Best pension plans in india – Disadvantages and Advantages

What are pension plans and how do you identify the best pension plan in India? Is it the LIC pension plans or some pension plan policies from pvt companies or some unit linked plan from companies claiming to provide you with Rs. ‘X’ for ‘Y’ numbers of years once you retires? In this article we will see some of the disadvantages of pension plans in India and how they work.

A lot of investors think that retirement pension plans are the only way to go; and if they do not invest in these products today, then they will miss out on something. In this article let’s talk about pension products. Before I move ahead I would like to coin two terms used in Financial planning which are very easy to understand.

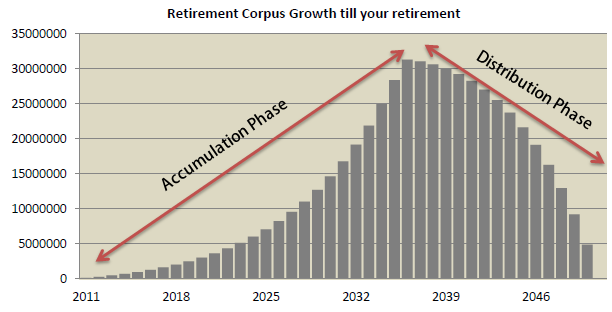

Accumulation Phase : Accumulation Phase is that period of your life, where you invest regularly each month and “accumulate” the Wealth. You start getting pension later in life. So when you invest your money in ULIP’s, Mutual funds, Direct Stocks or anything else you are into accumulation phase.

Distribution Phase : This phase refers to period when you start withdrawing money from your already accumulated wealth for consumption purpose. So at the time of your retirement or even before that, when you start taking out certain amount per month for next ‘N’ years, that’s called distribution phase.

Two major categories of Pension Plans

Let me start by taking about pension plans and their types. There are mainly two type of pension plans at broad level.

Deffered Annuity Plans : Most of the pension products in india are sold by LIC and all the private companies are deferred pension plans. These plans have accumulation phase inbuilt in itself and hence you first pay premiums for ‘X’ number of years. Once you retire, then you start getting pension income. You can see these types of plans all over the market. Some examples are LIC Jeevan Tarang, LIC Jeevan Nidhi, Bajaj Allianz Swarna Raksha ROC , New Pension Scheme (NPS)

Immediate Annuity Plans : These products are called immediate annuity plans because they start paying you the annuity right from day one once you make a lumpsum payment. So if a person wants a monthly pension and has huge lumpsum money, he can buy an immediate annuity plan and start getting pension. It’s a simple product which is not so much popular in India like deferred annuity plans. Some of the examples of immediate annuity plans are LIC Jeevan Akshay , ICICI Pru Immediate Annuity , HDFC Immediate Annuity .

4 reasons why you should not buy deffered annuity plans

Let me tell you 4 strong reasons why you should avoid buying pension plans in India .

1. There are better options for growth of your wealth

The accumulation of your wealth happens in a pension plan for many years, but it’s not the best way your money can grow, ultimately if you had to invest your money in equity (underlying asset class), you have simple and no-cost options like mutual funds, index funds. Also you can choose to put money in real estate. A regular SIP in an equity diversified mutual funds should give much better returns then accumulation in a pension plan (read unit linked products).

2. No predictable returns for annuity

The core function of a pension plan is to give you pension. But do you know how much returns you will get out of your pension plans when time comes for retirement? A lot of pension products do not give a clear idea on how much will you get at the end. What is the return earned is around mere 4%? What will you do? The same is true for NPS.

One major (I mean MAJOR) DRAWBACK is you have no clue what will happen once you finish the accumulation stage and go on to the withdrawal stage. Let us say you have accumulated Rs. 500 lakhs in a NPS account. They allow you to withdraw say 50% of the amount and the balance has to be invested BACK in an annuity. Let us say you ARE FORCED to invest Rs. 250 lakhs in an annuity which pays Rs. 11,000 per month as a pension…looks good? Well depends on what you are capable of doing with your own money!

At this point of time, the better alternatives would be old fashioned products like Post office monthly schemes , Fixed deposits with monthly payouts or even senior citizen savings scheme. these all give near inflation returns atleast .

3. Rigidness and no flexibiity

Almost all the pension products are rigid in taxation and what you can do with your money at the end. Under current laws you can withdraw only 1/3rd of your accumulated money tax-free, where as there is long term capital gains at the moment is 100% tax-free. Also it’s compulsory to buy annuity for the remaining money. What if I want all my money for some reason at the end? What if I don’t have a requirement for income later?

These problems won’t be there if you accumulate your money in plain vanilla mutual funds or PPF or other simple investment products.

4. High charges

Who does not know how ULIP’s and other similar products have charged so high costs for initial years without giving clarity to customers. These annuity plans also have high allocation charges many times and customers do not know about it and can’t do much later when he acknowledges it! So why do you want to pay high fees for these products?

Conclusion

It’s suggested that you invest in some instrument which does not have any rigidness on what can be done with your investments at some later stage, like Mutual funds, Direct Equity, PPF, Index Funds, Real estate or even old fashioned products like FD, NSC, KVP… You can create your own accumulation stage and when the time comes for “distribution phase” (pension), you can always buy some immediate annuity plans or create your monthly income through ways of renting out property, getting FD interest or plain dividends from stocks or any combination of these. I hope you have got a fair understanding of what are pension plans in India.

October 11, 2011

October 11, 2011

Kindly provide me your opinion on Tata AIA insurance plan. My bank relationship manager is pressing me to take a pension plan scheme from this insurance provider. Is it a reliable firm to invest your money..

If its a term plan, you can take it , else not

Thank you.

My understanding it is a term plan. First 12 years you have to pay premium. Next 12 years they are promising guaranteed sum yearly.

No , its not a term plan then ..

Hi Manish,

I am 33years of age and working in pvt. company. I want advice on a good pension plan. Is HDFC personal pension plan a good option to go? pls suggest.

Do one thing , register your name and email here and my team will call you to discuss on this

http://jagoinvestor.dev.diginnovators.site/solutions/buy-retirement-investment-product

Hello, I am 29 yrs old and works in a Private org and earns well. I have no as such pension/mutual fund. Thinking about a plan where I can invest 5000k per month and should get returns from 45-50 age. Plans with Less impact on Market fluctuations is been prefered. Can You suggest me some ?

Hi Manish,

What are you thoughts on Pension plan that gives guaranteed benefit and some variable bonus.

for eg – BSLI Vision LifeIncome Plan & HDFC Life Super Income Plan

I got some illustration of BSLI Vision LifeIncome Plan which claims for premium 2 Lakh for 16 years gives first return of 17 lkh on 16th year and then for rest of the life 2.40 Lakh( only 50% is guaranteed in this and other part is bonus) and in the end by 100 years or by death close to 32 Lakh.

On paper it looks good but what are your though on this.

THe litmus test is IRR ! ..

Calculate how much is the IRR of the policy ! .. POlicies use the language which sounds good to ears !

Hi Manish,

Thanks for the article. I have been paying premium for ICICI Pension Plan II maximizer from 2005. IRDA policy that buying annuity is must for Pension Plans apply to even old pension plans i.e. 2005?

I would like take lump sum amount when the plan matures.

Thanks in advance

SO whats the question here ?

My question – Is IRDA policy that buying annuity is must for Pension Plans apply to even old pension plans or it applies to only newer pension plans which are offered after annuity rules were announced?

I think all the pension plans have this component that some part has to be invested in annuity. Is it not written in your policy document ?

Hi Manish,

I am planning to buy a retirement plan for myself. I am currently 28 years old. I would like to generate regular income after 45 years. Can you please suggest me a right path for me to input my funds? I have read the discussion and came to know SIP is the best one compared to pension plans? Can you email me your opinions and we shall have a discussion on this.

Hi vivek

We can surely help you on this and also advice you , please leave your details here http://jagoinvestor.dev.diginnovators.site/start-sip

Hi Manish me too planning to buy a retirement plan for myself. I am currently 40 years old.

I have taken LIC Jeevan Anand Policy in April 2006 for ten yrs and it got matured last month. Now I have around 13 Lakhs rupees to invest for my future Financial life. I am Single and planned to get married later this year. My father is a pensioner and my mother is a housewife. I do Not have any Dependents on me nor do I have any financial liabilities.

I request you to kindly share me the best Retirement policy. I want to invest my LIC policy maturity money in that for my family future needs.

Thank you and Best Regards,

Raja Duddilla

Do one thing , fill up your details at http://jagoinvestor.dev.diginnovators.site/solutions/invest-in-mutual-funds

And mention to my team about the retirement plan, they will help you on that !

Dear Manish

Thank you for the prompt response

I will update my details in the link provided by you. But currently i am not able to Login into JagoInvestor.com because I am not able to reset my password through the link i got to my email. I will respond to you as soon as I am able to Sign into JagoInvestor.com. I will mention to your team about the retirement plan.

Once again Thank you for your reply

Best Regards,

Raja Duddilla

Just enter your details in the form, that should be enough.

Dear Manish

I have entered my details in the Mutual Funds Account form and I got confirmation mail from Nandish too.

Thank you & Regards

Rajashekhar

Dear Manish,

Good article, Thanks for all the information.

Recently I have started looking for some retirement / insurance plans which can life cover within and after the premium. I found 1 interesting plan, BSLI Vision life insurance.

I am not really aware of each nity-gritty of these plans. Each company provides their different options.

Need your expert opinion, also need your help for better instruments for maximum returns.

Thanks

Anshul

Dont go for these plans .. we suggest investing in mutual funds ..

We can help you on that . See http://jagoinvestor.dev.diginnovators.site/start-sip

Hi we r planning to take pension plan ,can u sugest what will be best plan for me ,my age is 37 year,and private jobs in missile mangment,

We dont think you should go with pension plans !

Hi manish ji,

I am 28 years and i want to invest 3 thousands per month for now and my main moto is to get good return in future so can you please tell where to invest and in which scheme i should invest please help me with this.I want to know specially the SIP plans for Mutual fund.

Thanks!

Hi rima

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

Hi rima

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

ManishHi rima

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

Hello. Very informative for a layman like me. Iam willing to invest appx 5-8k every month for next 10 years. I was looking for a pension plan, but Iam open to better suggestions. Iam only worried that my money need to be secured. Please suggest what do I need to do? Is Reliance good? Or should I go for SBI/LIC.

thanks & eagerly awaited.

Nilav

Hi Manish,

Thanks for such a detailed explanation and its very useful.

I am investing Rs : 15000 yearly in “HDFC Savings Assurance Plan ” starting from 2011 for next 10 years. Please could you confirm, its good to continue investing money for next 5 years? or better to surrender (?) and move to SIPs.

Waiting for your response.

Regards,

Savin

Sir i am 26 year old . I am working in psu .

Nps is available here.

Nps is not too good…

Sir how much money i invest in pension plan or which company

You can rather invest in SIP in mutual funds to build your long term wealth

Please contact us incase you need help on this.

@ Manish – what is the best investment at the age of 52 to secure my retirement age. Mutual funds or retirement plans?

There is no one answer to this . Mutual funds can be surely used as the investments for setting up retirement pension .. Even retiremnet plans can be bought for that.

Dear sir very nice n informative article abt pension plan. It clear all my dought abt pension plan. Thank 4 ur article

Glad to know that Rahul ..

I AM 40 YRS. IN GOVT SERVICE . COVERED NY NPS. BUT MAY NOT CONTINUE THE JOB. SO I NEED AN INDIVIDUAL PENSION PLAN PREFERABLY TRADITIONAL ONE. CAN INVEST AROUND 1 LAKHS IN AN YEAR. SUGGEST A FEW GOOD PLANS WHICH WILL GIV GUD RETURNS AFTER 15/20 YRS.

You can look at pension plans from HDFC . Let us know if you want us to schedule a call for you with HDFC on this.

Dear Manish. Currently i am working in gulf. I am 42 years old. I just joined in zSBI life retire smart pension plan. Half yearly premium of 3lakhs for 5 years. I will start getting pension after 10 years. Lock in period is 5 years. Do you think it is better option than bank FD for my retirement

It depends on how is the performance of the fund till now. What is the IRR Of the fund till now ?

I HAVE ICICI PRU IMMEDIATE ANNUITY PENSION PLAN YOU ARE REQUESTED TO SEND PRESENT ANNUITY RATES WITH OTHER DETAILS. MY DOB IS 5/11/1942

I WANT TO INVEST RS 500000.WHAT I WILL GET PENSION YEARLY/MONTHLY

IF I SELECT, ANNUITY OPTION LIFE TIME WITH RETURN OF PURCHASE VALUE.

THANKS, WAITING FOR YOUR FAVORABLE REPLY.

WARM REGARDS,

PARMANAND JETHANI

Hi PARMANAND

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hello sir ,

Did u aware lic pension plan..with return on purchased price?

I am retiring next year and working in a gulf country.I am 60 yrs.

Hee Manish

Which is the best way of investing my gratuity amount when I retire for future. It will be a good amount.

Immediate annuity with a one time premium or 5 years premium for monthly benefits.

or do you advice any other option .

regards

Joseph Mathew

Hi Joseph

We generally suggest creating dividend income from mutual funds and combination of FD. I think you should discuss this in detail. We can help you with your retirement planning if you feel thats a good idea. You can look at our service for that – http://www.jagoinvestor.com/services/financial-planning

Hi Manish, Now i am 42yrs old and would like to get 40k /month as pension from 52yrs age. Please advise which is the best product can be followed and also review about the SBI-Life-Retire-Smart-Pension-Plan.

Thank you Vinu

You should do an SIP in mutual funds to build a corpus for that. I do not recommend going with the pension plans .

Hi Manish,

Thank you for the advise.

Hi Manish,

First of all Thanks For Financial awareness campaign. I am 30 years old. I want to invest 5000 PM. I have already a SBI Life yearly premium of 50,000 per year. I want to get at least 15,000 PM as pension after 50 years. Please advise which financial institute or mutual fund will be better for me to achieve my goals. Also please suggest if I can continue the SBI Life Plan.

Thanks, Rashmi

Yes, Mutual funds are a good choice to create a good corpus and get pension from that

Dear Manish,

I am an NRI presently working in gulf I am 46 yrs and planing to retire by 52 ie 6 yrs. I have recently constructed home and rent out a portion for 40kpm. Also I have FD of Rs 50lacs. My kids are in grade 9 and I would like to know howto

Hi Sid

Looking at your query, I think your case is complicated and you should discuss and consult a financial planner, because just a random answer will not help you at all.

If you are interested, I suggest you look at our financial planning service also and fill up the form there to have initial discussions

http://www.jagoinvestor.com/services/financial-planning#fill-form

Manish