How you will save more Income Tax compared to last year due to Budget 2014 (Download Calculator)

Budget 2014 was a big event this year as the expectations from BJP govt was very high. Here are some of the income tax rules which were changed int his budget and impact a common man directly.

1. Income Tax Exemption Increased from 2 lacs to 2.5 lacs

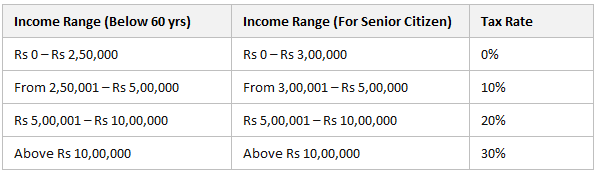

The basic exemption limit was raised by Rs 50,000 in this budget and now the new limit is Rs 2.5 lacs . So there is no tax to be paid upto income of Rs 2.5 lacs. For senior citizens, the new limit will be Rs 3 lacs. So the new tax slabs looks something like this

This was a big relief for most of the people, as the old limit of Rs 1 lac in 80C was not enough for most of the people. There are too many things like EPF, PPF, Home Loan Principle amount, tuition fees, Life Insurance Premium, Tax Saving Mutual Funds and Tax saving FD and many more things, which gets 80C exemption.

Now with this exemption increase to 1.5 lacs, more motivation will be there for people to utilize this 80C limit. So if a person earns Rs 4 lacs, he/she can invest upto Rs 1.5 lacs in 80C, which lowers the taxable income to 2.5 lacs , which does not attract any income tax. So in best case, a person do not have to pay income tax upto Rs 4 lacs income with help of 80C investments done.

3. PPF limit raised from 1 lacs to 1.5 lacs

The limit for PPF investments was increase from 1 lacs to 1.5 lacs. This is going to be a great news for PPF fans and especially those who are investing in PPF in their children names, as the overall limit would increase for their family.

4. Home Loan Interest exemption raised from 1.5 lacs to 2 lacs

This was again a big relief for salaried class, as a lot of people who have taken home loan pay much more than 1.5 lacs of interest per year. With the increase of limit from 1.5 lacs to 2 lacs, the extra saving is of tax on Rs 50,000 , which turns out to be around Rs 15,000 for those who are in 30% tax slab. Note that this is only applicable for self occupied house taken on home loan.

5. Capital Gains Tax on Debt funds raised from 10% to 20%

The capital gains tax on debt funds has been raised from 10% to 20% and the minimum holding period to get benefit has been raised from 12 months to 36 months. So what happened was that earlier, people in 20%-30% tax slab rate used to invest in debt fund for 12 months and got it taxed at 10%, which was a great alternative to fixed deposits (where you pay 30% tax , if you are in higher tax slab) . But now this cant be done . Those who are interest to understand this part, please read this analysis on Deepak Shenoy Blog.

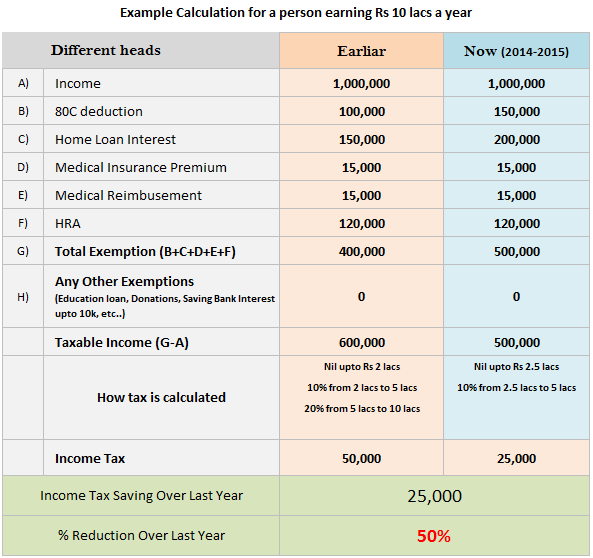

Then vs Now – An example calculation of a person earning Rs 10 lacs

Below I have given an example of a person who earns Rs 10 lacs, and takes full benefit under 80C , Home loan Interest and other basic exemptions like HRA, Medical Bills, Medical Insurance premium etc and compared his situation from past year rules vs the new rules which came in new budget. It has been seen that he can save approximmately Rs 30,000 additional tax. Have a look below

Download the Income Tax Calculator

I have created an excel calculator which you can use for calculating your new income tax and also compare with past year and see how much saving you will make with new rules.

Click Here to Download the Income Tax Calculator

Some Other Changes and Points from Budget

- There is a proposal for introducing a single demat account for all the financial products

- The EPFO will launch a unified EPF account, which will be a single account and there wont be headache to transfer or merge them every-time you change the job.

- There will be uniform KYC across all financial institutions so that you don’t have to update your KYC at all the places

Please share how do you see this budget and the benefits ? Do you think its really going to help bring the “acche din” or not ? Please share your thoughts in comments section below.

July 11, 2014

July 11, 2014

My house owner does not want to give his PAN for claiming HRA exemption of the full amount of rent i am paying.

In the absence of PAN details of my house owner can I claim upto Rs 8000/ (less than Rs one lakh per anum) per month

as rent paid and claim exemption in IT form. Will HRA claimed be allowed?

I guess yes, it will be allowed !

How the CESs and surtax(new 12%) is calculated?

I am a self employed professional earning around 7.25 lakh per annum I have made investment of 1.5 lakh under Sec 80c, 15ooo under Sec 80d for myself, 20000 under sec 80d for my parent (above 60 yrs) and donation of 18000 under sec 80g. I have also taken home loan for which interest is around 1.1 lakh. what will be income tax for the year 2014-2015.

Hi Chetan

Its not that easy that we can do calculation like that. you better get in touch with a CA for this.

whether a senior citizen can save income tax on rupees fifteen thousands in addition to 150000

In which way ?

Hi Manish,

Can you please thorw some information on 80EE as i want to cliam it this year as i have not claimed it last FY 2013-14 and i have not found any question or info on this in articl. Hence requesting you to please provide the inform please.

You can read about it here – http://taxguru.in/income-tax/section-80ee-income-tax-benefit-home-loan-interest.html

Hi Manish,

Very interesting piece of information. My annual salary is Rs. 797,000.00. I would like to go for tax savings scheme and other savings options. It would be great if you can give me some directions.

Thanks in advance.

Ashwini

You can go for some options like Canara Rebeco Tax Saver

Hi Manish,

Greetings. I am a regular at your wonderful blog. Over the years, my financial situation has improved largely due to following your suggestions. Thanks a lot.

I have noticed some unethical behavior from credit card companies .. and would like your help to inform the readers about such practices so that they do not fall into a trap.

I own HDFC credit card. The initial limit was 80,000, which was later increased to 1, 20,000 and then again to 1,60,000.

Each time, after a period of about a month, i received a call from HDFC card representatives and she would inquire general things like if the card was working properly. Then she would move on to say that, as a part of your card, company is providing some great insurance plan and bla bla. When i politely asked them that i don’t need it, they mention that this is compulsory and if i do not subscribe, the enhanced limit on the card would be reduced to earlier limit. Since i knew 100% that this is not going to be case, i rejected offer each time .. but many credit card holders may fall into this trap. Even if they get less than 1% success, they may be making a killing considering the total number of card holders.

If you could do a small article on this, i think everyone will be helped.

Thanks,

Santosh Thapliyal

Thanks for sharing that .. I will make a post on this .

At all times, you have been taking the initiative. Thanks for the calculator and crunchy information! Many tax payer will get benefits from your post

Kuhankumar

bizbilla B2B portal

Welcome

Hi,

I am staying in Rented house in Hyderbad and purchased one house recently in my hometown by taking home loan .Currently i am claiming tax benefit on Interest (LOH) & Principle amount (80C) and HRA .I am planning to buy new house in HYD by taking another home loan.I want to know if i can claim tax benefit on the interest & Principle amount paid for the 2nd home loan also ?

I want to give this new house purchased in HYD for Rent so that i claim my HRA benefit as well.

I know that Rent which i get from 2nd house will be used in calculating tax exception .

in summary i want to claim tax benefit on ( HRA + 1st house interest & principal +2nd house interest & principal ) …..

Any update on my query plzzzzz…

Hi Surfraz,

For the house which you give on rent – the interest will be taken as actual (it can exceed 2lacs)

The principal instalment of the house on rent will not be considered for Sec 80C

Hope this helps !

Suraj

Suraj,

Thanks for the response .

can you please clarify that i can claim tax benefit on HRA ( for house in Hyderabad where i am staying currently) + 1st Home loan Interest + 2nd Home Loan Interest ??

I don’t think you can include 2nd home for any tax purposes. If it generates any income (thru rent), you have to show that as additional income. Rest (with rented house + 1st loan) stays the same.

My wife is earning Rs45000 per month. She is not having house loan and saves upto

150000 under sec 80c. what will be income tax for the year 2014-2015.

It would be 19000

Dear Mr Manish,

Please confirm if a senior citizen/very senior citizen is allowed to open a PPF account.

Thanks

Shobha Ganesh

Yes…. any indian citizen can open PPF account. but it is not advised to open a PPF account by senior citizens as the lockin period is 15 years….

Yes, any one can open a PPF account

Hi Manish,

I have started visiting the site recently and find it very iseful.. I have one query, you have shown both Medical reimbursement and Medical Insurance seperately.

Can you let me know whether we can claim medical insurance seperately? My understanding is that both comes under Sec 80D and max total limit including both is 15k. Please clarify.

Thanks in advance

Revathy Dasan

Hi Madam,

The difference between claiming medical re-imbursement and medical insurance are as below .

(1)Medical reimbursement (max limit : 15K ) can be claimed as an exemption under Under Section 17(2) Proviso (v)].

(2)Medical insurance can be claimed as Deductions under Chapter VI- A,section 80D .Limits for this are as below :

The Deduction that can be claimed under Sec. 80D at the time of filing of income tax return is the sum of the following:-

1.In case the payment of medical insurance premium is paid by the assesse for himself, spouse, dependent children – Rs. 15000. In case, the person insured is a Senior Citizen, the deduction allowed should be Rs. 20,000

2.In case the payment of medical insurance premium is paid by the assesse for parents, whether dependent or not – Rs. 15000. In case the parents of the Assessee are Senior Citizensthe deduction allowed under Section 80D should be Rs. 20,000

Hope this clarifies the difference between the two.

Rgds,

Nirjhar

No , Medical Insurance is for the premium you pay for the policies for health insurance . thats limit of 15k

The other thing is Medical bills reimbursement which is also upto limit of 15k per year. You can give bills of medicines and doctor visits for yourself , spouse, children, parents etc and do not pay tax on that 15k amount

Manish

Hi,

I need help with filing ITR-1. I’ve got a tax refund for AY2010-2011 and AY2012-2013. These refunds were credited in May and June 2013. Do i have to show this amount while filing the IT returns for this year. If yes, where do i have to mention this amount in ITR-1. I’m not sure whether this question should be posted here or not, but i’m kind of struck and don’t know where to get the help from.

Thanks in Advance

Surendar

Per my limited knowledge, I don’t think they would be considered additional income unless they generate interest (if they are credited to your SB, then you may not know the interest for this component anyway!).

No , you dont have to show them .. as they are refund only .. there is no explanation required for them

Nice article.

Hi Manish,

Kudos to you for smmarising everything and presenting the things in such a great and lucid way.

I have a concern, about the title chosen for this article, it is kind of misleading for many people.

50% rebate is on this special case selected by you..in the similar fashion/logic someone may even prove that its 100%.

Thanks,

Swetank

Yes Swetank, I think I made that mistake , I will change it !

Dear Manish,

Thanks for your informative Article. Just one doubt, Have they (post offices) started accepting additional 50K under PPF ? I have already made maximum allowable 1 lac deposit and wish to contribute additional 50k now.

The Department of Post’s Indiapost website still showing max allowable as 1 lac.

Yes, they have started accepting it now

Thanks for the information.

Dear Manish,

Thanks for your informative Article. Just one doubt, Have they (post offices) started accepting additional 50K under PPF ? I have already made maximum allowable 1 lac deposit and wish to contribute additional 50k now.

As per my understanding all the budgetary proposals will come into effect only after it is passed by the Parliament. After that concerned agencies such as PPF regulatory body etc will issue the concerned notification such as increased PPF subscription etc. After this only one can utilise this.

I don’t understand the need for Parliament to pass the budgetary proposals. This is not a bill which has to be passed by Parliament before it comes into effect.

As per my understanding, the changes in budget are final and not merely proposals. This means the changes in budget will have immediate effect. Can someone clarify on this front?

I believe we are merely waiting for the circulars to be circulated to the Post offices and banks and the Software/system to implement to new 1.5 lac ceiling in the case of PPF.

Hi Manish,

Can you please throw some light on 80TTA. Can we claim 10K under it as interest on Savings A/c & FD interest?

How do we plan for this better?

Hi Manish, What’s the effective date of these deductions? Can I deposit 1.5 lacs in PPF this year?

Can one avail both deductions on home loan and HRA?

Yes , IN some cases it can happen