LIC Online Term Plan Launched – 37% cheaper than Offline version

Good News! . Finally LIC Online Term plan is launched. The name of its online term policy is LIC e-Term and can be bought via LIC Direct initiative. Investors community was waiting for this online term insurance from LIC from very long time and finally many will buy the term plan to cover their family. In this article I want to give you a crisp review of LIC Online Term plan.

Let me share some of the features of LIC Online

1. Completely online buying – without agent help

Like any other online term plan, LIC e-Term is completely online term plan. You just need to calculate your premium, give your details online and then buy the policy by paying the premium. Incase you need to appear for medical examination, that will be done offline.

2. Different premium for smokers and non-smokers

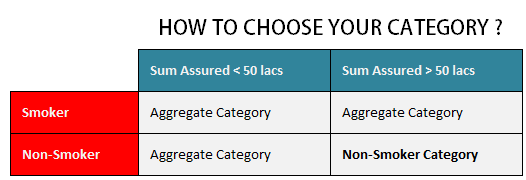

There are two categories of premiums which will apply. The first one is called Aggregate category which will apply for all those who will choose the sum assured between 25 lacs and 49 lacs (it does not matter if you are smoker or non-smoker) . This category has to be chosen if you are smoker anyways (incase you take more than 50 lacs of sum assured)

The next category is non-smoker is called Non-smoker if are choosing sum assured more than 50 lacs and if you are a non-smoker.

3. Eligibility Conditions and Other Restriction

- Minimum Sum Assured : Rs. 25 lacs for Aggregate category and Rs 50 lacs for Non-smoker category

- Maximum Sum Assured : No limit

- Minimum age at entry : 18 years (completed)

- Maximum age at entry : 60 years (nearest birthday)

- Maximum cover ceasing age : 75 years (nearest birthday)

- Minimum policy term : 10 years

- Maximum policy term : 35 years

4. Cooling-off period

If the Policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to us within 30 days from the date of receipt of the policy bond stating the reason of objections. On receipt of the same the Corporation shall cancel the policy and return the amount of premium deposited after deducting the proportionate risk premium for the period on cover, stamp duty charges, expenses for medical examination and special reports, if any.

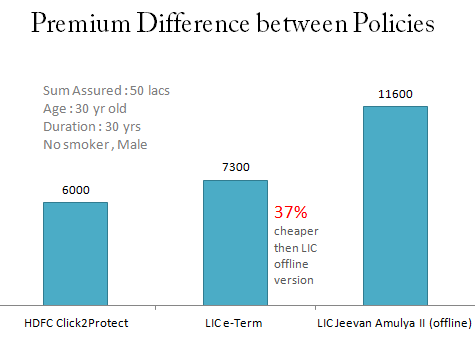

Cheaper Premiums of LIC Online Term Plan

The great news is that LIC Online term plan premium is much cheaper than the offline version of its term plan. If you see the premium rate charts, you will see the premiums for LIC e-term is around 20-30% cheaper then the offline version.

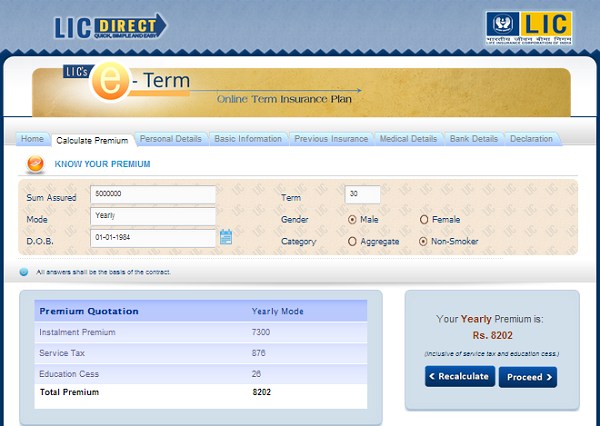

For example – The Yearly premium for LIC online term plan for 50 lacs sum assured was Rs 7,300 (for 30 yrs old male and for 30 yrs term), compared to Rs 11,600 for the offline version (LIC Jeevan Amulya II) . For the same profile HDFC Click2Protect charges Rs 6,000 , so LIC online term plan is around 20% costlier to HDFC Click2Protect plan.

Here is the graphical comparison for the premium difference between 3 policies

Details you have to provide for taking LIC online term insurance ?

When you buy the online term policy from LIC, here will be few things required. Those are as follows

- Details about your occupation/ Educational qualification

- PAN number

- Your Income Details ( Form 16 / ITR for last three Years or P&L Account)

- Details of all your previous life insurance policies (like policy number, sum assured, plan etc) taken in last 3 years.

- Details of family members like age, state of health, age and cause of death (if applicable)

- Details of your medical history including illnesses, injuries and any medication.

- Bank details like Account number, MICR code etc.

Can NRI take the online term plan from LIC ?

Yes, NRI’s can also buy the term plan from LIC, but it clearly mentions that they will have to be present in India for medical examinations.

Step by Step process of buying LIC Term plan online – VIDEO

You can just go to this LIC eTerm Page and start the process of buying the plan. Below you can watch a 10 min video on how to buy LIC online term insurance policy in step by step manner. I have explained more of the things in the video itself.

Comments on LIC Platorm and overall experience

I have gone through the overall form filling experience and I find it well researched and thorough. LIC has taken a lot of time to come up with platform. Given the popularity of LIC and the trust of its customers, LIC will surely be going miles and will gain millions of new customers. Investors now are well aware of the importance of term plan and its popularity will only grow overtime.

Are you buying the LIC Term plan ? How did you find the review ?

May 17, 2014

May 17, 2014

Dear Mr. Manish,

Kindly assist by clarifying the below point asked during filling of form.

a) Is your life now being proposed for another assurance or an application for revival of a policy on your life or any other proposal under consideration in any office of the Corporation or to any other insurer?

b) Whether proposed simultaneously on the life of spouse and children?

d) Has a proposal or an application for revival of a policy) on your life made to any office of the Corporation or to any other insurer ever been ?

d1 ) Withdrawn, Deferred, Dropped or Declined?

d2) Accepted with extra Premium or Lien?

d3) Accepted on terms other than those proposed?

Regards,

RP

Is the LIC customer care not helping you on this?

good morning sir

in few days back I applied online term plan in Aefon life for 75lakhs 717per monthly based.

is it good or not

is best comany or not

what I do

Dont worry .. its fine

Hi Manish,

Need your assistance. I have 2 LIC policies with me which will expire after-10 years. Reading your articles on Term insurance, I would prefer ti discontinue those and take a term policy instead. I have already finished paying premiums in those 2 policies for more than 5 years. Will it automatically get paid up or is there a formality? My agent is not guiding me properly and I havent paid the premium for this year and he says it will automatically become paid up. Please guide.

Once you stop your payment, it automatically gets paid up . NO need to do anything. Apart from that you should buy a good term plan. Our team will help you with that if you want. You agent is not helping because his commission is dependent on policy 🙂 . Note that we will help you buy the online policy which does not have any commission attached to it

Just fill up a form here

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

I was trying to open online a eterm policy. While filling the details of existing policy details, the system is asking to select HOW ACCEPTED? In the Drop Down menu, there are two options: 1. OR 2. Extra.

Please explain the meaning of these two terms so as to enable me select the correct option.

Hi Suman

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Thanks a lot, I have got in touch with LIC representative and got the info. One more query which I do have, is when my form is generated, Premium amount is showing as 0. Although the amount should be 8600. In the video, I can see proper premium amount of 8202 is also shown in the pdf generated. Can u plz throw some light on this?

It might happen that the due date for the premium has not come and its showing you for the current year itself for which you have already made the payment.

Hi Suman

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi

I wanted to know is there any difference in claim settlement between govt insurance company LIC and private such as ICICI. I wanted to take a term insurance for 1 cr, age 27 non smoker. ICICI is giving at around 9000 while LIC is quoting 16000. Also as I am overweight I doubt if LIC will increase my premium later. Should I go for ICICI then, I mean taking into consideration 35yrs term period will ICICI be as bankable as LIC

I am LIC agent. Is it good for me to apply for online term plan?

Explain how?

Hi Manish,

I’m already having an existing 1 Cr term plan from LIC through an agent. Will it be good to go for LIC E-term plan and cancelling the existing one as there is almost Rs.8,000 difference in yearly premium.

Yes

I’m an NRI.. Could I purchase online Term insurance?

YOu are eligible to buy it. We cant answer “if” you should buy or not. Its your wish !

Hi Manish, I want to buy LIC e term plan but the link in web page for e term insurance is not working since past many days. I tried it many times in last 1 month. I suspect the mighty agent lobby is not happy with e term and they might force LIC to stop this plan. Your views ?

No , it should not be like that. It must have got changed now .

Om, if you are accessing the website from your office network then it may not open. Try opening it from your home internet. I too faced similar problem, website opens with some port numbers and they are restricted at some office networks.

Looking for a cover of 1 cr. I have looked at many online term plans and cant seem to find any that provide death benefit due to an act of terrorism. I am in the merchant navy and Piracy / Acts of Terrorism are potential risks to life. Are there any plans that offer cover due to death caused by piracy / armed robbery / terrorism? Thank you.

Hi Farshid

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

Thank you Manish. Managed to get my term cover through Jago Investor / Coverfox

Glad to hear that Farshid

I am looking for term insurance of rs 30lac from lic and as i am from semi urban-rural place whether to go for LIC term insurance online or amulya jeevan offline so many of my friends told me that if we go for online the lic people will not co-operate in medical check up / service and if i have to do online what to do or better to go offline which one?

There is nothing like that !

I am looking for term insurance of rs 30lac from lic and 20 lc from hdfc if suppose any thing went wrong at the end can my family legal heirs get sum assured from both company or only from any one out of two

and again as i am from semi urban-rural place whether to go for LIC term insurance online or amulya jeevan offline so many of my friends told me that if we go for online the lic people will not co-operate in medical check up / service and if i have to do online what to do or better to go offline which one?

what about hdfc click 2 protect I am looking for myself as well as my wife combine or separate 20 lacs

HDFC has a good policy for term plan and we have a special tie up for our readers. You can try that also

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Please provide the below details for purchasing e term policy online.

1) if i took the policy for 30 lacs should i undergo for medical check up or not.

2) after doing the payment what is the next step should i visit LIC office.

3) Should i submit the proposal form to LIC office.

4) What about my Hard copy of Insurance Certificate.

1. Depends on company if they are taking it or not

2. POlicy will come to you , dont worry

i have limited money. i have health insurance. i want to take Term plan of 30 lakh , 30yrs term, age 33.

whether i should go for LIC or HDFC ?

pls advise.

You can go for any. which ever has lower premiumn

I have joined service 6 months back. I dont have Form16/ITR related documents as of now and am interested in taking LIC e-Term plan. What documents should I be needing to complete the process now that I dont have ITR/Form16 documents?

Hi Rahul

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I have two LIC (OFFLINE) term insurance, following are details

1. JEEVAN ANAND(WITH PROFITS & ACCIDENT BENEFITS) :SUM ASSURED: 400000/- Premium (Y-Y): 21134/-, coverage till : 2032

2.JEEVAN MITRA (TRIPLE COVER ENDOWMENT PLAN)WITH PROFIT(WITH ACCIDENT BENEFIT): SUM ASSURED: 300000/- Premium (Y-Y): 16462/-, coverage till : 2032

I am 34 now ,salaried person I want to surrender one of above policy.Please suggest which one shall I continue?

Hi RAVINDRA

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

I work in abroad and visit India in every 6 months.

I want to take a term plan insurance for an amount of 35-40 Lakhs.

Currently i am in india and will be here for 15 days.

Could you please suggest which policy will be better for me.

Hi Nagaraju

HDFC is a good term plan and you can go for it. If you need our help in that, you can fill up this form http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi,

I am working in UAE (where there is no tax) since 6 years, before that i have not worked in India.

I do have a PAN card, but not filed any returns, assuming that i was not working in india so no need to file the returns.

I am planing to take LIC eTerm Policy for 2CR, as i gone through the details mentioned in this article i found that Income Details ( Form 16 / ITR for last three Years or P&L Account) need to submit.

I don’t have any Form 16 or P&L, am I eligible to apply for this plan. Please suggest how to proceed for furthur.

Thanks in Advance.

Hi Ramu

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi Manish,

2 doubts..

1. How do we decide the policy term? 30 / 40 years? Im 30 yrs old now

2. Is the LIC term policy better than HDFC C2P in any way?

Thanks in advance

1. 60 yrs – your current age

2. No , you can go with HDFC if you want. We can help you with that, just fill up this – http://jagoinvestor.dev.diginnovators.site/services/life-insurance

I have two LIC & 1 Aegon Religate term insurance, following are details

1. LIC Covered amount : 2500000/- Premium : 9,125.00, coverage till : 2046

2. LIC Covered amount : 500000/- Premium : 1,584.00, coverage till : 2033

3. Aegon Covered amount : 3000000/- Premium : 4412 coverage till : 2057

Total coverage : 60L, Total premium : 15121

I have following options, what would be your recommendation.

1. Surrender #1 & #2 policy, continue with #3 policy. Buy eTerm of 50L, premium 13089 per annum. With this total coverage of 80L premium 17501(=13089+4412)

2. Surrender #1, #2 #3 policy & take a eTerm of 60 L, premium amount : 15707, Life cove till : 2050 years

3. Do not buy e-Term, continue with offline policies, as premium is almost same as existing polilies, but please note that if we buy new e-tem policy it would cover me till 2050.

Appreciate your response.

Atul

I would suggest going with 3rd option. There is no major reason why you need insurance till 2050 .

I think when we talk about insurance then duration of insurance is very important factor. one should take insurance as longer duration as possible, because as more older you become, it increases the chances of death. Insurance is more important then. Having said that I think duration is important.

What are your thoughts on Option #1?

Atul

Hi Atul

I suggest you read this article which talks about the same point about tenure of term plan – http://jagoinvestor.dev.diginnovators.site/2013/04/why-you-should-not-take-term-insurance-till-75-yrs.html