Floating Rate Mutual Funds – How, When and Why?

Let us say you have 1 Lac rupees and you want to invest for the term of 1 to 1.5 years that can earn a decent interest rate. You thought of investing in fixed deposit in a bank for 1.5 year @ 6% per annum. Just after one month, bank increased it’s FD interest rate by 0.5% and again after 6 months interest rate is increased by 1%. But you cannot avail this benefit since your FD carries fixed interest till 1.5 years. Is there any investment instrument that could work to handle this situation? Of course YES, Mutual fund industry does offer floating rate debt mutual funds to invest in.

Basic Definitions you should know

- Coupon rate: The stated interest rate on a bond or other debt security when it’s issued.

- Benchmark rate: A rate used as a yardstick for measuring or setting other interest rates.

- Expense ratio: A measure of what it costs an investment company to operate a mutual fund.

What are Floating Rate Mutual funds?

These are the Debt mutual funds which invests about 75% to 100% in securities which pay a floating rate interest (bank loans, bonds and other debt securities) while the rest is in fixed income securities. See List of best Debt Oriented Mutual funds

There are two kinds of floating rate funds– long term and short term. The portfolio of the short-term fund plan is normally skewed towards short-term maturities with higher liquidity and the portfolio of the long-term plan is skewed towards longer-term maturities. However, even the longer-term funds are positioned more on the lines of short-term funds and are not very aggressive in nature.

Floating Rate securities vs Traditional bonds

As you may know, that most bonds have fixed interest rates which are set when they are first issued, either by a government or a corporation. That rate of interest doesn’t change for the life of the bond. A floating rate security on the other hand, has a variable interest rate. That means it’s interest rate will go up and down, or “float” to reflect changes in current market rates.

Depending on the particular floating rate security, the interest rate may change daily, monthly, quarterly, annually, or at another specified interval. The rate is generally changed to keep it in line with a particular interest rate benchmark, which is often called the “Reference Rate.” Among the benchmarks used to set the interest rate on floating rate securities are the MIBOR (Mumbai Interbank Offered Rate). Hence, each time the benchmark rate fluctuates; the coupon rate is adjusted accordingly.

Note

The MIBOR rate is the weighted average of call money business transactions done by 29 institutions, including banks, primary dealers and financial institutions. This rate is calculated and disclosed by FIMMDA-NSE. [ Ignore If you dont understand ]

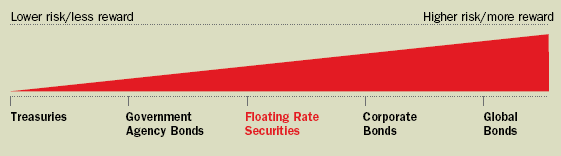

Credit Quality and Risk/Return spectrum

Credit quality is the measurement of a bond issuer’s ability to repay the debt it undertakes. Investment into AAA and equivalent rated instruments, call money market and government securities are the safest and most liquid instruments, while below AAA and equivalent rated instruments reflect downgraded quality and lower liquidity. However, their lower quality results in better returns, albeit at a higher risk.

Example analysis

Let us compare the floating rate, fixed rate debt fund and liquid funds over the years to understand the performance.

| HDFC Floating rate Income fund long term plan (G) | HDFC Floating rate Income fund Short term (G) | HDFC High interest (G) | HDFC Liquid fund (G) | |

| Category | Debt: Floating Rate Long-term | Debt: Floating rate short term | Debt: Medium-term | Debt: Ultra Short-term |

| 1 month | 0.35 | 0.35 | -0.65 | 0.3 |

| 3 month | 1.20 | 1.06 | -0.4 | 0.95 |

| 1 year | 7.68 | 5.0 | 5.53 | 4.68 |

| 3 year | 8.58 | — | 8.2 | 7.17 |

| 5 year | 7.48 | — | 5.98 | 6.77 |

| Expense ratio | 0.25 | 0.75 | 2.25 | 0.5 |

| Exit load | 3% within 18 months | Nil | 0.5% within 6 months | Nil |

Why, When & How

Why to opt for floating rate funds

- The primary advantage of these funds is that, they are less volatile than other types of debt funds. In case of fixed rate bonds, when interest rates in the economy change, the price of the bond adjusts to make up for the fixed coupon of the bond.

- Looking at the performance table over different time frames, floating rate funds have delivered outstanding performance over the years and more importantly, with considerable consistency.

- A look at the performance table also reveals a better consistency in delivering higher returns when compared to other type of funds.

- Credit quality of floating rate funds’ category is more or less similar to liquid funds and ultra short-term funds. Average maturity does not play a very important role in case of floating rate funds as they invest in instruments, that have a variable coupon rate.

When to opt for floating rate funds

- Floating rate funds make better choice when interest rates are set to rise.

- Floating rate fund can be considered to establish emergency fund. In the above case of HDFC Floating rate Income Long term plan (G), one can slowly build up emergency fund and once 18 months are over, you can redeem any time.

- If investment period is 1 to 2 years and liquidity is a concern, then one can look at floating rate funds over fixed rate debt funds. Now banks are coming up with recurring deposits with quarterly revision of floating rates. Always look for alternatives as per your investment period, returns, risk and liquidity.

How to select floating rate funds

- Long term floating rate funds are better than short term considering performance, less expense ratio.

- Select a fund which has proved its performance over a period. (This shows the effectiveness of the fund house in mobilizing the assets under management).

- Select the fund which invests significant % of asset in companies/securities with highest credit rating.

- Select the fund with low expense ratio.

[ad#big-banner]

Floating rate funds in India

The primary reason for their lack luster presence in the mutual fund industry has been investor ignorance of the nature of floating rate funds. There is a shortage of sufficient long-term floating rate instruments. Due to this, fund managers divert certain portion towards fixed interest securities. In the present situation of Indian economy money market and higher inflation situation, interest rates are set to rise in near future. Always consider floating rate funds over liquid/ultra short term/debt funds.

List of Top Floating Rate Mutual Fund

Long Term

Short Term

This is a guest post from Srinivas Girigowda who is one of the best contributors on this blog :), Kudos to him. Check out his finance blog Here

March 4, 2010

March 4, 2010

My husband has 2 LIC Money back policies taken in 1993 (93-25) and 1997 (108-25) for 25 yrs and SA of 1 Lac each. Maturity is in 2018 and 2022 respectively. My suggestion to him was that we encash these two policies and divert them into Balanced or Debt oriented funds. what do you recommend?

Yes, I recommend that , the other option is to make them paid up and not put more money in that !

One of the good articles I have ever come across about Floating Rate Fund. I have checked the history of both HDFC and Birla FRF and the author’s recommendations are factual. Thanks for posting this detailed article about FRF.

Glad to know you liked it . keep coming !

want to invest for a short term, say for 2-3 months, i have searched than found jm mutual fund money manager super fund its an ultra short term fund… Is it a good choice.. pls suggest???

Rohan

How much money ? If its small sum , then its not worth the hassle . Only complicate it if you are looking for investing 10 lacs or more . else put in FD or a liquid fund

Manish

[…] Jago Investor has a primer on floating rate mutual funds. […]

Manish,

Which type of short term fixed deposit do you think is best ?

I thought of an option where each month you invest some 50,000 amount in a FD for 3 months(monthly payout) so that at the end of 3 months, from the 4th month onwards you invest 50000 and get in return (50000+3 month interest) effectively investing nothing from the 4th month onwards. However, at any point of time you maintain 150000 amount in that bank.

This, i observed is earning better returns than the recurring deposit totaling 150000(12500 each month) in that year but less than a single cumulative FD of 150000 for that year.

The dilemma i am having is that the first option of monthly payout is earning a decent total return but after all i am getting the return in small chunks and not in one big amount. In a cumulative FD, i have to shell out 1.5 lacs in one shot which is a big deal in general.

what do you think ? which option do you suggest ?

Thanks,

Shantharam

Shantharam

How are you calculating returns on both the cases ? I dont think the first option is better .

Manish

Dear Manish/Srinivas,

I wish to invest Rs. 3 lacs for one yr (into safe avenues) and was contemplating your points reg FRF/FRF+STP. But HDFC FRF- long term charges 3% exit load for redemptions/STP within 18 months. Is it then worthwhile to invest in it considering my investment horizon of 1 yr. where else then should I park my money? Please advice.

Rashmi

Rashmi

If you are not looking for great returns and just safety , then do it in FD only , else Liquid funds are good option .

Manish

Fixed deposit is better in your case.

[…] a good Debt fund or Floating Rate Mutual Fund from HDFC , which allows STP to HDFC Top 200 […]

hi manish

i feel that chit business(must be highly trusted one) gives more return s than mfs.chits always gave me atleast 18% cosistently(1.50interest) .i have been in chit group and consistently earned 18%and sometimes24%(re2.00 interst).of course chit doesnot has compounding effect.what do u think so.

I am using them for past 5 months now, extremely convenient

Adding one more thing on my previous response

Complete process is almost online & NRI’s can also open account & start buying & selling MF.

Hi Manish,Srnivas,Hemant & all

I came to know about one website through which we can sell & buy MF free of charge.

No charge needs to be paid by investor .0.5% will be charged from Fund house annually

by FundSIndia.

Can u suggest & give ur opinion shd we go for this option & Is there anyone who

is already having an account with FundsIndia.

Plz go through below link for all information

I think a seperate can be written on this.

Regards

Yogesh

Yogesh

Have a look at the Interview of Srikanth , who is Director of FundsIndia . I dont know anyone personally who has the account there .

Manish

I have been using FundsIndia web site for my mutual fund investment since last 7 months and have found it quite useful and user-friendly. I have also set up SIP for couple of funds. The process is very transparent. The investors get the emails and SMS alerts for all the transactions. The same can be verified by the electronic or paper statements sent by the fund house(s) or the Transfer & Registrar agents (CAMS or Karvy).

Kindly feel free to contact me if you have any queries.

Thanks,

Rajesh

To Author,

Why do you say it is better to invest only if “Interest rate is expected to rise”

Is last 5 year, top 3/4 Floating rate MF, return is 8+%, I think is last 5 year we have seen Low interest rate –>high (2007end 2008 begin)—> low (2009) —> Expected to rise in 2010 .. Enough volatility wrt Interest Rate.. Still return seems to constant … (over 5 yr period) …

So why does you think “Wise to invest only if Int. Rate is expected to rise” .. ?

Due to the inverse relationship of bond yields and prices, when the yields decrease, the price goes up. During falling interest Rates, a Income Fund will outperform Floating Rate Funds.

However, all this depends on the risk profile and whats the expected return to achieve the goals. If that kind of return is sufficient then there is nothing wrong with floating rate funds.

Regards,

Abhishek

Regards,

Abhishek Gupta

Hi Manish,

For a 6 month plus kind of horizon and seeing the volatility in the debt markets, Short Term Debt Funds would be a better choice than a floating rate funds.

Also, there are not many floaters available in the market, hence liquid plus funds would be an obvious choice give a similar kind of return for 1 -3 months horizon.

Regards,

Abhishek

hi Srinivas/Manish,

If some one has already reached 80C limit then no need to invest in ELSS funds.

So what shd be protofolio in that case

4 Euity Diversified funds,1 balanced & 1 debt

or

2 Euity Diversified , 2 balanced & 2 debts.

if 80C is reached with PF and House loan interest/principal, then one can plan other investment with his risk appetite and goal.

It is okay to have 2 Equity diversified, 1 balanced.

no need of debt fund, you can target debt fund as you near your goal and you need to exit the market…it is 3 years before the goal

Hi Srinivas,

thanks for information.

Just curious to know,How u hve insides of bank?Are u working with banks?

Hmm….This is also part of Direct Tax Code.

🙂 I am not working with banks.

hi srinivas,

thanks for information

just curious to know, how u know insides of bank?R u also working with banks?

Hi Srinivas,

Next year onwards, Will bank going to deduct TDS even if interest earn in single year is less than 10K.??

Regards

Yogesh

10k limit still there. but no form submission. the moment 10k is reached tax is deducted. So you will be forced to keep FD in different branch.

Govt is planning to centralize all banks branch as early as possible also…so that people cannot keep FD in different branch and escape from tax.

Nice article.

Probably adding below complete information (taken from value reasearch) to article would be good:

1. Entry Load: 1%

2. Exit Load:

a. Exit load of 0.50% if redeemed within 6 months for investment upto Rs. 10 lakhs and

b. for greater investments 3% if redeemed within 18 months.

I think most of the readers will fall in ( < 10 lakh) category and so will fall in 0.5% category and also its 6 months for that category.

But maybe it needs to verified since this was update from April 2009.

-Praveen

Hi Srinivas,

We have to use all the opportunities .its very true .Then both FR & FD fits.

Moving from developing to developed nation FD will definately cme down.

And one more thing i have notice if bank system or any organization are in crisis situation then also can get good returns.Like Tata few times back it was giving 12.xx% interest on FD.

Hi Manish,

Do you think it is better to put money into FMP or Mutual Fund, if you plan to use the amount after an year. Since it is March time and on FMP u can get double indexation benefit, as well as I think currently stock market is bloated enough that there should be a consolidation in coming months, I am feeling putting money in FMP might be a safer bet with still decent returns. Will you agree?