Importance of your Child’s Education plan in coming times !

So, what’s your biggest financial goal in life? Your Child’s education? Their marriages? Planning your own retirement? What is the strategy you’ll follow to reach these goals? What if I tell you that in the coming times, your way of looking at these goals needs to change?

You can’t look at goals the same way as your parents did! The lives & times of our parents, ourselves and our children will have lots of differences; difference arising because of the way our society and economy changes from year to year, decade to decade.

Let’s question the beliefs we have about some financial goals in our lives, how we should change our way of looking at them and planning for them. I believe this is really important; important enough to cover this over a series of articles. This is the first of a 3 part series and we will cover Child Education in this series.

Let me start from basics. Here’s how typical financial planning works in India. A financial planner captures your situation, helps you define your goals and then he plans for how those financial goals should be achieved. Take any financial plan and topmost goals are

- Retirement Planning

- Child Education

- Child Marriage

For years, traditional financial planning has been going on like this, & no one questions the way we plan for these goals and how much importance we give to these goals in our life. Note that these goals take up a good amount of your monthly investments and you end up with less money each month!

How will you feel if after 2-3 decades you realize that you shouldn’t have worked so hard on these goals?

How is Child’s Education Planning done in India?

Right now, almost every average India plans for their child’s education in an unstructured way. They just put some random amount in some generic financial product, without understanding how much would they require at the end, when the goal actually arrives.

The amount of investment done is guided by the potential of a person or some whole number like 5,000 per month or 10,0000 per month.

Normally Financial Planners will take a better and more structured approach to plan for your child’s education. They would first take the amount required for funding education in today’s world (this is often given by you).

They then, take the target date of the goal (for example, 25 years), assume an “education Inflation” to figure roughly how much education could cost in the future, plug-in other important factors like “regular inflation”, “Your earning potential”, “Increase in your investments each year”, “you risk appetite” and some more factors to figure out the amount of money you need to invest monthly or yearly to reach that goal.

There can be many variations to plan, but this is how most of the financial planners plan for the child’s education goal.

Watch this video to know the best investment for newborn child’s education:

What’s the problem in child education planning?

The problem is that we have taken into consideration changes like inflation, costs, etc., but not considered other factors like how these goals will look like in the future. Whose responsibilities will be it seen as? Who will be responsible for taking care of funding the education costs?

Will it be the parents, the child, or both – the parents and the child?

Planning for child education is not just dependent on the numbers, rather it’s a combination of a number of factors; social, personal beliefs, religious, your way of approaching & looking at life…

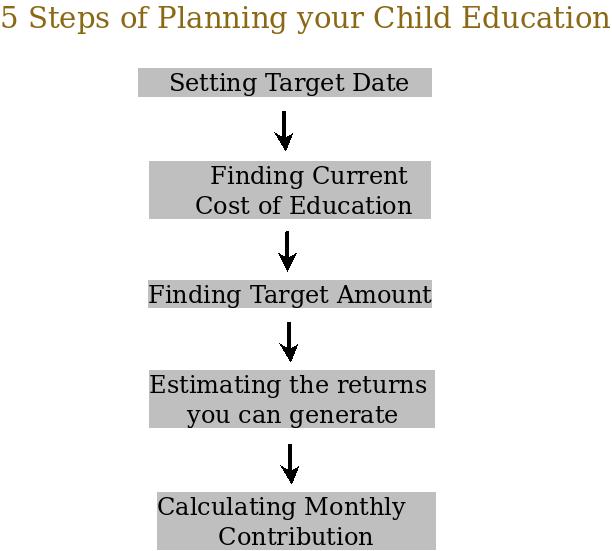

In the image given below, you will see the steps of a child’s education planning:

If you are a person who has seen enough hardships in life and have taken care of yourself right from the beginning, you may believe that your duty as a parent is to provide minimum support to your child, up to a certain basic level and they should become independent, sooner or later and that their life is their headache, not yours.

As far as our society goes, earlier providing a great education to children was seen as a passport to a good retirement, because you do your duty of providing support to your child, and in turn, he completes his responsibility of taking care of you in your old age.

But friends, the times are a-changing! Gone are those days and people and relations are going farther and farther. Even in Health Insurance, family means immediate family (spouse and children), not parents.

We are entering (or have already entered) an era where parents will provide for their child all the necessities up to the age of 18, then consider him or her, “self-dependent” , and then expect him/her to make their own path in life.

So the question which we are trying to answer here is, Is “Child Education” so important in today’s life? Or more, will it be so important after 2-3 decades? I don’t think so.

Change in social trend and our thinking

For years, it has been the parent’s responsibility to save money for their child’s education. His grandfather saved for his father, his father saved for him and now he saves for his children.

But will this chain of “responsibility” be the same always? Will, it always be the sole responsibility of the parent to save for his child’s education and in case he fails, is he or she a bad parent?

In 70s and 80s , it would be a really, deadly shock for a child if his parents told him, “Listen, we as Indian parents know that we should help you with your education, but sorry old chap! We can’t! We would rather prefer to keep the money we saved, for our retirement. You go right ahead please, & find some alternatives to fund your education. You can live in this house till you find another one.”

The child would have gone straight into a coma after hearing this! You would also be shunned by friends, relatives & society at large and labeled as an unsupportive and bad parent because you didn’t do your duty!

Education Loan is the new tool for self-funding

In the new India, it’s not a big thing to hear that someone is doing his studies with the help of an education loan. The trend is not really new, but it has started gaining popularity only recently in the last 10 years or so. SBI was the first bank to start giving Education loans in 1995, but it was not really sought after much in those times.

Only now, do we see increased awareness and a shift in parents’ mindset that “It’s fine to take education loan.”

Even so, taking an “Education Loan” is the last option for most people, rather than the default choice of parents and children. Parents do everything they can do to fund education and only if they fail, do they opt for a loan. It’s still not seen as the best option to fund education by the majority of the population. (though this is changing)

More and more people are opting for higher education after a first job, It’s not uncommon to hear people pay back an education loan EMI while they’re working, so you can see the trend emerging now. It’s only going to grow bigger and bigger and take a big shape.

Some Stats

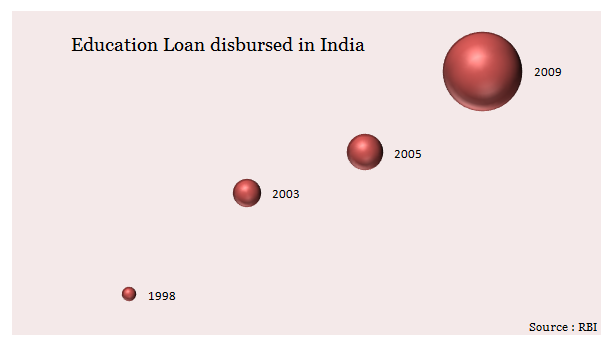

There is a steadily growing market for education loans and govt is also encouraging and setting better targets. Banks had given Rs. 35,000 crore in education loans last year. The government has set a target to increase the amount in education loans to Rs122,838 crores in 2017 and Rs1,66,541 crores in 2020.

This would help increase the enrolment ratio from the present 12% to 30% by 2020. (source) .

Here is the chart which shows you the relative size of education loan disbursed by banks and you will be able to see the fast growth. Given the number of youth our country has, there is a huge demand as well as supply for loans.

As per a survey, 81% students would like to go for education loans if they are eligible for it. Only 2-3% of Indians apply for education loans compared to 85% in the UK and 50% in the US (2005 data).

Don’t stress a lot on Child Education

The motive of this article is to give you some idea about future and how child education will look like. This article is not discouraging you to save for your child education. The only point is that you can take some of your tension away from it, atleast partially. In the coming times, there can be more important goals in life, which needs more priority.

If you are an earning member of your family and feeling the pressure of creating a corpus of several lacs for your child after 20-25 yrs, I would suggest lower your tension! 🙂

While you can still save and plan for that goal to fulfil your “kartavya” as Indian parent, I say, don’t worry so much. Your target amount might be correct, but don’t worry, the India of 2040 will not ask you to fund 100% of your child’s education. If you even save for 50% of what you have planned, rest would be funded by education loan.

Don’t become slaves to numbers! Understand and be with the changing India! Focus on some things more important in your life! We will talk about these in the last article of this series.

Please share your thoughts about this topic? How much do you agree with this way of thinking about a Child’s education?

Disclaimer : All the thoughts are purely authors opinion and does not reflect the opinion of financial planners.

February 27, 2011

February 27, 2011

Thanks Manish !!

I have RDs and Balanced funds investment setup done.

Hello,

Looking at all these postings made it clear that it might be a better world for new parents or rather yet to have kids…

What is the investment strategy for parents like us whose kids will need money after 7-8 yrs . Also every year the so called good schools are costing us around 175000/- every year per kid..how to cope up with this?

I think now as the time is just near by, you do not have option to put very small amount . Its more of nominal returns you will get like 9-10% on your invested money . I can see RD / Balanced funds as a good option to you now !

Manish,

Very good article. Your article reinforced my thought process vis-à-vis role of child education in retirement planning.

Without belittling child education loan difficulties people have now, we did face similar problems 25 years back getting a house loan. Things have changed, and I believe, similar changes will happen with respect to child education loan in the coming 5-10 years.

Very practical and futurist article!

– Pavan

Pavan

yes , I am of same thoughts 🙂

Manish

Very well articulated . . . . thanks a lot for the “New kind” if idea

Regds

Amitava

Navi mumbai.

Amitav

Thanks , keep reading and share it with more people

Manish

Manish,

I do not agree with this article 100%

education is the best gift parents can give to their children. this article is trying to prove benefits of education loan for child as it work in western countries education system but please understand india is far different that that. Our political, cultural, social env. is totally different. There are not many graduate or post graduate people in country like USA. There are plenty of people in US i know who like the concept of education loan and give examples of india where parents support major part of child’s higher education.

many of them work in McDonald or dunkin-donuts shop and forget the education.

we need to think many times before copying something from western culture. first understand weather its really proven method or not and then copy.

lets not just blindly copy whatever western world does…respect and feel proud of what we have

thanks

jitesh

correcting one mistake

“There are plenty of people in US i know who DO NOT like the concept of education loan and give examples of india where parents support major part of child’s higher education.

Jitesh

Thanks for your comment . Not agreeing is fine . Its the way we think about certain things . Also note that you have not taken the message from the article , which is not “Stop saving for child educaiton” , Its more about “Think about how it would look in future and if you see logic in it, partially fund your child education and start investments for other important goals in life which we will talk in 3rd series of article” .

There are many who agree to the concept and you can read them above in comments section and there are equally lot of people who disagree and both feel they are right .

So I would consider it as a personal beleif and how you take it . If you dont , thats fine . After all you have to be happy with what ever you are doing .

If you talk of examples , there are enough stories discussed about to talk on both sides of the coin .

What’s your take on that ?

Manish

Here is an article about the subject from someone more experienced:

http://www.subramoney.com/2011/03/finished-education-no-job/

Herge

I read that one actually . Is it not a different topic ?

Its related in the sense that education loans are not for every child. Its for strong-minded independent enterprising kid who has even if jobless after graduation and a debt already to boot still keeps his/her nerve and gets out of it.

This requires pretty good parenting! This is why I keep saying this is an extremely complicated issue.

I am seeing many guys who don’t save a penny upto their marriage & calls their parents to buy essentials/minimum req’s for a house after getting married. But here u r talking about funding education from own pocket/loan. Hilarious 🙂

Praveen

my god , thats extreme .. After a job , if they ask I can still imagine , but after a marriage if they ask , I am just wondering how irritated their wives would be on them ! . However this is extreme cases and I can tell you exactly opposite cases aslo .

manish

My specific objection is to statements like this

“What if I tell you that in the coming times, your way of looking at these goals needs to change?”

This is a fantastic statement made without proof.

If you are only giving your opinion then I feel the tone of the statement is incorrect. Your blog is one of the most popular and is well-read. You don’t need to make a special effort to sell your article. All your articles written with facts are informative enough and sell on their own even with dull English.

The only statistic in the article is increase in student loans. As someone above pointed out this can simply be because current parents haven’t saved enough to tackle inflation.

There seems to many who think that Manish can so no wrong and what he says is right. A stronger disclaimer must be provided for these guys when you make such statements.

Kumar

Ok , I take that . I might have to think again while giving statement like that . Btw, there are enough critics on the blog who dont agree with me , and I encourage that should happen . Even with this blog , one has to come , read and then take the best out of it , something which adds more value to them .

I personally think, that people of this generation are becoming more and more dependent and think that they should start supporting themselves after a certain age itself . And higher education will be on those lines .

I also wrote at the end that its my personal view and not a general view , Are you saying a seperate disclaimer page has to be there of this statement?

Let me know . Also share your views how do you personally see this goal after 20-25 yrs and what expectations parents , children and society in general will have regarding children education ?

Dont you think that dependence on parents for funding higher education will much more than today or past ?

Also do you think that in future instead of funding all money for higher education , its better for a parent to give a loan to children , You can read Sundar’s comment above to see an example why this is becoming more important in some cases .

Manish

Its difficutl to strike balance between theory and practical. Colleges are cgarging fees like anything and that too without reputation. What if child is not able to secure job after degree or satisfactroy job after degree? loan will kill him and his parents. very few educational institutes are there which guarantee job after completion of course, rest we all know too well. I would not suggest completely bankfinanced education.

SS

thats fine , its more of what beleifs you have about this area . There are many who think it is the right way , so its a personal choice

Manish

“so its a personal choice”

If you argue like that then everything is a personal choice. One can say I wont plan for retirement because its my choice and I will somehow manage.

Many come to jago investor for facts and figures. That is missing in this article. Your own opinion may change after you become a father.

Speculative guesswork for such a complicated problem is dangerous.

Kumar

There are facts and figures in the article . All anyone can do is to give one facts and figures and what one feels about it . Not everything can have a “right” or “wrong” answer and this is the same kind of topic. If you look at the article it clearly shows you that. The reason I said its a personal choice because you read the rest of the comments ,there are two class of poeple who think completely opposite about this topic , now who is right and who is wrong ?

So As a blogger I am just trying to initiate the conversation and how I feel about the topic based on my understanding , If one sees some login in it and feels that its worth taking . One can go ahead , else he/she has go as per their beliefs and how they feels about a particular thing .

This is not a topic like “Asset allocation controls portfolio risk” which can be proved with numbers and same conclusion everytime .

I would suggest you concentrate on the gist of the article and what its trying to convey , If you feel that the article is conveying “stop saving for child education” , its not the case. I would suggest re-read the article and read the conclusion part again .

Manish

Hi Manish,

Was under the impression that financial planners as a rule, love to create a fear psychosis in the minds of investors by putting huge numbers to be acheived as targets for child’s education, marriage etc and benefit from it by asking them to subscribe to schemes particularly by appealing to sentiments than rationale.First time I am seeing a article that says something different.Keep up the good work.

Hi Manish,

Great post. i appreciate your effort in writing this “controversial” post. and i completely agree with you on this.

however, there are some aspects which one needs to think about before turning slightly carefree about not planning “completely till last detail” for child education. one needs to really think if s/he as a parent will be economically well-off to guarantee the child’s education. i can tell you from my own example – “myself & my father failed to secure an educational loan for my MBA”. i had to borrow money at 12% from one of my relatives & paid him back in cash. the point i’m trying to make here is its the parent who needs to be clever enough about whether the parent would be in a position to secure a loan. s/he may not be able to say this with 100% probability. but s/he can always secure the education by term insurance & plan it well enough that the child reaches a state where child him/herself can take it further from there. and for this to happen, the “upbringing” has to have lots of non-monetary aspects to take care of. these days parents really feel that their “children are not capable of anything & take toooo much care”. they forget that most children & atmosphere around them makes them smarter rather than dependent beyond a point.

planning minutely is going to have only incremental benefits. its more about “being responsible with money & investments” that is needed.

—

Santosh

Santosh

You have echoed the same thougts which I had in mind , may be I was not able to put in properly as many have taken it in negative sense . A lot depends on that way of your thinking .

Manish

increasing education loan takers may simply mean the present parents did not save enough to match increasing education costs. Also students have to study more these days to get a good job. This cannot be taken as evidence that students want to decrease the burden of parents.

An educational loan may save your retirement corpus. It will however affect the retirement plans of your children. When they start earning they need to pay an emi for a few years which will cut into their nestegg plans.

As a parent I would either save separately or even use part of my nest egg rather than let my boy start his life in debt.

Speculation can never be good advice.

Herge

“Also students have to study more these days to get a good job.” thats partially true . Times are changing , more than college degree or educaiton one has to concentrate more and more on his ability to talk , communication and concentrate on his soft skill these days and will it be true in coming times . http://www.subramoney.com/2011/03/times-are-changing-your-thinking-has-to-change-too/

Manish

Precisely. Which means you need to take courses for that too, which means more fees.

Today loans are offered @ ~ 12% which will take anything between 5-10 years to clean up. Unless the child earns significantly this will be difficult. Standard undergraduate courses do not offer that kind of salaries. It is a vicious cycle. More salary require more education. More education require more loan. More loan means longer to settle. Longer to settle means less savings for the child.

Unless loan rates drop by half to about 5-6% the scenario you have talked about is shortsighted.

The Indian economy is not an independent economy. No one can predict loan rates will fall that much.

In the last 10-15 years rates have only increased. So it will take a long while for a significant fall to occur. So I am not convinced.

Herge

ok , Agreed with you , so what according would be the scene in coming years , say 25 yrs from today , what are your thoughts , Cant parents atleast part rely on education loans in future ? Or do you suggest one has to save all the money themselves ?

Manish

As you once pointed out education is becoming costlier @ 10 per annum. So unless the right kind of investment is done a parent will be forced to take an education loan.

Loans will become easier to get only when they are re-payed regularly. Most industries and individuals are still recovering from massive layoffs in 2008. If this repeats every 10 years (and such a scenario is indeed possible) then banks will find it difficult to make norms easier for getting loans and decrease interest rates.

My point is its an extremely complex problem depending on several factors.

Hoping to get a loan for partially funding education 2/3 years away from entering colleges is okay because you an make a good estimate of fees how much one cane spend from pocket etc. If the goals is several years away I think hoping to get a loan for more than 50% of education cost is dangerous. If one cannot qualify for the loan then one will be forced to take a personal loan which is financial suicide.

It is not a good idea to start a child’s salaried life in debt.

People who say we should follow the American system are again short-sighted. The average American spends more than he earns. He has all sorts of debt. This culture is on an absolute scale bad.

The bottom line is parents should actively think about child education even before they are born. In fact it is important to become parents only after a certain level of financial independence. They should actively change their lifestyle and perhaps their job to ensure they at least partially fund the education.

personally with a frugal but satisfying lifestyle I save 50% of my gross pay: 30% goes to retirement and 20% towards child education. As of now according to my calculations I will be able to fully fund my childs education (two degrees) and have a little extra which will be diverted to my retirement corpus. But thats todays estimate. Who knows what will happen tomorrow.

Constant state of alert, thought and use of commonsense. That’s the key in my view

Herge

Its good that you are not compromising on your retirement and able to save both for retirement + educaiton of child , my point is the same , you have to first concentrate more on retirement , and then other goals .

Manish

Hi Manish,

Thought provoking article. However, on a lighter note –

Looking at the money schools are charging for primary education these days, I dont think we might have to wait until the child finishes his 10+2 or graduation for taking a loan. For only one year of primary education, some schools in Hyd are charging more than what I spent for my entire education up to PG . In the near future, one might have to start looking out for a educational loan as soon as the child is born to pay their primary school fees. 😉

Regards,

Arudra.

Arudra

I am still not there 🙂 , You know better how much schools are charging .. Better i stop this blog and open up a school ! 😉

manish

Many comments were in disagreement to this topic. But things are changing and this will be the norm in 5 to 10 years or little later. Say, how many college students were working part time 5 years back? Now not all of them but many of them are. Dating, living together etc.

Kids wanted to be independent in everything even at the age of 10. Our kids copy everything from the US. So let them do the same in funding education too 🙂

Dominic

Exactly , thats my point !

Manish

Hi Manish,

A bold article that might invade in the personal space of few. Our generation is carrying the twin burden of our own retirement planning and fully funding the child’s education.

Smart

thats a good point , our generation is carrying the twin burden. so true !

Manish

Hi Manish,

A different theme from the articles you had written earlier.

Still feel that under pressure and targets you can achieve lot. Target for child education and you can use the same for other emergencies if required.

Regards

Atul

Atul

In that case one can always save for emergencies as such . Agree with you that ultimately it can be used later

Manish

@ Manish,

By this theory of taking Education loan then there is no need for Retirement planning also coz at that time the Reverse Mortgage System will be common thing.

And if i take a Flat of Rs. 60 Lacs then it will be Rs. 6 Crores at that time (say after 30 years). Taking retierement around 65 years or so.

And also there is no need for Child Marriage Funds or Plans coz at that time say 25 years from now our Childs will marry according to their Choice and may end up marrying in Courts. So no Expenses like it is in today sceneriao.

That’s why people live in today and forget about future life.

I rememeber this Song from all this Article I read,

“Kal kya Hoga kisne dekha abhi Zindagi ka lelo Mazzza”

And people are foolish investing in SIP’s and all other investment products

-Vinay

Vinay

No , Retirement will be very different , it will have to be taken more seriously , There has to be some trend of reverse mortgage getting popular or a common way of funding retirement . Also just reverse mortgage wont be able to funds the whole retirement . unlike child education (Masters) retirement is a long term goal which takes another 20-30 yrs .

Also Child marriage , what you have mentioned has become the trend even these days and in future it would not get worse or better , depending on how you feel about it . For me its better .

At the end , the motive of article was just to communicate that people should shift some of their tension on education loan . It does not suggest that you just forget about the goal .

Manish

@ Manish,

I made comments on the Future and Consistency of One’s life. You raised the issue correctly when cheaper and tax benefits Eductaion Loans are available then why thinking of the Child Education Plaaning.

But one must consider the other TWO Goals which I raised seems also useless in future. The reason for the same are mentioned. And in INDIA 99 % people will follow that coz they are not planning now for future goals.

Only the goal one must set is the Emergency funds should be enough to cater the problems arise due to unseen circumstances that cum in one’s LIFE. Because we can think and evaluate for next 3-4 years only beyond that its not possible.

Not exactly useless , Retirement I think will have to be funded in a better way that today , shifting of focus from education of children to reitrement is suggested

manish

Hi Manish

Eye opener article.

What we have to focus is for a safe retirement life with out depending your children.

Reason: Culture is slowly chancing in India too and we may see our childern are NOT going to support in our old age life.

Also I think that marriage corpus should not be in our high priority as Rakesh mentioned “I have seen people getting married on a Friday and coming to work on a Monday.” Soon in India also this will be common and marriage corpus importance will go down.

I guess the Marriage Survey is your ground work for your next article and we are eagerly waiting for it !!!

CT

CT

Yes, I agree with you . Thanks for comment 🙂

Will be publishing the article on marriage soon

Manish

Manish

Thanks for your bold views. Because you have not used SOFT words, it attracted. For prudent saving person, your words will relieve tension. For any parent with kids, child education is the most attractive thing for saving. Let that MANTHRA force him to reduce his expenditure, forcibly and save for his kids. If the reader is not prudent, your article may spoil the future of the child. It is not the fault of your article.It is excellent. If you permit me, I will quote you and your blog in my second book( Money purse 2- Sramaleni Aadayam) on personal finance in Telugu. We must give equal importance to child education and retirement planning. House with rental value is best retirement plan, I wrote in my book. This will solve child eduction need also. If required we can mortgage house and take education loan. Let that loan be repaid by child and leave the house which gives rent to the father.

Vanga

In todays time, parents who are “over enthusiastic” about saving all their savings for children education will cry blood in their retirement years incase their children dont support them .

Giving child education a high priority over own’s retirement is recipe of disaster in future India . There is nothing wrong in funding child educaiton , but there has to be balance .

I would be happy to get quoted in your next book , It would be honour 🙂

Manish

Manish:

I fully agree with your views. I have a live example in front of me. Retired father spent about 33 lakhs for his Son’s education in India and in USA. Son, sensing easy money, did not care to get a bank loan. He got a job in US and with starting salary of USD 80,000 p.a. After that he forgot his obligation to return back the loan saying he did not sign any papers. Father is now crying foul as he has retirement saving of only 25 lakhs and he is 65. He is going to court against his son. But his Lawyers told him, sorry you do not have any evidence that the money you provided to your son was a loan and not voluntary. His son is making several excuses. Unfortunately even legal notice he managed to send his son in US was not acknowledged and returned “addresse not responded”. My sincere advise to all readers is be careful. Draw a proper loan agreement if you want to fund your ward’s higher education. If not you will be in a fix. Your bank transfer documents is not enough. You should have proper loan agreement.

Sundar

Thanks for giving that example ,while that example does not reflect the general trend, still I am in agreement with you.

These days as you said one should be lending the money to children rather than just showering it on them . this was a great point .

Manish

Manish,

Very informative article.

My take is that more stress to Child Education & Marriage is give in our country only. In most of the western countries children are given basic education by their parents and they themselves fund their post-graduation courses.

Marriage is mostly a low-key affair there too. I have seen people getting married on a Friday and coming to work on a Monday.

Rakesh

Rakesh

Yes , thats what I am trying to put in the article , that our culture is also on the way to be same as west , atleast in how education is funded .

I like your point ”

I have seen people getting married on a Friday and coming to work on a Monday.” .

I have heard worse , people taking half day for marriage , can be beleive that ..

Manish