5 signs which proves your financial life sucks and you are screwed up

Is your financial life going well? Are you on the growth path or on the verge of disaster very soon? Your financial life might be in trouble, but maybe there is some more time left before you really take charge of your financial life and really do something about it, else it will crumble and you will be destroyed beyond recovery.

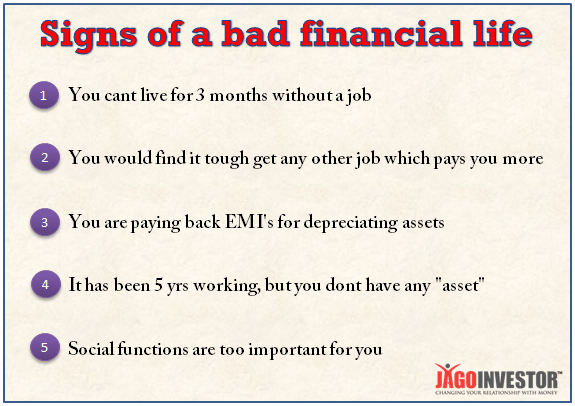

I see lots of people who are not in agreement with the fact that their financial life sucks and they really need to take giant leaps. Somewhere they are comfortable with the whole situation and keep expecting that “somehow” their financial life will improve. So, I am giving you 5 simple indicators, which you can look at and decide if you are headed towards financial disaster or not. The more these indicators are true for your financial life, the bigger is the problem and you need to get really serious about it. If none of these indicators are true for you, then congratulations! , you are mostly in a good situation.

Sign 1 – You cant live for 3 months without a job

The first and the biggest sign of disastrous financial life is that you cant live for a few months if you do not bring money on the table through your job or business. If you have been earning for a few years now, you should at least have a year’s worth of income saved with you, but that’s not the case with many people. Their monthly expenses make sure they are left with nothing at the end of the month. Worse, many people have the negative cash-flow and they are piling up debt each month to survive. These people are mostly dependent on credit cards and keep using them whenever they are in a “crisis” situation. The credit card should be held for benefits + reward points and not because of its a survival tool for you.

Ask yourself, how many months’ salary have you drawn to date in last so many years and how many worths of salary you have saved till now? If you cant survive for more than 3 months (or 4-6 months), you are in big trouble. I asked this same question on my facebook wall a few weeks back and I got responses like “6 months”, “3 months”, “10 yrs” and all kinds of numbers. So better look at your number of months. Do not focus on income alone, because income is not the same as wealth.

Sign 2 – You find it tough to get a higher paying job

Your job/business is the means to bring money to the table each month. Every year or in few years, ideally you should be able to move one ladder up and command a high salary because over the years you will gain experience, add new skills and would be wiser/knowledgeable. However, if you cant move upwards in your professional life, the amount of money you will bring back home will not increase and if that’s the case, you are in trouble.

Ask yourself – Do you see yourself earning 10X of your current salary someday in the future like the next 5-10-15 yrs or not? Are you dead scared of losing your job and never be able to find another? Do you feel that you have reached a level in your professional life, where if you lose your current job, you will find it tough to get the same salary job somewhere else?

If that sounds your case, you are in trouble financially because your biggest asset is your earning capability and not your this year’s pay package only? If it sounds your story, its time to find out how you can increase your skills and take better jobs in coming times, don’t wait for the last moment, it takes few years to hone your skills!.

Sign 3 – You are paying back EMI’s for depreciating assets

There is two kind of debt – good debt and bad debt. Any debt which helps you build assets and grows in value over time is better (I am not saying, go for it, but it’s just better than the bad debt). The bad debt is mainly the debt which is used for CONSUMPTION purpose. You use it and its gone. Examples are personal loans, consumer durable loans, credit card debt or even a car loan(especially the car, which you really don’t need, you can do with a two-wheeler, I am not talking about the car which is really required and can’t live without), then you are paying an outsider on a regular basis, without building any assets for yourself.

It’s like – you are doing the job to help others squeeze money out of you. If you are doing this, better stop it now and see how you can change your direction, you still might have the time to come back on track.

Sign 4 – It has been 5 yrs working, but you have nothing worth called “ASSETS”

You have worked for 5 yrs in the job, now even if you had saved 2 months’ worth of salary each year, you must have had 10 months’ worth of salary with you saved today? Is it there? You must be having some investments in Fixed Deposits, or some gold, or some mutual funds or at-least a small part of your future house down-payments which you are fantasizing about? Is it with you or you have blown up? In my 1st book – “16 personal finance principles every investor should know”, I have explained in the first chapter how the early start of your financial life can break or make the rest of your financial life. Grab it and read it.

Ask yourself, how much you can show off for the last 5 yrs of earning? Just add up all the salary you have drawn in last 5 yrs (let’s say at 4 lacs per year, its 20 lacs in total 5 yrs), how much you currently have in assets? Even if you have saved 3-5 lacs, I would say its fine. But if you are still trying to locate where has all that gone, it’s not a good sign. Remember, how do you start your financial life can be an indicator of your whole financial life. Dont neglect the first 5 yrs of your financial life because it matters a lot.

Sign 5 – You like to spend a lot of social functions!

Most of the people with the worst financial life in India are too social in nature (not vice versa). They keep spending on all the useless social functions either due to social pressure or by choice. Examples like – “How can I not celebrate my child’s 10th Birthday with a grand party, all relatives are looking forward to it” or “I have to gift something worth to this friend/relative because of reasons reasons reasons.

Social functions in India are one the largest wealth-destroying activities, which are not comparable to anything. Dont get me wrong, I know you need to celebrate marriage, birthday, anniversaries and that’s an important part of life, but when it stops being celebration and becomes showoff and obscene display of imaginary status (which others know very well that you are faking), it’s utter nonsense and destroys your financial life. Please stop it

I know the current young generation does not believe too much into showoff and useless social functions, but due to parents’ pressure and mindset, even children have to kneel down at times and cant avoid this social spending’s even if they hate it from the core of their heart. Ask those children, who are struggling to buy a house because they do not have money and their parents blew up 30 lacs on their wedding to invite 800 people (500 of them you meet the first time in your life and they eat maximum ice-cream at food counters). What a joke !. A small bold decision would have made so many lives easy.

It would be a good idea for you to write down how much % of your income to date, have you spent on social functions (which you could have avoided) in the last 5 yrs. If its more than 2 %, I am sorry for you.

I must mention that all the views are my personal based on my ideologies, If you don’t agree with some point, You are equally right and much like anyone else. The points are general in nature and might not be 100% true for every person’s case.

Take some bold step

I can tell you from my experiences – Most people have bad financial life and they do not do anything about it, because it’s not affecting them in the short term. Every additional bad decision does not hurt their next day, the food will still be on the table, the next movie will still be watched and the small Sunday outing will still happen, but how long if you continue having these 5 signs in your financial life? In our 3rd book – “11 principles to achieve financial freedom” written by Nandish, the coach helps a guy in changing his mindset about his financial life and helping him think like a pro in his financial life, Its an amazing book I would say which no investor should miss.

You need to take some massive action, some really bold step, it has to be 20 times stronger than what you have in mind, you have to really upset few people in your life and have to embrace discomfort for few years. Just a tiny “try” will not help. Imagine you get a deadline from your employer that you can only work for the next 5 yrs and then you will not get any job in the whole world for the next 3 yrs, how will you prepare for this situation? That’s your game plan now!

June 17, 2013

June 17, 2013

excellent article manish sir ,

the way you write , the way u pass on ur thoughts is amazing ..

many people write articles just as there hobby, but u write u feed among others….

rgds manish

Thanks for your comment

[…] not bothered about future much. Its their children and legal heirs who have to suffer later, due to their laziness or ignorance about these matters. In this article I want to highlight few important documents and processes […]

Hi Manish,

I have recently found out about this site & find it quite intresting. All your articles are insightful and gives food for thought. This one in particular, has made me realise that really my financial life sucks. I have some investments scattered here n there, but am not sure where i stand. I have a PPF[opened just this year :-(, planning for 1lac per yr atlst], RD [for 2 years with 5k monthly], SIP[3 yr duration & due to get over this december with 5k monthly] and a FD for 5 yrs with 40k.

What i wanted to ask is whether investing in RD is a good idea or not. I can manage a saving of 15k monthly apart from above investments and was thinking of putting it up for RD for 2 yrs as my goal is to save some money for my my future first…hopefully nothing major comes up in the next 2 yrs, till atlst RD matures…. But does this make sense? to put it all in RD – the returns would be taxable and that worries me. My inhand sal per month is 42k.

RD has to be used for a specific purpose , not for anything . RD should only be used for short term goals for which you can invest on regular basis

Thank you so much Manish. I appreciate your quick response.

Welcome

Hi

I am new to your website. but i frequently read articles on financial planning in different blogs. I am amazed and like you articles very much. Thy are great.

Just as an extension of the above bad loan topic. Can you put some light if it is good to prepay car loan specially if there are charges for preclosure ( around 5% of balance). I have already paid for around 19 months and 75% principal is still outstanding.

I think if you have the capacity to pay each month then its fine to continue, because anyways a big part of your EMI is main principle

I need you help on my situation.

I am 23 years old working in MNC.

2 month ago I purchased a flat in Pune and for that i took a HL of 17 lacs for 22 yrs my father is co-applicant.

Now my condition is I am paying my EMI and managing some of my monthly expenses on my own, and rest are managed by my dad.

I want to achive financial stability before my marriage. But not sure about what should be my next step to achive that. by reading some of your article i come to an conclusion to have a long term plan now instead of any short term plan.

I cant repay my hl right now as it is for 22 yrs.

can you please guid me what should be my next step for future?

Thanks

Prashant

Prashant

Very nice way of dealing with your finanical life . Very mature question .

I think you should first concentrate on your short term goals 🙂 . Not long term . I mean first get stable . Have a good job, control your expenses and check i your expenses can be maximum of 40% of your income . Before you get married, prepay some part of home loan , get a car etc . Get some decent bank balance (few lacs) . So that when you start your family, you are not in pressure and in next 10 yrs, you should be able to clear off all the liability and go to the next step.

I suggest you read this article, i wrote last week – http://jagoinvestor.dev.diginnovators.site/2013/08/your-threshold-point.html

I think I am one of the victim .. really need to think hard..can u guide me please

What guidance you need ?

Can I reply you on any personal id. Mine is [email protected]

1. sign 5 was true when i got married and spent 4 lakhs 10 yrs before. By adding another 1 lakh, I could easily buy a 1 RK in Ghatkopar which is worth 65 lakhs now.

2. I am 38 now. and Sign 2 seems to be true now as i am finding difficult to find higher salary job. i really need to brush up myself by adding another higher degree.

Thanks…….

Good that you realised this now ! ..

Really nice eye-opener.

Manish,

Again a Best Article from a Finance Genious..

Thanks !

Manish, it’s okay if people do not respond to me but hope they do respond to these insights in their own life.

I have problem in point 2. The others are fine. How can I improve? I may need to go in for higher education as IT jobs are overpaid and there is no job security. I am willing to even take lower paid jobs that have more security. Can someone suggest good jobs in other sectors that can use my skills? Excellent English, well versed in foreign cultures and have good functional knowledge of healthcare sector.

Also medical expenses for my parents are a huge problem. How can one get good medical care when govt hospitals are so corrupt and private hospitals charge lakhs of rupees for even minor operations.

Lalit

Sadly, no one will be able to help you on this , as its something internal to you, you have to find your own ways . If one vertical is closed to you, you need to identify how you can add skills to get into other verticals . And adding other skills is not because you want to go to some other sector or stream , but just because you want to be prepared and see it as good practice .

If you take my personal case , I can take a role of a financial planner, as well as a Programmer (Python) for now . I can also do SEO consultancy and I can also help into MS Excel advanced tools .

Over the years , I have exposed myself to learn new things and have taken pain to explore things at a level that tomm , if needed I can switch to different jobs . It would not be easy to get a high salary, but atleast I can enter those areas .

Are you getting my point ?

Manish

Manish, I love reading such articles and would love to send it as forward to as many people as I know. But you know what? People never respond or even comment. People are uncomfortable and embarrassed discussing money. All I get is silence. People are in denial and don’t wish to talk or even read such articles.

You responded to this article, however I never expected it ,I just wrote it and did my bit . Just that like you should not expect them to respond and come back to you, just do what you are suppose to do for them , dont expect anything 🙂

Well sir, its been a very conflicting situation for me .

I am pretty secured in point 2, 3, 4, 5 . But for point no 1 , i cant live even 1 month if i dont get my salary.

Now thats the risk I took, to secure point 4. Creating asset in form of a house.

Tell me was it a good decision ?

I think for you its a temporary phase. You may be able to built in the desired corpus to survive for 3 months in some time.

Even I have the same situation. But then I have made it a point to cut down on additional expenses for a few months to add this saving to the kitty for surviving for at least 3 months without a job.

I think point 1 should be taken seriously . You should slowly accumulate some money to last atleast 3 months !

“One should not depend on his first income, you should always have second income”-Quoted by Warren Buffet.

This is perfectly relate to this article.

Thanks

Excellent. In-Your-Face Article. Point No. 5 was a big punch. 🙂

Welcome 🙂

Really very good future snap…

I never thought of this situation and just spend my salary without much saving but I want to know how can i stop/reduce my expenses which are compulsory??

You cant stop those which are compulsory, but you can do some thinking on how you got these compulsory expenses ? Could you have avoided them or lowered them ?

Hi Manish,

Your book “16 Personal Finance Principles Every Investor Should Know” is out of stock on Flipkart. From where else can I buy it?

Here – http://www.uread.com/book/16-personal-finance-principles-every/9789380200620

Ask them to notify you, it keeps coming .

Or you can order from homeshop18.com

You have ignored medical expenses in the article, god forbid if something happens to any of the relative and you don’t have a medical policy, you are screwed…..

yea .. good point

Point 5 is very true.. especially kneeling down to parents thing what you said.. Hopefully i should not face that

Yea .. Most of the youngsters facing this a lot