asia.

what do you think ?