Why every investor should create a Personal Finance blackbox ?

How many different types of information, do you have stored in your head, relating to your financial life? Your PAN? Your policy details and where they are stored? That fixed deposit, which you opened up some years back? Maybe, you’ve kept the documents in the top cabinet of the red almirah, but no one has any clue about it! And if someday, God forbid, you die suddenly, and your family needs information in a hurry, where do they look? Where do they go? Yeah, eventually, they will figure it all out, but only after a whole lot of time wasted (weeks, months, even a year!) and a lot of heartburn! Why not create a better situation for them ?

How about spending a few hours to make an emergency kit which has all the info, they might need at any point of time, so that they don’t have to get frustrated every time, they figure each investment / insurance policy, home legacy? Isn’t that a great idea? Here’s an example. Just to find out how to get the insurance claim settled, they have to start from scratch. They will start enquiring with others, search the internet (if they know how), and various other means. They might not have a clue that whom to contact and what options they have. Won’t it be the better, if they can find everything directly from you? TODAY? The kit is a kind of ready-to-use first aid box, only it relates to your overall financial life. Handy dandy for your family, if you’re disabled or immobilized or… dead! What normally, would take many months for them to find out – by playing connect the dots – can be given to them before hand, ready made & beautifully packaged! 🙂 This might seem embarrassing to many, but bluntly out, you choose!. Minor shyness / embarrassment now, or huge problems & inconveniences to your family later. Note that this whole emergency kit making will not help you today much, but a lot to your family at some later stage, read this article

What all details you can have in that kit?

- Important Details of your life

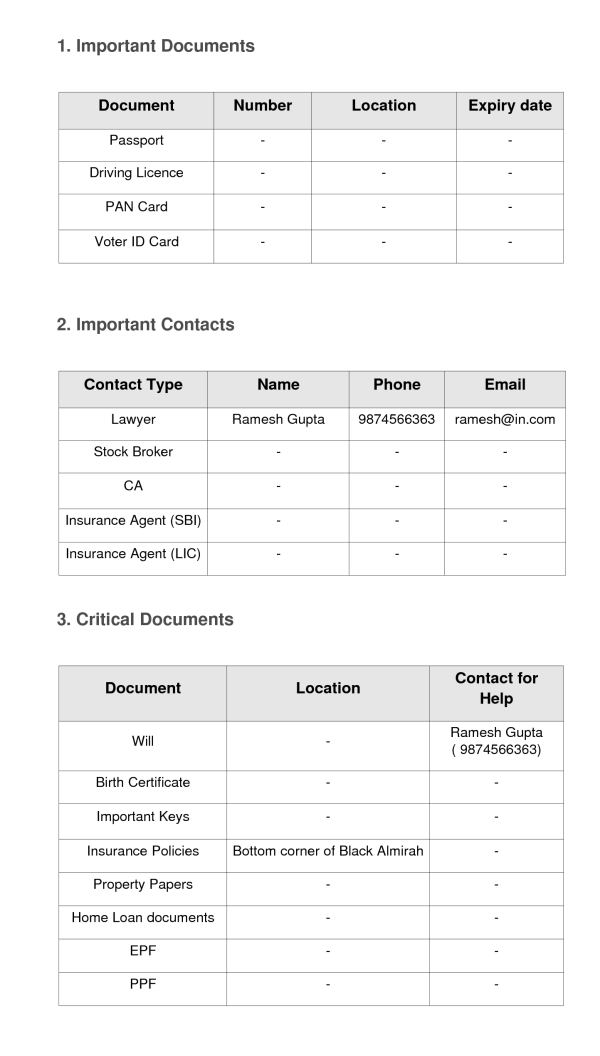

- List of important documents and their locations, eg., Passport, Driving licence, PAN etc.

- Important instructions for them to carry out, once you are dead. Eg., insurance claim process, steps to selling off some property, claiming the bank account, investments etc.

- Important contacts, like the CA , lawyer, your stock broker and their details.

- List of all assets and liabilities you have

- All your investment and bank details

Following is the sample of how you can store that information in a tabular form.

Who should make this kind of Document ?

If your spouse and parents are financially literate and are from this generation who surf internet, know how to find out information somehow, you won’t fully appreciate the beauty of this whole exercise. I’ll bet my hat however, that that isn’t the case :). Most of the spouse do not take much interest in these financial matters . Ergo, you can see, how important this document can be for your family! This can turn out to be one of the best gifts you ever make them.

Ideally, you should make your spouse aware of this. However many wives/parents don’t want to hear about death and deliberately don’t pay attention. This document is especially for those situation. We must print it out and give one copy each to wife and one to your most trusted friend or relative. Also you can have this document stored in a Bank locker and tell a trusted friend about this fact that there is a location which has all the information which your family might need some day.

Important Instructions in the Document

Make sure, you mention all the things which you wish your spouse/parents/children to do or carry out.

It can be things like

1. Life Insurance claim procedure

Give them detailed instructions on what they should do to claim your Insurance amount from the Life Insurance company. It can start from contacting the agent, filling up the forms, making sure all the documents are in place, constant follow-up with company etc.

2. How to use your life Insurance money for future

Once they get money from your Life Insurance, suggest how they can channelise it into different instruments based on their understanding, risk-taking capability and the amount of ease you want them to have in dealing with those.

3. How to Break FD’s or redeem Mutual funds in case of emergencies

Put some details in, on how they can break the FDs or redeem the mutual funds, in your name, in case of emergencies.

Sample of an Instruction for Life Insurance Claim

Ajay has taken Amulya Jeevan Term Insurance policy for Rs 50 lacs cover. Ajay lives in Mumbai . He would write something like this.

Steps you should follow for claiming the Life Insurance cover money in case of my death.

I have a life insurance policy “Amulya Jeevan” with Sum assured of Rs 50,00,000. In case of my death, you should follow this procedure.

- Meet our Agent named Mr. Funsuk Bangdu and ask him for the claim settlement forms , incase he is not able to give it to you , you can download it from LIC website

- You should make sure you also have original policy document which I have kept at ________ .

- Make sure you have you proof of title like PAN , Driving Licence etc AND marriage certificate copy .

- Make sure you have taken my death certificate from ____________ which will act like my proof of death , this is Important ! .

- Incase I die in accident, also have a proof of accident, this you can get from police station or hospital.

- I have stored all the Medical treatment at ___________ , also keep with you just incase its required.

- Incase LIC asks for my employer’s certificate, I have kept it at __________ or you can also ask my friend Robert who works with me and can help you on this , See this article to understand how someone you trust can help you .

- Incase you face any issue in getting claim settlement, take help of Ombudsman whose address is as follows .

Shri S Viswanathan

Insurance Ombudsman, Office of the Insurance Ombudsman,

3rd Floor, Jeevan Seva Annexe,S.V. Road, Santacruz(W),

MUMBAI-400 054. Tel : 022-26106928, Fax : 022-26106052

Email : [email protected]Note : Worst case scenario — try to get help at jagoinvestor.com or contact Moneylife.com who can help you further in this regard!

This was just an example! You too, can mention detailed instructions for key things, which you feel can create issues for your family or where you feel they might get stuck because of lack of knowledge .

Download a Template

Now, this whole kit & caboodle won’t take more than a day, and it’ll be extremely helpful to your family and loved ones. And, to save your time and as my small New Years gift to you, I have created a template for you, to use 🙂 Just download it in any format (pdf , doc or image ) and fill it up .

Take Action today! Unless you take action, reading this article is worthless!. Share what you feel about this idea of creating a master document which would help your family in case of crisis. Do you want to add some more points which you feel i have left out? How much value do you feel one will add to his/her financial life by doing this? And aah… one more thing. Don’t forget to update this document every year 🙂

Bonus : Do you want to look at how our questions and answers Forum is helping VidyaSagar take his frist steps in personal finance ?

January 6, 2011

January 6, 2011

Good one and eye opening article. I am going for my black box guys 🙂

Hi Shailendra

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Eye opener !!!

[…] Do check out the link Here. […]

Manish,

I’ve put all the details in a document. I have also mentioned all the instructions. I am just unable to put in words for ‘How to use the life Insurance money for future’. I understand that it’s unique from person to person, but still, have you mentioned this thing in any of your articles? Please let me know, if I have missed something. With respect to the Nominee and not the person? I need just a basic template.

Regards,

Prasoon

Prasoon

I think a simple thing you can tell them is to put the money in FD with interest on quarterly or monthly basis ! . Thats all .

Hi Manish,

I was took Aviva term plan before 3 months on my name that time I was mention there as married status,but now my wife is no more and I am the windower.should this information i have to inform to aviva.

My nominee is my kid only.

Regards

Prashant

No Prashant

There is no need for this . All matters is your nominee should be around, just to keep things very clear – also write a WILL .

Manish

Dear Manish,

Really nice article.

I totally agree with you. If misfortune happens, in most of the case our family members does not known, where we have invested our hard earn money.

It is really advice-able to mention all the details of investment at one place which can readily available.

Thanks

BrijMohan

Yea 🙂 . Go prepare it !

Manish

Dear Manish

This is the second time i am writing you a comment. first time written for your ‘best term plan comparison’ article…… and now this time for above article.

Again i have to say Bravo !!!!!!!!! Welldone ….. you know i have made something like this – but not the procedure for claim. (newer concept i understood how imp. after reading ur this article).

Thanks …….. and yes you should know that i am following you for last one month only. Great ! Keep it up Buddy !

Regards

Arun

Thats great to hear 🙂 . Keep coming ..

Manish

Nice article.Thanks Manish.

Welcome .. spread the word

Thi is a great and helpful article. I download the template, and I’ll modify a little and fill it up. Thanks to Manish for providing such a useful personal finance first-aid kit.

Caribou

Good . just make sure you also share it with some trusted friend and put bank details also

Manish

Manish,

A wonderful job done. I am posting this after downloading the template(thank you 🙂 for making it easier), writing down everything and plan to gift it on the dinner table to the whole family.

Kunal

Just make sure you take safety measures, you can divide this document into two parts , first part can have insecure data, which even if some other person gets can not do anything , that you can make some xerox and put at different places .

the second part can have some data which is critical and you might not want any person other than your family to know about , just let your parents and spouse know about where you have kept it

Manish

Sure, that would be a nice thing to do!!

That’s indeed a great post Manish. I came back from vacations and read all the stuff you wrote along with comments and delighted again 🙂

I’d be doing this very soon, writing down essential credentials on paper, documents, receipts, passwords, numbers and storing it in Bank locker and keep its updated every 6 or so months would looks good.

Many ‘daryadil’ folks lends money to friends/relatives without telling/forgetting mentioning it to family members should also include such details in master document 😀

–

Jagbir

Jagbir

Nice 🙂 . Just see how you want to store the passwords . You can do basic encryption for humans like reverse and shift by 2 and add 1 . something like this and tell to your spouse etc . make it easy

Manish

Manish,

Excellent.you must work really very hard to come up with such useful articles to help us. This is the perfect gift to be given to the spouse. We usually maintain all details in separate files and folders. But to create one single kit with all details included is a superb idea. Very nice indeed.

Thank you.

Anitha

Good to hear that you liked it . Now from your side take action and do it

Manish

Really good article, Manish.

Can you please through some light on the loop holes and the tricks that these insurance companies have. Just to make people aware about those.

For example: I am having a LIC policy (Jeevan Tarang) of sum assured 5 Lac and after reading your blog i decided to buy a term policy of sum assured 50 Lac. I thought, i am assured for 55 Lac, but the loophole with the LIC was that you have to add up all your policies, otherwise one will get the sum assured of the policy which is lesser among all the policies sum assured.

This may be looking awkward to me, but this is a point to note.

This is just one, add up if you know more !

If you have two policies, then your nominee should get sum assured in both the cases. If one is of 10 lakhs and second is of 5 lakhs then nominee should get 15 lakhs. It does not matter whether both the policies are taken from same company or different companies. This is my understanding.

Perhaps, while taking 2nd insurance plan, if that company is not informed about the existence of first plan then issues may come.

Where did you see this loophole?

Anand

Yes , there will be the issue ,as you are not disclosing the material fact to second company and it can have impact on their underwriting process (premium calculation) .

Manish

Kapil

In life insurance , you get the total sum assured always , so if you have policy for 5 lacs and 50 lacs, you WILL get 55 lacs. How told you that you get minimum ?

What is meant by “you have to add up all your policies” ?

Manish

Hmm.. Somebody has misled kapil.

Kapilji,

What you have mentioned is totally wron g,some one has surely misled you or you have misinterpreted something you have read.

In case of death in your case if both the policies are in force your nominee will DEFINITELY get 55 lakhs plus the bonus which has accrued under Jeevan Tarang. Don’t worry be happy

Other than spouse, with whom should we share the data if children are small and in worst case both husband and wife leave this world together(accident)?

Arun

Some trusted friend or relative is another option . Or you can put the details in the locker , in the worst case some one will have the data somewhere

Manish

Nice article Manish!

Just wanted to add – What person should do with online accounts – Bank Account, Credit Card, Trading etc. Most of the IT savy people do things online, adding this to the above list will be helpful.

Note – But we also change online password more often.

Policywala

I think one should be updating this master document every year or so . Freuqent updation of online passwords is there always , but we cant make everything full proof 🙂

Manish

Agree with you 🙂

Hi Manish,

I am an avaid follower of your blog..I am now financially LITERATE because of you.

I am aware that you have posted some retirement calculator in your website,but i am looking for a detailed one,which gives

a)% on your savings(equity,debt )etc.

b)DOESNT have one single field for inflation,since inflation for food and education is different.

c)Customised fields for different milestones

Also cater to a situation,where after say 70 years of age, you can start breaking your FDs as intrest alone wont suffice with say 83 years as life expectancy.

Sorry,i am trying to write too much and thoughts are not focussed,but i hope you get the idea..

woukd be able to share any such calculator(or detailed spread sheet ?)

Ashish

Ashish

For now , I am not able to create it , but will try in future .

Why dont you work on the excel sheet like this and share with others , it wont be a tough job

Manish

Good article. But I would like to add the following additional security protection data for possible misuse in case of emergency.

1. Bank Accounts and online account access data (log in and Passwords)

2. Credit Card/Debit Card online access data to prevent misuse.

3. Online Trading access data and DP/Client IDs.

4. Mobile Phone online account access data.etc.

Sundar

I am not sure here . These data are unsecure and sensitive right ? Are you saying we should mention them in plain text in the kit !

Manish

One of the reputed financial planners answered the question” When is the appropriate time to make a will” by saying ” one day before you die………provided you know when or else when you create your first asset”

very well written and explained..

we tend to forget small things..

also happen to see this so thought of sharing with you all..

Customer going for a Ride!

Story of a loyal customer of Kotak Bank, who was duped for crores

In a shocking incident, a high net-worth client of Kotak Mahindra Bank was hustled into buying a dud product for a whopping sum of Rs2.27 crore, with the bank pocketing a cool profit of Rs1 crore in the process. The wealth management arm of the bank allegedly misled the investor into putting the money in its India Growth Fund, based on bogus claims regarding its worth and taking undue advantage of the brand name to influence the buyer. The investor’s repeated pleas to rectify the damage have fallen on deaf ears as Kotak officials refuse to budge.

For full story click on this link http://moneylife.in/article/4/12944.html

Manish,

Why you didn’t included Bank details in this emergency kit? Those related to Bank also important info in the situation of emergency right?

Basavaraj

yes, its a good idea to include that too …