Sovereign Gold Bond Scheme Launched – Here are 6 important Facts

Today I want to share some quick facts regarding Sovereign Gold Bonds which was announced in budget session and recently mentioned by our Prime minister.

RBI is going to issue something called Sovereign Gold Bonds for investors who want to benefit from the movement from Gold prices. It’s an alternative way to invest in gold apart from buying physical gold or through gold ETF or gold Mutual fund.

These bonds issue is part of the market borrowing program of govt of India, where it tries to borrow money from the public for the long term. So to understand it in brief, govt wants to borrow money from those who want to invest in gold and they would return back the money after X number of years which will be linked to the price of gold apart from a small interest.

10 FACTS about Sovereign Gold Bond Scheme you should know

Now let’s understand quickly what Sovereign Gold Bond Scheme is all about and some high-level important points every investor would want to know.

1. Issued by RBI and hence it’s safe and secure

These bonds are issued by Reserve bank of India and hence it carries a sovereign guarantee by Govt of India.

So in a way its 100% safe and secure and there are no chances of fraud or any issues happening in the future.

However, you need to know that the bond value is linked with the gold prices and hence the value of the bond can increase and decrease in the future depending on the gold price movement.

However, whatever is the maturity value will be paid to you and the guarantee is only for that. There is no assurity for any minimum value payment or any promise of return. One can hold the bonds in a single name or joint name as per preference.

2. First Batch of bonds available from Nov 5-20

As per a report, out of Rs 15,000 crore of bonds, the first batch of Rs 1,000 crore bonds are available from Nov 5 and the last date for application is Nov 20. The bonds are available for only residents Indian and NRI’s cant buys it. The bonds will be available at selected banks and post offices designated under the scheme.

I was not able to find exact locations, but I think all the major PSU banks in every city and some big post offices will be the contact point if one wants to purchase these bonds.

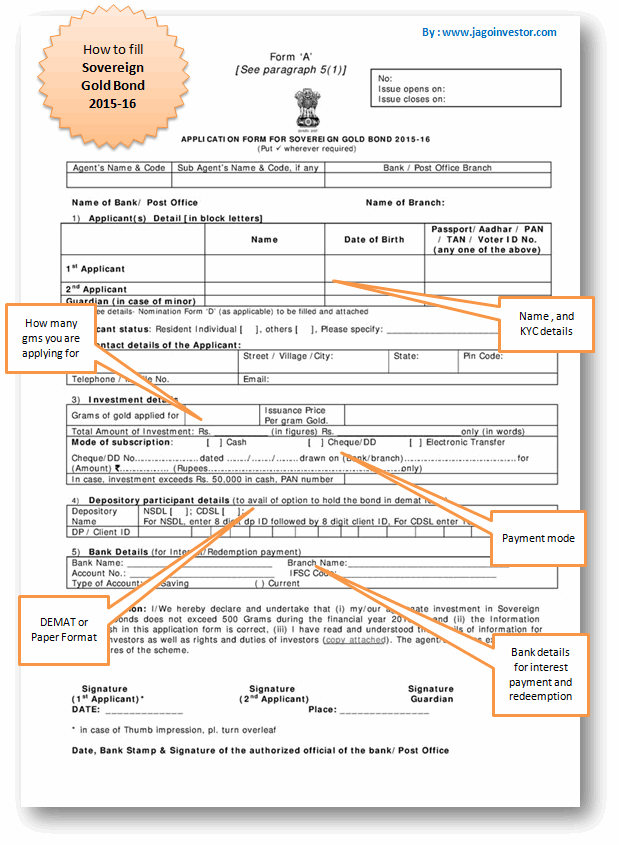

Below you can see a sample form and how it has to be filled. You can also download the form from his link

3. Amount of investment and Tenure

The minimum one has to buy 2 gms worth of gold bonds and the maximum can be 500 gms. So every normal middle-class person who wants some exposure in gold can buy it. The initial issue price is fixed at Rs 2,684 per gram. Which means a minimum initial investment would be Rs 5,400-5,500 at least.

Note that price fixed is a simple average of the closing price of the 999 purity gold, published by India Bullion and Jewellers Association Ltd (IBJA).

The bonds will be issued with an 8 yr tenure, however, an exit option will be available after 5th year onwards. The bonds can also be traded on stock exchanges if you have it in Demat form. However, I think it’s not going to work for most of the investors because that will get too complicated.

Also, you will be able to trade the bonds on markets only if the volumes are very good, otherwise it will be locked away and you will be able to get back the money only after the 5/8 yrs of time. You can read detailed FAQ’s on this scheme here

Also note that these bonds can be provided as collateral incase, you need any loans.

4. You will get interest of 2.75%

You will get interest of 2.75% interest on the initial value of investment (not the market price) every 6 months. I have not gone in details, but I think the way it will work is that if you invest Rs 1,00,000 in these bonds, then every 6 months you will get 50% of 2.75% of Rs 1 lac as interest, which would be Rs 1,375

5. Taxation on returns and maturity

Note that the interest you earn every 6 months will be taxable in your hands. Also at the time of maturity, the long-term capital gains will be applicable, which means that after applying indexation, you will have to pay 20% tax on the returns. Note that because KYC is done properly, you cant escape this.

6. KYC requirement

You will be able to buy these gold bonds only after the KYC is done for you. In simple terms, at the time of application, you will have to provide your identity and provide your PAN or Aadhar card etc and the payment can be done electronically, with cheque/DD or even CASH.

However, you will not be able to hide your identity. This will surely discourage those investors who want to convert their unaccounted money (CASH) into white money.

7. Investment in Paper or Demat Form

You can purchase the bonds in paper format or Demat holding as per your preference. Means if you want the bond in paper format, you will get a receipt and a bond that you can keep in your locker or at home and at the time of maturity you can give it back. Or you can hold it in Demat form and not worry about keeping the bond safely.

Who should not invest in these gold bonds?

I think that 5-8 yrs tenure is a long tenure and you can earn much better returns in this long term. Equity mutual funds would deliver better returns compared to this scheme. Hence if you are a young person below age 40, and are looking at wealth creation as your main goal, then you can give a miss to this scheme.

The return on the scheme (2.75%) is not to be considered and the gold returns historically have been around inflation only.

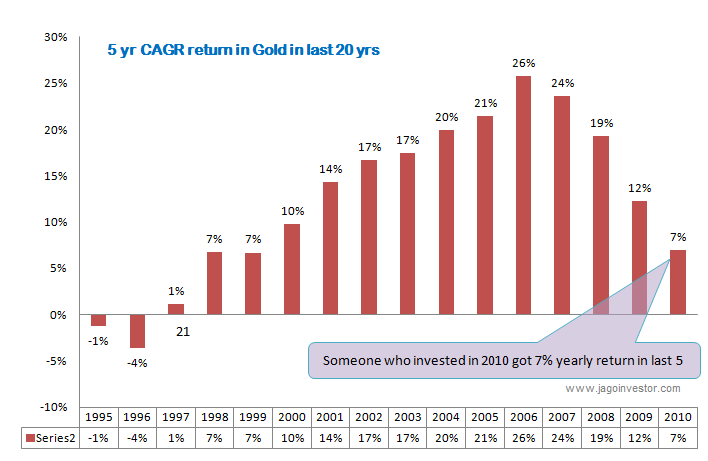

If you look at the below chart, you can see 5 yrs CAGR return of the gold investment. Note that for the tenure of 2000-2010 the returns have been very very good, but then if you look at someone who invested in the year 2010, they have just got a 7% CAGR return, which is very much in tune with long term gold returns.

So if we look at the optimal use of your investment to generate a decent return, I personally dont consider this as a great investment product. You can skip this.

Who can think of buying these bonds?

Now if we look at the other side, There are many investors who are very attached to gold and really want to invest in that. No logic will move them and no conversation of CAGR will make sense to them. So for those investors who were anyways going to buy physical gold or Gold ETF, can look at this scheme as a good alternative.

Anyways your investment value will move as per gold prices and on top of it, you will get 2.75% interest which you do not get in case of physical gold or gold ETF/funds. The best part of this scheme is that you don’t have to worry about the quality of the gold or where to store it as its all in paper format and no one is going to steal it from you.

The money will only come back to your bank account only which you have provided at the time of investment.

However, note that the investment in these bonds is going to be mainly illiquid in the very short term. If you buy physical gold, you get that liquidity in your hand and if you need money urgently you can sell off the gold. You will not get it here.

So overall, you are the right person to pick if this scheme is for you or not.

Please share what are your views on this scheme. Do you think it’s going to be a hit among investors?

November 5, 2015

November 5, 2015

Gold Bonds Scheme is really helpful for your future. You can get more interest as of your yearly value. So always invest in gold to brights your & your Family future remarkable.

Manish, I would agree that gold should not be a primary investment and should not be in general more than 5 – 10% of the portfolio.

However if someone is using gold to diversify across asset classes, this happens to be one of the best options from returns perspective, since in ETF or gold mutual fund the investor pays fund management charges, while here he gets 2.75% interest, thus effectively there is additional gain of 3-4% per annum compared to other means of investing in gold. So if someone dies not need money for a long time, he can invest a part in this scheme whenever it is open for subscription.

Having said that, the liquidity on the stock exchange may not be good enough to allow an exit at a reasonable cost for early redemption.

Thanks for your comment Avinash

these scheme was launched previously also that time it was failed , now also it won’t succeed because for earning marginal interest rate of 2.75% people don’t want to get taxed and moreover they are loosing on liquidity frontier also , if some one want to invest into gold for the marriage purpose then they can deposit that amount into RD or debt mutual it will be sufficient to take care of their gold needs and moreover gold is in bearish phase and from past 2 to 3 years it’s giving negative returns so it doesn’t make sense to park your money into such ill-quid instrument for 5 odd years

Hi parveentiwari

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

“Thanks manish ” you are really doing good job, by educating investors in India where financial literacy is zero and investors are be-fooled by every tom,dick and harry who claims to be a financial ad-visor , moreover in India where no social security schemes are there and in absence of strict laws , honest and right advisory is need of the hour .

Glad to know that parveentiwari ..

Manish, How do I buy if I want to buy the Gold Bond and Coins with Ashoka Chakra now?

Its still not clear

Hi Manish, i was waiting for this article.I buy 10 gm gold every year with the view of making ornaments after 20 years for my daughters marriage.Now suppose i buy 1 lakh worth of gold bond, get the maturity proceeds after 8 years from now, pay capital gains tax and buy physical gold of same weight, will i end up paying more.Should i instead buy physical gold and skip the bonds as my aim is physical gold.Kindly share your opinion

I dont think capital gains will be applicable if you use the proceeds to buy GOLD itself. It will get nullified. But I think in your case, you go ahead with buying gold itself

Dear Manish, Thanks for sharing details . I have read in new paper that “Since discount is already close to 3 % investor should not rush in on the initial days and wait till the last few days of the launch to buy ” we should leave the gold bonds if the discount is too high.

do you agree with this statement ? please provide your input.

I personally dont like to over analyse it to this level . If you want to buy it, go ahead . Dont micro think ..

You are great, not just posting a article with all details but also reading each and every comment and responding to them.

Glad to know that Narasimha ..

Any parent who wants to conduct his/her daughter’s marriage in about 8-9 years will benefit from this Scheme.

Hi Sundari, after 8 years when you get the bond money you have to pay capital gains tax.After this if you buy physical gold from shop for marriage purpose, it will be at more price than the bond value as in shop it is always available a bhigher price.So is it advisable to buy physical gold instead of the bonds.Kindly share your opinion

Hello Manish,

Thanks again for the detailed information on SGB. Your consolidation of data is very good for getting the basics of this scheme.

I hope you will be coming up with Blogs on other 2 investment methods launched by Govt of India.

1. Gold Monetisation Scheme (GMS), 2015

2. Gold Coin/Bullion Scheme

A very small correction in your article. (Fact no 4).

Interest is at 2.75% per annul but not for half yearly. So in this case of Rs 1,00,000 investment, people might get an interest of Rs 1375 before Tax.

Correct me if my understanding is wrong.

Thanks.

Deepak Gudla.

Deepak

I will try to cover that soon. Thanks for sharing the mistake from my end. I have corrected that in article

Manish

Thanks Manish for very informative article.. Is it possible to invest in this scheme online (as you can do in some mutual funds). Or this has to be applied by physically going thru banks only?

Hi Darshan

As of now, there is no way to invest in this online.

Is there any guarantee that my 2-gm worth of Gold Bond will be backed by EXACTLY 2.0000 gms of 999 purity gold ? Or will the issuers decide to get smart down the line and start issuing bonds for 10- gms when they only hold one-gram gold ?

In this case, in the event of any external aggression, war, natural calamity, when there is an en masse redemption of these bonds, their value will crash as the govt will be unable to redeem every bond with an equal amount of gold !!

Hi Koustubh

I dont think you have to worry on that. Its issued by RBI .. Things will not change .

Interest on this Bond as mentioned is 2.75%. But whether it is Yearly/Half-Yearly or Quarterly is not mentioned. As return of 1 Lac investment in 6 months being Rs. 2750 (2.75% of 1 Lac), rate of interest will be 5.5% per annum. Is it correct?

No , its 2.75% yearly. you will get 1375 as interest in 6 months on investment of 1 lac. I have corrected the mistake in the article

Thanks for the timely info which helps us to take informed decision .

Thanks for your comment Ravi

For HNIs who want to park some minimal amount of funds as part of diversified asset allocation, this is a good option.

I think, it´s good do invest at least 5-10 % of investments in a particular year in Gold , specially in unique scheme like this.

The Geo-political situation of world is very volatile and unpredictable. And we all know, in such scenario it´s the GOLD that shines…!

Glad to know that Vasu ..

Very good article.

Why should price of the gold has to be calculated including taxes and import duty in it? If there is change/reduction on these charges automatically price of gold will fall so returns on these bonds.

I’m I correct? Thanks,

Yes

sir,

i have some gold etfs which i donot intend to sell for more than 8 years. is it worth selling all these etfs today and buying these bonds for the same amount.

advanteges::::

i will earn something (int) and avoid some expences (amc fees) for 8 years.

will get more or at least same from both , when i sell/redeem after 8 years.

regards

baljit

Yes, if you are planning to anyways carry these for 8 yrs, then you can buy these bonds

If they give 2750 on 1Lac after every 6 months then the total roi must be approx 5pcnt isnt it?

Also, isnt it better than FDs or liquid funds if it gives 7 pcnt retruns every year plus 2.75pcnt totalling to 9.75pcnt?

I have corrected that mistake. iTs 2.75% a year !