When exactly does PPF account mature ? Answer is not 15 yrs !

When does a PPF account mature ? If you thought that its 15 yrs from the date you started your PPF account, then you are wrong ? Yes – there is a myth around this topic and most of the people do not know how does it actually work.

Its extremely simple to find out when exactly your PPF account matures, and let me show you how to calculate it!

How is PPF maturity date calculated for PPF account ?

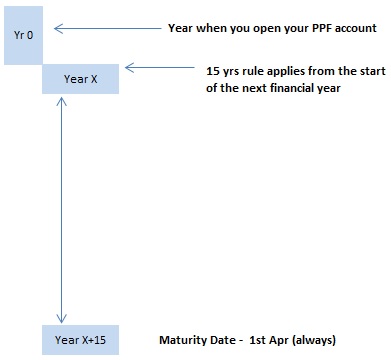

The maturity period for PPF account is 15 years from the close of the financial year in which the initial subscription was made. Its that simple. So if you open your PPF account on 4th Nov 2014, this date lies in the financial year 2014-2015 , then the financial year ends on 31st Mar, 2015 .

So the 15 yrs will be calculated from this date (31st Mar, 2015) and the lock in year would be 2015+15 = 2030 . So the exact date would be 1st Apr, 2030 in this case.

Note that PPF maturity always happens on 1st Apr , and not any random date of a year. Most of the people just add 15 yrs to the date of opening of PPF account to find out the maturity date.

Below you can see a short video which will explain PPF maturity calculation to you. Have a look at it.

So technically your PPF account can mature in 16 yrs in best case, suppose you open your PPF account in the first week of Apr, then your 15 yrs will be calculated from the next year (financial year ends on 31st Mar of the next year).

December 20, 2014

December 20, 2014

Sir, One question. My daughter turns 18 next year. I am planning to open her PPF account, which may tentatively get matured in Year 2040. At that time her age will be 34 years. My question is after maturing, will she able to close this PPF account and create new one ? Around at what age it is advisable to open a PPF account ?

She can simply extend the PPF account for any amount of time she wants.. Why to close and open the new one?

Hi Team,

Unfortunately I came across with this website after I opened PPF account by June 2022. As per max investment limit of 1.5L per year, if I deposit 1.5 L within Mar 31 2023, will it be all good with interest calculation? As it seems, I don’t have any other choice.

Also, another concern for lumpsum and monthly investment. Can I get more interest by lumpsum investment by 1-5th April in every year?

Thanks in advance

Subhendu

Ys.. but only marginally !

Very useful article and I knew many things after reading comments with answers as well. Thanks a lot to jagoinvestor.

Welcome

My ppf account is going to mature on 24.6.2021. I have three questions.

1. Should I deposit my subscription for the financial year 2021-22 as the maturity will deem to be 1.4.2022.

2. I wish to close the present account on maturity. Shall I have to give in writing before 24.6.21 that my ppf account be closed.

3. Can I open a new ppf account in July 2021as the first account stands closed on 24.6.21.

1. Yes

2. Yes, it would be better to inform them in advance

3. No

I have opened a PPF account on nov 2008. Till when I can deposit. And If I want to extent for next five years, can I deposit in this extended period in the same account

Dr. S Mandal

Yes you can extend even after maturity, but you need to submit a form which says that you want to extend with contribution!

Can u please help with extention after maturity …. Mine would mature on 1st April 2021 and not yet matured … Can I apply for the extentiuon now or should I wait for it to mature?

It automatically gets extended.. you don’t have to do any thing as such in 1st year.. just make sure that you go and fill the form to tell them if you want to extend it with deposits or without deposits!

Hi, I have opened PPF on March’96. which means more than 20 yrs completed. I did’t apply for formal extension but kept it live thru’ subscribing it every year for IT benefits. Can I close this account permanently now? I had taken a loan last year…do I have to repay that to close this account. Please clarify.

If you have taken a loan against PPF account, then obviously you have to make payment first to close the PPF

Hi Sir

I opened a PPF a/c in Mar1996. After 15 yrs I extended for 5 more yrs by paying regularly.

20 yr period ended on 31 Mar 2016. Howevever I paid in July 2016 for 2016-17, I have not given any request letter for extension and amt for extended period is credited in my a/c.

The Bank record shows the maturity date as Mar 31,2011 ie 15 yrs. Can it be rectified by the bank.

can I close the a/c now.

If you have not extended it yourself, then YES

Hi, Sir, My daughter opened a PPF a/c in Mar 2007 . She got married in 2011 and settled in abroad

Since then I was paying every year a small amt to keep the a/c active. Whether she can close it now.

Or I have to continue paying till 15 yrs term is reached.

please clarify

PPF cant be closed before 15 yrs complition !

Dear sir i have PPF account, if i am extend for another five years, can i close the account before the 20th year. If yes can i get the amount without any interest loss.

No , once you extend it for next 5 yrs, you will have to continue it then. You cant CLOSE It before 5 yrs .

Do I need to pay TDS on maturity amount if I open two PPF accounts for my two kids but not showing those savings in my 80C savings sections(i have my own savings to show under 80C)

Do you mean tax or TDS ?

what will be maturity date of a minor account becomes major before 15 year of opening whether it is 15 year from opening or 15 year from attaining majority

15 yrs from opening !

Hi Manish,

I have a different query. I had opened PPF account long back when I was in India. Then I moved out of India and eventually acquired other nationality. Now I have returned back to India. So technically I am resident indian. My account will expire it’s tenure of 15 years next year. I do not know whether I can continue this account being a resident but non ordinary citizen. Do you have any clue?

If you are resident right now, then you can extend it. If you are NRI yet, then you cant !

I was opened PPF account 18th Jan 2003 then after 15 year I extended PPF account further for 5 years but I was deposited 17thJuly 2018 Rs 40000/- & 28th Feb 2020 another Rs 1000/- My account had been closed then banker had been recovered penal interest ?Pl give me suggestions on this matter.Tks dir

Ramesh, please ask it again . Your query was not clear.. Did you close the PPF account or it automatically got closeD!

I could not deposit any amount in my ppf a/c during 2014-15. Subsequently I deposited Rs 600 in April 2015 thinking that the fine of Rs 50 would be deducted and the a/c would continue. But no fine was deducted and the entire 600 is shown deposited in the account and the account continues. Further I invested Rs 5000 in Februaly 2016. This amount is also shown deposited in the account. I want to know how and when the fine for not depositing in 2014-15 would be deducted and if not, Shall I have any problem at the time of maturity?

Better enquire with the bank/PO people on this.

Hi Manish,

One question regarding PPF deposit.I have opened PPF account in Oct 2015.So it will be matured on 1 Apr,2031.I want to know that mine 15th year deposit will be in 2029-30 so do I have to deposit money in account in financial year 2030-31 or not??

Yes, you have to deposit !

hi

if i had an ppf aacout at ahmedabad sbi branch after maturing can i withdraw amount from any sbi branch or should i visit same branch fro withdrawal?

Hi Manih

I am not 100% clear, but I think as of now , you need to visit the same branch

How much amount can i invest in PPF account now in a financial year..

1.5 lacs

Hi Manish,

Thanx for sharing information regarding PPF account.

I need to know that i have 2 kids & i want to open their PPF account. can you tell how much amount i could transfer in their account in whole year as per Govt norms . i know that Max limit is 1.5 lac but is there any transaction issue to transfer in their account from my account.

Hi sanjay

This article will answer your query about PPF – http://jagoinvestor.dev.diginnovators.site/2014/02/5-must-know-rules-before-opening-ppf-account-for-minor-kids.html

I am working in Private company earns 10per month and 2K OT some times. I will work hard so my manager gave his own project to work and it will last for 12-24 months only In this 12-15 months I will earn 45K per month

I have opened my PPF account 2 years but till now 10K is deposisted as my monthly salary 10K and my monthly expenditure is 8-9K

Now I am thinking to deposist all my project money to PPF so that I will not worry to deposist in PPF anymore(As my only Salary income with that project is not suficient to invest in PPF)

ie., 45K * 20 = 10.80

Can I deposit 45K per month in PPF even though If I dont earn interest beyound 1.5K per year as in later year I will get the interest right?

Yes, you can deposit it

If he is depositing 45K per month means it will be 5.4 Lacs per year. But I heard 1.5 Lacs will be the maximum to deposit per year but you said above “can deposit”.. May I know how is it possible? and what is the limit of maximum amount deposit to ppf?

one can deposit more, but one will not get the interest

Dear Mr Manish,

First of all thanks a lot for the good job you are doing. I want to know one thing, I have started a PPF of 20k at a time per year,but in the next year can i invest more than 20k in the same PPF account. and what are the benefits or losses.

YEs you can invest any amount between 500 and 1.5 lacs in any year !