17 tips to tell you how to manage your Personal Finance and save money

Personal finance is not only about your saving and investment, it includes tax planning, savings, expenses, debts, retirement plans, investment products and all the insurance and other policies. It is an understanding of how these tools works together and also affects each other.

In this article I will tell some tips which will be helpful for your personal finance.

Image source: Wealthfit.com

1. Split your Term Insurance

You should split your Term Insurance for two reason:

1) Top most reason is flexibility in Decreasing the cover later. So in case you need cover of 60 lacs now, you can divide the cover into 30:30 or 20:40 and then in future whenever you need that your insurance requirement has gone down you can just stop one of the policy.

2) The second reason is that your risk of claim decline from insurance company goes down, but this is a secondary reason.

2. Invest in Tax Saving Products for long term goals

Most of the people still invest in Tax saving funds for their shot term financial Goals. The fact that the money invested will get locked for long term should be taken in positive way and hence you should invest in these for your Long term goal, so that you don’t feel bad about the lock in period because you anyways need money after many years.

For example – Child Education, Retirement, Holidays abroad after many years. For short term goals like Buying car, paying fees, saving for some short term commitment should not be taken care by Tax saving Instruments.

You should use Fixed Deposits, Fixed Maturity Plans, Debt Funds, Balanced funds and Non Tax saving Equity Funds (Risky) for Short term goals. Once you think like this the lock in period will not matter to you at all 🙂

Watch this video given below to know about the tax saving investment tools in detail.

3. Use Top up’s in ULIP’s to minimize Cost

For investors who are going to buy ULIP’s or using ULIP’s for their long term goals, they should use Top up facility in ULIP to minimize the cost. The Allocation charges are generally linked to the regular premium you pay and not the Top up’s. So if you are investing 60,000 per year as premium, you should rather take a 20,000 policy and top up your policy with 40,000.

This way your will save charges on top up money. You can decrease your cost (charges) by anywhere from 50% – 75% using Top ups.

4. Investing in GOLD ETF’s instead of physical GOLD

Why do you want to invest in Physical Gold? The biggest reason is for Daughter’s Marriage and Jewellery required for the same. But the underlying reason always is capital appreciation.

So why not always invest in Gold ETF’s [ Understand what is ETF ] and whenever you need Physical gold, sell the ETF’s, take the money and Buy the Physical Gold at that time. Most of the people invest in Gold physically for Daughters marriage, but the better way would be to invest in ETF’s and when time comes you buy the physical gold by selling the ETF’s.

That is a better way because its more flexible, safe and easy route.

5. Use your LTA, HRA and Medical Reimbursement

I am amazed to see that many Salaried Employees especially youngsters do not care to take the benefit of LTA, Medical reimbursements and HRA just because of their laziness.

So make sure you take advantages of these even if you partly use these things you will save couple of thousands in Tax. All you have to do is save the bills, take the xerox and walk couple of steps to your Finance department and submit them, don’t you think its worth if its can save you couple of thousands in tax saving?

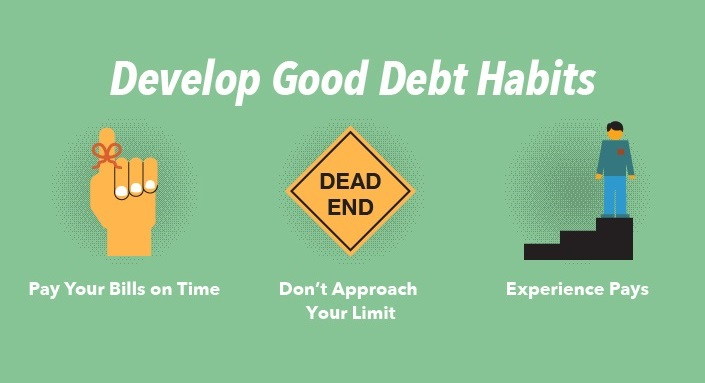

6. Control your Credit taking Habit

Image source: freecreditreport.com

Most of the people take Debt more than they can afford or deserve. Criteria for giving credit is mainly how much you earn. The company never knows your expenses and your future goals, your risk appetite, your future plans etc.

People earning 5 lacs per annam take debt of 30 lacs for Home, unnecessary personal loans for buying LCD’s, going for vacation and other non-priorities in life. This can have ill-effects later on.

Also companies are now keeping an eye on your credit taking behavior and it affects your credit score through which companies in India have started using as a decision making variable. So watch out your credit taking behavior. Don’t over-do it.

7. Dont Over monitor your Portfolio

Keeping an eye over your portfolio is great. You should look at your shares, mutual funds, ULIP’s etc. but overdoing it can be fatal sometimes. Some of us have this obsession of watching shares, mutual funds NAV and ULIP’s NAV on daily or may be weekly basis. See How much time you should invest in Personal Finance.

This is not a good sign for long term investing especially for people like us who are into regular jobs and have no much time to contribute in your Finances.

When you are a long term investor, why keep track of short term movements, these moves will have not much value in your all growth and short term movements will affect you mentally and tempt you take take decisions in short term because your money is either going up or down fast.

More of anything is bad and same things is true for your over involvement. Couple of hours per month or every quarter is good enough. Don’t get a feeling that successful financial life means more action.

8. Share your Financials with Family

If you are dead in another 1 hour, do you think your Family will be able to find out all your investments and Insurance documents and successfully claim them?

Are they unaware of the fact that you took a huge Insurance cover for them or you invested 50,000 in a ULIP last month?

Most of us graduate from novice investors to a good investor but still are left behind in taking care of this extremely critical point of sharing each and every details of our finances and making sure that the documents are within reach.

Let your wife, children have a good idea of where the documents are and where your investments are, have xerox copies of every document and have them at 2-3 different places and make sure people know about them. Emotional pain of losing some one and no idea of the finances which will take care of them is a kind of situation you never want you loved ones to be into 🙂

9. Don’t compare your returns with others

Image source: i.ytimg.com

You are different, be proud of this fact. If your returns are less than your friend’s mutual funds that’s fine. Don’t compare your self with others, there are many things which determines what you get in life like knowledge, luck, skills, timing etc.

So just make sure that you are getting what you try for. Don’t lose focus from your goals, your main aim in life is to achieve your financial goals easily and smoothly. Financial Planning is a race where everyone who reaches their personal target is a winner.

Make sure you don’t hurt yourself by competing with others.

10. Investigate everything before you Buy it

When you buy something, make sure you try to get information on Internet, ask on forums at different websites and make sure you find out maximum about thing product you are buying. Spending 30 minutes investigating your product can save you from lot of trouble.

One person I know recently took a home loan from HDFC and went for additional Life over from same bank for 30 lacs. He didn’t investigate much about the cost. It was around 8k per year for the term Insurance. When some days back we saw quotes from other company, the cheapest quote was around 6,000 from ICICI Prudential.

He was paying 2,000 more for the same thing because he didn’t spend 5 min extra investigating about the product. Just think what is the loss of spending some time investigating your product. How many of you took an ULIP after agent explained it to you and didn’t inspect much about it.

Email This to your Friend:

11. Invest and Spend, not vice Versa

You receive your salary -> then you spend all your money -> then save or invest if you are left with something. This is not a right attitude.

You should change it to Get Salary -> Invest your money as per your future goals -> Spend the rest.

Once you are saving some part of your salary, somehow you will find ways to spend on things which are of first priority and would refrain from spending on things which can be avoided but if you spend first and try to save later, you will end up spending on unnecessary things.

So better change the order of spending and saving. You can definitely live with your 90% salary , so at least save 10%. There is no harm in trying out this. If it does not work, you can go back to spend and save.

12. Build your Emergency Fund now

Make sure you have emergency fund. If you are listening about this from long time and haven’t done it yet, the best thing would be to take a pen and paper right now and plan for it.

This is the money with the aim to provide you immediate access, not growth of money. Don’t concentrate on getting great returns from this part of your portfolio. The aim of this part is just to give you high liquidity in case of emergency. That’s all.

So simple rule is 2 months of expenses in Cash which you can access in minutes from ATM and 3-4 months of expenses in Liquid funds, which you can get back in 3-4 days.

This is preparation for a situation like if you lose your job and need time to search for something you really like, or get a long term illness and cannot earn money in short term or special emergencies. You can always reach out to close friends and Family for money, but why to depend when you can be self-dependent.

Its’ all about strong planning.

13. Equity for Long term, Debt for Short term

I say this again and again, this is the golden rule, one of the fundamentals of Strong financial planning. Long term goals whose target date is more than 7-8 yrs like Child Education and Retirement should always be linked with Equity products like Equity Mutual funds, Direct Stocks, ULIP’s, Index ETF’s, Index Funds.

That’s because you can get great returns in long run from these things with lesser risk. On the other hand short term goals should be achieved by debt products like FD’s, Debt Funds, Recurring Deposit, Short term bonds. You can also use Balanced funds if you have moderate risk appetite and time horizon is 3-4 yrs.

14. If you dont understand, Don’t take it

How many investors understand how their ULIP works and what are different costs and how to use it efficiently? Not more than 3-4 % I believe.

How many people know why they have invested in Mutual funds which had a fancy name and which makes you feel like you have invested in something great and how many Endowment Policy holders know the overall final return they would get from their Policies?

Investors get into products which they do not understand well and then they can’t make best use of it which defeats the purpose. In reality the best products are least complicated one’s like Mutual funds, FD’s, Term Insurance, ETF’s, Gold ETF’s etc.

So if you don’t invest in something which looks fancy, you are privileged and should be thankful to god. Companies come up with complicated things which makes general investors feel that they are dumb and these companies are some big shot high class super knowledgeable in field of finance.

Read features of a good Portfolio

Just ask yourself if you want to eat the best, tasty and healthy food in this world then where will you go? 5 star hotels? I don’t think so 😉

15. Try new products now

There was a time when LIC policies, FD’s, NSC and PPF were the only thing in one’s portfolio. There was not much choice and people were risk averse. That was a different time.

Things have changed today and Finance world is different now and it’s more complicated now compared to olden days because of lots of choices in Financial products for us today. Don’t hesitate by trying out new stuff.

There are different products these days like Index ETF’s, Index Funds, GOLD ETF’s, SIP in Mutual funds, Reverse Mortgage etc. Don’t be stuck in same products like our Fathers and grand fathers have done.

16. Take Personal Loan to pay off your Credit Card Debt

In case you have any Credit card debt and you have converted it to EMI, it would be a better option to take a personal loan and pay off your Credit card debt as soon as possible.

Credit card interest charges are anywhere from 36% to 48% per annum which you don’t realise because it sucks your money slowly and it’s not significant per month so you don’t feel it. So taking a personal loan is a better choice and pay 15-20% interest on that.

You should always try to stay away from Credit card debt at the first place anyways.

17. Educate your self more

At the end, you have to learn stuff. No need to become a pro ,but you should keep updating yourself every month with basic things. Read Personal Finance Magazines like Outlook Money (Link to online issue) and Money Today (Link to online issue) and other blogs on Financial Planning .

Also if you are new to this blog, Subscribe to Email Updates to get fresh content in your Inbox twice a week. .

Readers Contribution

18. If appears to good to be true then probably it is not: So better if something looks great, then make sure you investigate well because there are more chances that it’s not that good as it sounds .There is no free lunch 🙂 – Amit Kumar

19. Learn simple maths : This is very nice point . Learning basic formula’s can help you a lot , you should know CAGR , IRR and Future Value formula .. – Amit Kumar

20. Find a right Financial Advisor : Find some one whom you trustand he is within your budget and you are comfortable with . – Guru

21. Plan for retirement Early in Life : See important of Early Investing and How to plan for your Retirement in 6 steps . – Swathi

Want to add yours…., please leave a comment 🙂

You are a valuable reader and your participation is needed , Please share any tip here like the one I have discussed , even 1 sentence is worth listening to. Also let me know which was your Favorite Point among these 16 points

December 21, 2009

December 21, 2009

Take Personal Loan to pay off your Credit Card Debt

I don’t agree with this statement, As its only True If Personal Loan Interest Rate is 14% or 15% But If more than this, both becomes equivalent

Deepak

How does it become equivalent ? How much is credit card interest on yearly basis as per your understanding ?

Its 18%!

I spent 124722 on credit card, Paid back 3118.04 on EMI Conversion, 321.15812 Service Tax, Interest 12424 (Comes out to be 18% Reducing)

So total amount I paid back is 140585.1981

How much is monthly interest rate mentioned by Company ?

37.8 % Per Annum

Then does it make sense to not take a person loan which is at 18-20% PA and close a loan which has 37.8% interest ? Why did you say in the start that it does not make much sense ?

I completely understood your point, but what I wanted to convey, is not this. I’ll write you a mail regarding this. I am also eager to know from an expert like you, that “what I calculated! is that wrong?”

Ok , send me a mail

This is about Jeevan Saral as an investment option instead of NSC/PPF … I discussed with couple of development officers directly to gather such info.. Please read on

W.r.to endowment policies, it is right that 6-6.5% of return, but this policy differs from others that the projected return as 10% compounded because,

1. Loyalty addition applicable ( a kind of bonus ) to policyholders who are holding the plan for 10years and above

2. The plan doesn’t have tax procedures. i.e LIC needs to pay 12.5% service tax + 5% government share on profits, but the profits from this plan are exempted from TAX altogether

3. The corpus of this plan is invested as Loan to industries like TATA and others for @13%

4. The objective is long term i.e 10yrs and above so one can expect good return of around 10% compounded or 8.5% in a worst case..

5. LIC mosted trusted org itself has distributed the brouchers with projected profit as 10% compounded.. And of course return is non taxable !!

Please post your views on these..

And an article about the policy in Hindu

http://www.hindu.com/2004/03/15/stories/2004031500261800.htm

Hi, I am Amit kumar of 26 yrs from rajasthan.I am a govt.employee with a monthly income of 25,000.I am having two LIC ENDOWMENT plans of which one is of sum assured 6 Lk and a annual premium of 28000 and other with a sum asssured of 1 Lk and a annual premium of 6000.I am also having 2 ULIP plans of which one is LIC MARKET PLUS (optioned GROWTH) with annual premium 10000 and other is ING VAISYA (optioned GROWTH) with a annual premium of 4000.There is also a deduction of 10% from my monthly salary under contributory pension scheme(C.P.F.).

I have started up with a monthly SIP of 1000 in canara robeco equity tax saver(growth) last month.now i am planning to open a PPF a/c wid SBI.i am also planning to invest in two equity diversified MFs wid monthly sip of Rs 1000 each.

I request u to plz analize my above portfolio and suggest me two or three good equity diversified MFs.I am having a goal of 7 Lk after 5 yrs.I also want to know that as i am having C.P.F. deduction whether i should open P.P.F. a/c or not. plz mail me.

Thanks.

Manish,

Great article, as always!! I love the way you and Subra write!

I don’t completely agree with you on 7 (over monitoring portfolio). It’s my personal view though and I wouldn’t dare say that it is a general rule. My logic is simple. I investigate throughly before I buy stocks/funds. Once I buy, I check everyday to find the right time to buy the next lot in the same stock/fund. That helps me accumulate good stocks and lower my prices. Of course, it requires lot of self-discipline to not to panic when situations are not rosy. In fact, those are the right times to into market (instead of exiting). Thanks to WB for all this wisdom 🙂

Pavan

Thanks for your views , whatever is pure monitoring for you may be over monitoring for many i guesss 🙂

Manish

Yeah…that’s why I said it’s my personal view! A knife can be used in many ways 🙂

[…] of the big problems, with women, is that they do not treat Personal Finance as something that’s important for them. For ages, they have not participated in Personal […]

Hi manish

As usual your blog was very good on personal finance..informing your beloved is the more important than even saving or investing……I have a question for you…I happen to read about this HDFC endowment super which has a life cover and also the investments go into Equitites.the charges are 15%,10% and 5% for the 1st 2nd and 3rd years.

Do you think it is a good choice of investment.I have a home loan for 80 laks and if i invest 2lacs per annum-do you think this life cover will really prove to be successful as i can see that there are a lot of difficulties when it comes to claiming the money incase of any uncertainity.

thanks

sowmini

sowmini

It looks like a ULIP . please dont get into it . Your Life cover requirement seems to be around 2 crores arleast considering you have 80lacs of loan in home loan , now this ULIP can not provide that kind of insurance at good cost . You should take a term cover asap .

Manish

Hi,

Manish,

I need help from you I purchased Profit Plus Ulip Plan from LIC in Dec 2007 for 50000.It was single premium payment.Recently i switched my fund to Bond fund. After switching the number of Units allotted got reduced to 3497. Earlier in the growth fund it was 4146 units. How the number of units allotted got reduced. I contacted LIC they told me it has lockin period of 3 years I cannot withdraw now.How to proceed further so that I get atleast my invested money back from this plan. Please Help me

Krishna

Dont worry much 🙂

So in ULIP for each kind of fund you have seperate NAV , so then you switched to Bond fund , looks like its NAV was higher , so accordingly the Units got reduced , but your net value must have been same 🙂

Check NAV at : http://www.moneycontrol.com/insurance/latestnav/homebody.php or http://www.licindia.in/plan_navs.htm

manish

Hi,

Manish,

Yep Net Value is Same.Thanks for replying can you suggest should i hold till the NAV comes up or should i exit immediately after the lockin period.Kindly Suggest

Article reg. splitting term insurance cover

http://www.themoneyquest.com/2010/01/split-term-life-insurance-plan-policy.html

Here you go Again awareness awareness awareness.. damn this gonna get close my or so many type of me, shops… lol 🙂

But Manish I would like to congratulate you for such informative article… I believe everybody, who visit this article once… get out with some information, some knowledge.

In the end, all I can say… What an article, sirji??? :p

Akhil

Nice to get a comment like this .. What do you do personally .. The fact that you are able to accept that this article is great even if you are into sales shows that you are a good agent .

manish

Cool 17.

Cool .. the shortest comment on this blog till now .. Great 🙂

Vijay , which one was your favorite ?

Manish

Hi Manish,

Please write a post regarding the difference between NSC and PPF and about the advantages and disadvantages of both. Which one is best in terms of returns and tax planning?

Regards,

SB.

Sure .. I will add a “Wishlist” tab on blog soon . You can add your list there . For now I will keep a note .. But remind me later

Manish

Dear jmoorthy,

Wow! That is a nice list!

Answers to most of your questions can be found in the policy document. It is beat to read that carefully and then ask about issues not answered there to an agent. Sometime if you ask too many question to an agent they may misinform you. They are human after all. A policy document has legal binding and is the ultimate authority.

Term insurance covers all forms of death incl suicide after 1 year. The only condition is that policiy has to be in force.

The cause of death has to be established clearly; So any document which helps to do this will be reqd. You cannot cremate or bury a body without doctors certificate so how can you make a claim without one. I think a doctor cannot give a certificate in case of accident or suicide without FIR so its obviously reqd.

“In case of un-identified suicide (train sucide), what is the process, how to prove.

“If nominee dies”

Better to leave a second nominee if possible or legal heir certificate has to be produced by next of kin. This will take a long time. So claim must be sent first

the died person is policy holder?”

This is tricky if fingerprints are available I guess that is acceptable. If face, identifcation marks and both hands are disfigured its trouble. So better to take a single piece of your hair put ir in along with your policy document! When need comes you can make a DNA test for identity. Good point!

There is no such thing as a private doctor. Every doctor has to have govt approved reg. number

“There is no such thing as a private doctor. Every doctor has to have govt approved reg. number”

Thats a nice points Pattu .. All the points you guys have put are great , Guru can add up some points more here 🙂

Manish

Excellent writeup !!!

I have a list of questions which should be discussed with insurance agent/company before taking term insurance. You can use this as a checklist.

There are 4 typses of death.

1. Natural due to aging

2. due to illness – Cancer, Herat attack, Kidney failure….

3. Suicide

4. Accidental death

1. In case Natural death,

a. what is the claim process.

Death certificate/corporation certificate & original policy docs

b. What are the documents do we need to claim this

c. In case nominee is not available who will be eligible to claim & what documents

they need to claim

d. how to change nominee & what is the process & is there any limit in nominee

change

e. How many days it will take to settle the claim

f. Both nominee & policy holder died on the same day, who will get claim & what

docs required

2. due to illness – Cancer, Heart attack, Kidney

a. Is there any restriction in illness category

b. All deceases death are covered

c. Claiming process

d. Documents required to claim

e. Doctor certificate required? private doctor or any govt/hosptial doctor?

f. with in how many days we should initaite the claiming process?

3. Suicide

a. Eligibility to claim the SA in sucide case starts after 1 year from the policy

commencement?

b. All suicide death covered? like hanging, poison, train

c. What are the documents required?

d. If both Policy holder & nominee committed sucide, who will get the SA & what

docs they required

e. Police FIR required?

f. post-mortem required?

g. In case of un-identified sucide (train sucide), what is the process, how to prove

the died person is policy holder?

4. Accidental death

a. In case accident death, both policy holder & nominee died, who will get SA &

what is the process & what are the docs required

b. Due to accident, policy holder body is un-identified, how to claim?

c. FIR required?

d. post-mortem required?

e. death case of murder, how to claim?

h. In case nominee kills policy holder, will nominee gets SA?

i. In case of accident, policy holder/nominee/kids died, Policy holder parents will

get Sum Assured?

j. Policy holder missing for long time & found murdered later some years. how to

claim?

If death happened in foreign, can we get Sum Assured?

-Jmoorthy

Very nice compilation .. I will try to find out answer and make a post out of it. thanks for giving this .

Manish

Well said Manish. IRDA has to come up with uniform guidelines. In fact the under written rules should also be the same. This is the best way to enhance claim settlement ratios for all insurers.

Pattu

I just mailed irda this query .. lets see if i get a reply back 🙂

manish

Kotak life insurance wants “Original Death certificate issued by the requisite authority” and

“Last Attending Physician’s Certificate in original.”

There are few other insurers who only mention “death certificate” while some others explicitly mention copy is enough. Similarly some say hospital records while others say copies of hospital records. Well unless the claimants are educated about what exactly to do in the event of death getting two claims is messier than a single claim. Its just too much work.

The point is in every other investment or health insurance benefits can be enjoyed by the individual who pays so he/she can factor his/needs needs/wants etc.

When it comes to term insurance the beneficiary is the nominee and his/her needs, convenience, education level, ability to use common sense when need to make a claim etc. must be factored in before taking two policies. Its not just about decreasing cover later and cheaper policies or claim rejection etc.

I believe IRDA should come up with some common ground rules or frame work for Claim settlement .. Seeing each and every company with different rule can be frustrating for customers ..

Pattu , What do you think ?

Dear Yogesh,

Great point! Convinced!

Hi Manish,

Just wanted to put my 2 cents.

Manish’s Quote : yes .. I will have to agree on that part .

If you buy the jewelery today. the making charges would be of today’s value .. I never thought of this point .. Anyways how come men are supposed to think that way .. Women are great

Manish

My observation.

We are missing one very important detail, that is we always buy physical gold which is of 22 carat (I havent heard anybody buying a 24 carat coin or bar even). However, ETFs are based on 24 carat gold price. Hence, on any day, when we sell an ETF unit it ll give enough money to buy a 22 carat jewellery + making charges.

No doubt women have much better sense of design. we can always afford a 22 carat gold unless we are getting a designer jewellery from D’Damas or Tanishq….LOL

Regards

Yogesh Tiwari

Nice observation .. I never thought about that 🙂

Sometimes I wonder what will be this blog without this kind of great interaction . I would like to thank everyone 😉

Manish

Yes nice observation Yogesh.

But Manish if you can it would be helpful if you explain about the gold ETF’s. As there are lot of confusion about whether it is good investment option or not. As many charges are there in gold ETF’s so to avoid that people follow traditional purchase like gold coin,bar,etc.

Rupali

this article will help : http://jagoinvestor.dev.diginnovators.site/2008/04/gold-as-investment.html

manish

Dear Manish,

I liked Point No. 9 Most. (Dont compare your returns with others)

Most of the problems in the financial world (or for that matter in other areas of life also) start from comparing with others. If we are doing better than our friend, we get elated. If we are poor than him in the investments, we get depressed, just by comparison.

i.e. Till there is no one ahead of us, we feel better and vice versa. And the moment other guy does better than us, we sink to bottom of our hearts.

I think this is to search for external validation to boost the ego “Yes, I am better than others”. Instead, the best way would be to compare with ourselves only, with what we were 6 months back, 1 year ago and so on. The same rule applies to finance also. More money does not means that they are more happy. They might be having more problems in some other life areas which we may not be knowing.

Lot of spirituality 🙂 but it is important to know these points.

Thanks ,

Jitendra

Wow .. a different angle 🙂 . good one

Manish

I think buying real gold coins is way better than holding gold ETFs and such. You don’t have to pay any fees when buying real gold, there is no counterparty risk, no risk that NAV and trading price are different, and the ease of selling both of them are same.

.-= Manshu´s last blog ..Target Gift Card Review =-.

hmm.. depends ..

Gold ETF;s are easier to monitor , save, sell . they are better from tax angle also .

Atlast it depends on person to person .

manish

Refer to

http://www.lifeinscouncil.org/consumers/claims-process

for claim related info.

Couple of websites mention that the required documents for claim are “Original Policy document and death certificate”. This should not be mis-understood as Original Death certificate. It should just be read as “Original Policy document” and “Death certificate” (Attested copy is good-enough)

nice link guru .. thanks for that