How PPF interest is Calculated (With Calculator)

There is a great confusion among investors on how PPF interest is calculated ? Just because a lot of investors don’t know this , they have questions like “what is the best time to invest in PPF to get maximum interest” or “Should they invest in lump sum or monthly?” . Once you know the procedure and exact ppf interest calculation method, life will be easy. Let me explain with examples how its done and also give you a ppf interest calculator in a excel sheet format at the end.

To explain in one line – “PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end”

Excerpts from Official PPF page

8. Interest – Interest at the rate , notified by the Central Government in official gazette from time to time, shall be allowed for calendar month on the lowest balance at credit of an account between the close of the fifth day and the end of the month and shall be credited to the account at the end of each year

What this means is that the interest is not compounded monthly ! . While there is no ppf interest calculation formula, but the way its calculated is very simple ! . The interest earned in a year will added back to final amount only at the end of the year. Thats the only catch ! .

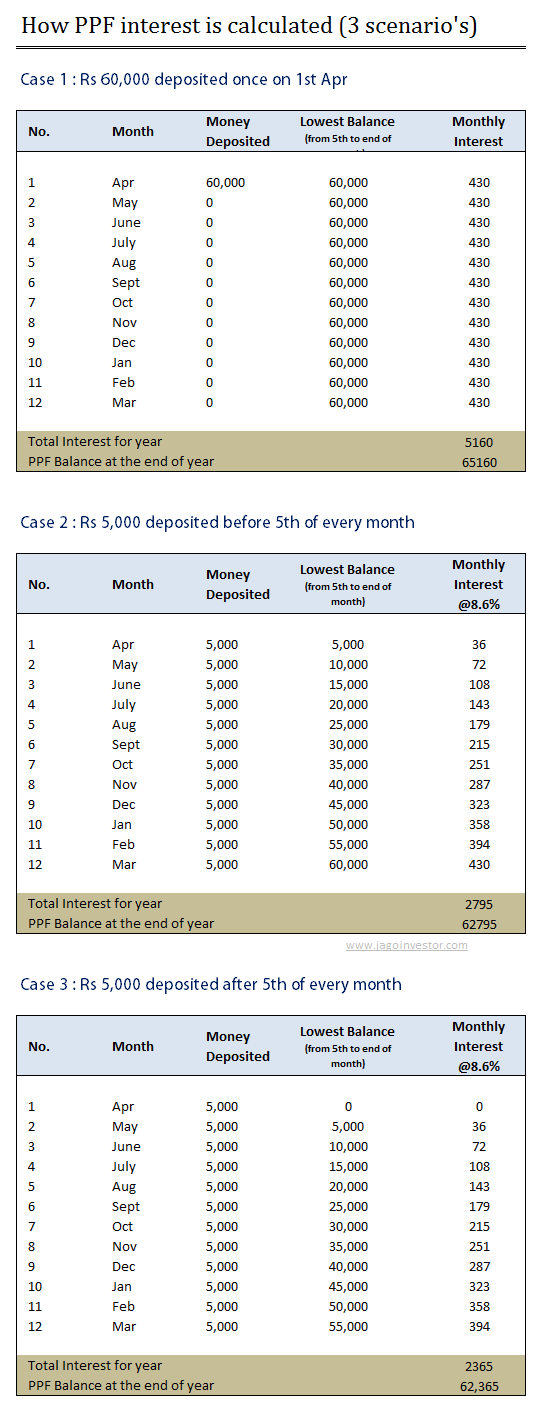

So lets see 3 different kind of cases where money is invested in PPF differently and see how the interest is calculated and added back to PPF account at the end of the year. We will see these 3 cases

Case 1 : Rs 60,000 deposited once on 1st Apr

Case 2 : Rs 5,000 deposited before 5th of every month

Case 3 : Case 3 : Rs 5,000 deposited after 5th of every month

The following examples give all the 3 cases examples assuming investment of Rs 60,000 in a year , but invested differently. I have taken interest at 8.6% per annum . Recently the PPF interest rate was increased to 8.6% and the limit was raised to Rs 1,00,000 and its now applicable from Dec 1, 2011 . So if you have invested Rs 70,000 earlier in this year , you can still invest Rs 30,000 more in your PPF account.

Note : Interest assumed is 8.6% for all the 12 months. However in reality it might happen that it may change in between for some months due to changes from govt.

Some Important Points on PPF Interest Calculation

- If you are investing in PPF on monthly or several times a year, before 5th or after 5th will not matter a lot , it would be just few hundred rupees.

- If you are investing your money in lump sum on yearly basis, it would be better if you can invest before the 5th of April, this will make sure that you earn interest on more balance for the month of Apr.

- The interest on a particular month depends on the interest rate applicable for that month, if PPF interest rates change in between , then there might be different rate applicable from a point onwards.

Download PPF Interest Calculator Here

February 13, 2012

February 13, 2012